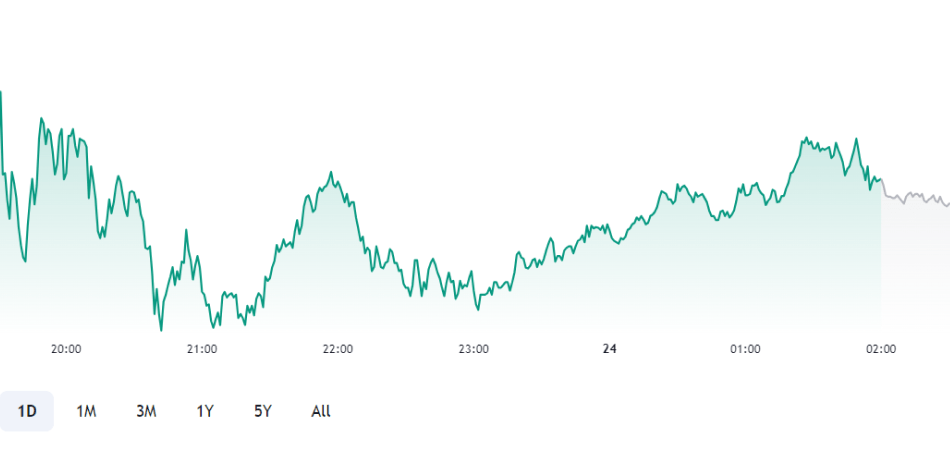

- 🇸🇦 Saudi Stock Market

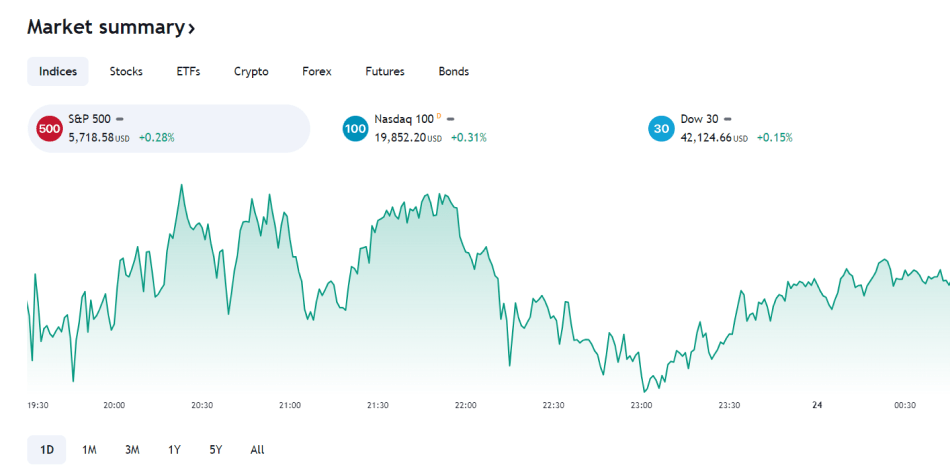

- 🇺🇸 USA Stock Market

128 - 130

12-14 Trading Days

6% – 7%

128 - 130

12-14 Trading Days

6% – 7%

Aldrees Petroleum and Transport Services Company is involved in the distribution and sale of fuel, gasoline, oil, and lubricants in Saudi Arabia. This company operates through two segments, namely Petroleum Services and Transport Services. It offers a range of amenities at its fuel stations, including car wash, tire servicing, additives, alignment, accessories, food, mosque, ATMs, and even car rental services. Furthermore, Aldrees constructs, operates, and rents take away centers that serve hot and cold beverages, food, and also provides catering services. Additionally, the company provides transport and logistics services, utilizing a fleet of trucks and trailers for the transportation of liquid and dry materials. It also offers highway transportation for goods. Established in 1957, Aldrees Petroleum and Transport Services Company has its headquarters in Riyadh, Saudi Arabia.

Relative Performance - Last 1 Year

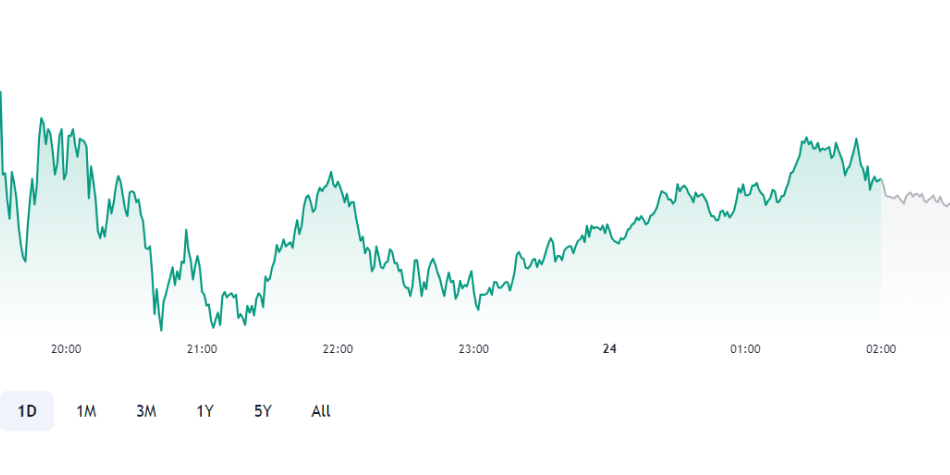

Tadawul 4200 : Aldrees Petroleum and Transport Services - Technical Analysis (Daily)

Tadawul 4200 : Aldrees Petroleum and Transport Services - MACD

Tadawul 4200 : Aldrees Petroleum and Transport Services - EMA Cross

Tadawul 4200 : Aldrees Petroleum and Transport Services - RSI

Based on our stock trading advice in Saudi Arabia, Aldrees Petroleum and Transport Services stock price target will be SAR 128 — SAR 130 in the next 12-14 trading sessions.

by NaranjCapital on TradingView.com

The stock trading advice is prepared by the Naranj Capital team under the guidance of Arijit Banerjee, CMT, CFTe. Arijit is a veteran trader and an active investor having in-depth knowledge of financial market research, advanced technical analysis, market cycle, algorithmic trading, and portfolio management. He is a Chartered Market Technician (CMT) accredited by CMT Association USA, the global authority of Technical Analysis and also has been honored as a Certified Financial Technician (CFTe) by the International Federation of Technical Analysts, USA.

The views expressed herein are based solely on information available publicly/internal data/other sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to accuracy. The recommendