A1 Trading Advice for US Stock Market NYSE & NASDAQ

- US Stocks

Subscription Plan

Wall Street Stocks Advice

only large cap & mid cap stocks

500 $

-

United States dollar ($) - USD

-

Saudi riyal (ر.س) - SAR

-

United Arab Emirates dirham (د.إ) - AED

- 33 $ /advice

1500 $ Original price was: 1500 $.1200 $Current price is: 1200 $.

-

United States dollar ($) - USD

-

Saudi riyal (ر.س) - SAR

-

United Arab Emirates dirham (د.إ) - AED

- 27 $ /advice

3000 $ Original price was: 3000 $.2000 $Current price is: 2000 $.

-

United States dollar ($) - USD

-

Saudi riyal (ر.س) - SAR

-

United Arab Emirates dirham (د.إ) - AED

- 22 $ /advice

6000 $ Original price was: 6000 $.2990 $Current price is: 2990 $.

-

United States dollar ($) - USD

-

Saudi riyal (ر.س) - SAR

-

United Arab Emirates dirham (د.إ) - AED

- 17 $ /advice

Included With Every Plan

Sent before USA trading time9:30am - 4:00pm Eastern Standard Time (ET) on WhatsApp

Included With Every Plan

Sent before USA trading time9:30am - 4:00pm Eastern Standard Time (ET) on WhatsApp

USA Stocks Advisory Performance

Company

Name

Trading Analysis

Trading Return

Buy Price

Sell Price

Contact Us for Any Queries

How to subscribe the plan? Step by step process to get the subscription.

01

Choose your subscription plan.

02

Complete your personal and payment information.

03

Securely process your payment.

04

Get instant confirmation via WhatsApp & Email.

05

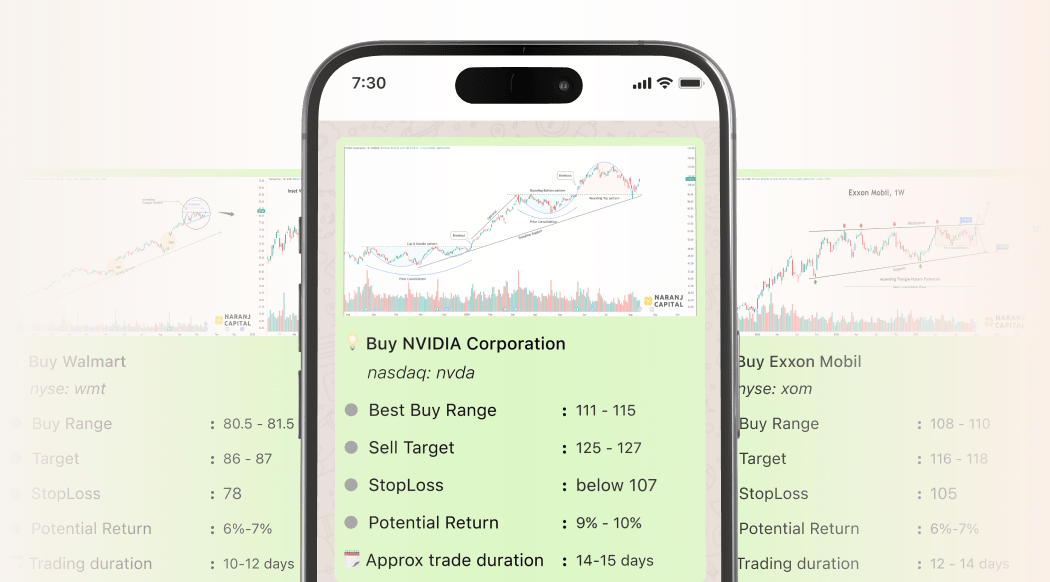

How Clients Receive and Access Our US Stocks Trading Guidance

- Get US trading and investment advice via WhatsApp.

- Access in-depth stock analysis on our website after logging in.

- Receive follow-up updates for active trades directly on WhatsApp.

Bank Account Details

Primary Bank

(Account number)

Secondary Bank

Age: 68 years

You can use STC Pay, MobilyPay, FriendiPay, UrPay or Western Union or other medium to easily transfer money to the secondary account.

Ratings and reviews by our clients

Frequently Asked Questions

A1 Swing Trading Advice for US Stocks FAQ

Do you offer free trial?

While we do not provide free trials, our minimum subscription plan offers a valuable opportunity to experience our US stock market trading signals with 15 recommendations. We also provide free trading insights on our social media channels. We encourage you to follow us for ongoing market updates.

- Twitter profile: https://twitter.com/NaranjUSA

- Facebook Page: https://facebook.com/NaranjUSA

- Instagram Page: https://instagram.com/NaranjUSA

- LinkedIn page: https://www.linkedin.com/company/NaranjUSA

- TradingView: https://tradingview.com/u/NaranjCapital

- Telegram: https://t.me/Naranj_USA

How do I receive your US stock recommendations?

Our short-term trading tips on US stocks will be delivered straight to your inbox and WhatsApp, so you never miss a golden opportunity. Plus, you can access our full trading analysis report on our website. We don’t wait for the market to open – we’ll send you trading alerts usually 2 hours before the US trading sessions (9:30am EST) to stay ahead of the game. And with WhatsApp notifications for all your follow-ups, you’ll be one step closer to mastering the art of short-term trading and investing.

How many swing stock trading calls do you give in A1 Trading Advice for USA?

We send out 10-12 best short term trading ideas for US stocks in a month, all of which are exclusive picks from our experts.

What kind of trading calls do you give?

We provide recommendations for the delivery based positional trading calls.

- Short term stock trading picks in US are the Buy and Hold trading advice and have a holding period of 1 to 3 weeks.

- Medium-term trading calls have a hold period of 4 to 8 weeks. Short term delivery based trading is more profitable than intraday trading because the risk is less, and traders who have alternative jobs can easily trade the short term trading calls. It is great for those people who don't have the time to stay glued to their trading screen all the day.

How to subscribe your trading advisory services for USA stocks?

- Step 1: Choose your subscription plan and proceed to checkout.

- Step 2: Provide your billing information, including your email ID and phone number.

- Step 3: Safely and securely pay through the secured payment gateway using Net Banking / Credit / Debit Card.

Alternatively, you can opt for Direct Bank Transfer to complete your subscription. Don’t wait any longer – pay your subscription fees upfront and let us handle the rest. Start maximizing your trading potential today!

Kindly share your name and payment details to our WhatsApp +91-8335058282 or mail us at sales@naranjcapital.com.

Do you accept direct bank transfer?

Yes. You can send the subscription fees directly to our bank account. Kindly share your name and payment details to our WhatsApp +91-8335058282 or mail us at sales@naranjcapital.com.

Direct Bank Transfer Details:

Primary Bank

You can use STC Pay, MobilyPay, FriendiPay, UrPay or Western Union or other medium to easily transfer money to this account.

Can I earn from trading?

One of the greatest ways to earn money in the world is through trading. Alternatively, trading can serve as a substitute revenue stream. Another option to benefit from your investment is to receive a dividend, which is paid by the firm to its shareholders when they make a profit.

Trading offers the chance to work from any location in the world and earn a limitless amount of money every day. The perks of trading for a living might be thrilling, so be ready for the lifestyle.

I am unable to activate subscription on your website. What should I do?

No worries. We’ll create the subscription for you. Kindly share your name, phone number, email ID and payment details to our WhatsApp +91-8335058282 or mail us at sales@naranjcapital.com.

I am not living in the middle east. Can I still become a member?

How do I get an invoice for my subscription?

You will receive an invoice to your registered email address as soon as your subscription(s) are activated. As an alternative, you can check the status of your subscription by going to your online portal

https://naranjcapital.com/my-account/subscriptions/.

How much time will it take to activate the subscription?

Typically, your subscription will become active instantly once the payment for the subscription is processed. In rare cases if your subscription service has not been activated, please reach us at sales@naranjcapital.com

Are there any add on benefits applied for short term stock trading advisory in USA?

Benefit add-ons have already been applied to your membership. Access our Investment Advice and Multibagger picks for USA stocks at no additional costs. Applicable to 90 and 180 A1 trading subscriptions only.

Can I start subscription from mid-month?

How do you handle market volatility when giving daily trading signals for NYSE stocks?

Market volatility is a common occurrence in the US stock market, and it can be especially challenging for swing stock traders in USA. So, with every recommended US swing trading stocks we put solid risk management strategy along with it – such as setting stop-loss orders and limiting the amount of capital you allocate for each trade.

How market trends can influence your swing trading tips in USA stocks?

Market trends play a significant role in our short term US stock trading recommendations. By analyzing the overall market direction, we identify potential trading opportunities and adjust USA swing trading strategies accordingly. For example, if the market is experiencing an uptrend, it may be favourable to focus on buying stocks that are trending upwards. On the other hand, during a downtrend, shorting or selling stocks may be more profitable.

A good trend following system will keep you in the market until there is evidence that the trend has changed.

Richard Dennis

Creator, Turtle Trading System

Which method do you use for swing trading stock selection for USA market - technical analysis or fundamental analysis?

How do you advise to set profit targets and stop-loss orders in short term trading signals for US stocks?

What is the risk-reward ratio in your US stock buy recommendations?

Risk-reward ratio is a critical aspect which refers to the potential profit compared to the potential loss on a trade. For example, if you are risking $1 per share to potentially make $2 per share, your risk-reward ratio would be 1:2. We always maintain a minimum risk-reward ratio of 1:2, as it means that your potential trading gain in USA stocks is twice than your potential loss. This allows you to potentially make profits even if not all of your trades are winners.

How do you determine the appropriate exit point for day trading signals in USA stocks?

Do you consider fundamental analysis to recommend swing trading picks for US stocks?

I have a specific questions or doubts on certain stocks or my portfolio holdings. Can I get your expert view on those?

Separate charges of $65 per stock will be applicable for any stocks outside our recommendations. Purchase the number of stocks to be reviewed and we’ll review it thoroughly and send our reports to your email/WhatsApp.

How should I decide which one of your trading advisory services for US stocks will suit me the best?

Our swing trading advise in USA stocks are designed in such a way so that you need minimal time and efforts to remain active in the stock market. If you need any personalized guidance and complete portfolio management solution check our Focus Portfolio Management Advice. For any assistance, feel free to call +91-8335058282 or drop us an email at info@naranjcapital.com.

What if I don't want to become a member?

We put our best efforts in the premium stock trading advice in USA, which are exclusively reserved for Paid members only. You won’t get them without subscription. Our free stock analysis and advice are available in our social media page. Please like and follow them to get such updates.

I have paid for a membership, but did not create an account. What should I do?

To claim your membership, please reach us at sales@naranjcapital.com. Kindly mention your name, phone number and email ID you like to register with your subscription.

Subscription and Product Delivery?

Access your subscriptions details and our premium swing trading recommendations for US stocks at any time by logging in to My Account online portal.

What is your company's refund policy?

Please note that subscriptions are non-refundable, irrespective of usage. However, we offer the options to pause your subscription or convert to another plan. We recommend reviewing our terms and conditions carefully before subscribing.

Can I share A1 USA swing stock trading advisory services with others?

Please note that our products and services are intended for individual use only. Redistribution to others, even within an organization, is strictly prohibited as per our terms of service.

Can I upgrade the existing plan in between?

How can I be benefitted from your trading advice in the US stock market?

Our unique approach in Advanced Technical Analysis helps you to create wealth and generate extra income. Subscribed members from our positional trading advisory in USA stocks will get guidance for:

- Stock selection

- Have a proper plan for entry and exit for every trade

- Know exactly when to book profits

How much can one earn money by swing trading in the US stock market?

Frequently Asked Questions

US Stocks Trading Advice FAQ

Is short term trading riskier than long term investing?

Short term trading in USA stocks can be riskier than long term investing, as there is a higher likelihood of market volatility and unpredictable price fluctuations. However, with proper risk management strategies in place, swing trading signals for US stocks can also offer higher potential returns. It’s important for traders to carefully evaluate their risk tolerance and develop a solid short term trading plan in US stocks before engaging in any form of trading.

How does research play one of the most crucial roles in successful swing stock trading picks in the USA?

What are some common technical indicators used in swing trading strategies for Nasdaq 100 stocks?

Some commonly used technical indicators in short term trading strategies for Nasdaq recommendations include moving averages, Bollinger Bands, and Relative Strength Index (RSI). These indicators can provide insights into price movements and momentum, helping traders to identify potential entry and exit points. However, it’s important to note that no single technical indicator should be relied upon solely. The best swing traders in USA always use a combination of indicators and tools to make well-informed trading decisions.

Can Day/Intraday Trading make you rich?

What are the benefits of setting profit targets for short term trading advice in USA stocks?

How to manage risk in swing short term trading in USA stocks?

Are there any specific industries or sectors that are more suitable for swing trading stock selection for USA markets?

How important is it to stay updated with market news and developments while engaging in swing stock trading in USA?

Accurate and timely market information is critical for all traders, but especially for those engaged in short-term US stock trading. As a premier US swing trading advisor, we leverage real-time market insights – including major events, economic data, and company announcements – to optimize our strategies.

What is your overall approach to swing stock trading advice in USA and how has it evolved over time?

Our short-term swing trading strategies for US30 stocks are designed to capitalize on high-volatility stocks with strong fundamentals and positive news. We recognize the importance of adapting to market changes. Therefore, during periods of increased volatility, we prioritize risk management and focus on securing smaller, consistent profits. This flexible approach aims to maximize your success in the short term trading in the US stock market.

Can you discuss the pros and cons of using leverage in short term trading picks in USA stocks?

Leverage offers the potential for increased profits in Nasdaq 100 swing trading by allowing traders to control larger positions with reduced capital. However, this also magnifies potential losses. Prior to using leverage, traders must implement a comprehensive risk management plan. Furthermore, a clear understanding of the specific leverage ratio employed in US short term delivery based trading is vital for assessing its impact on potential gains and losses.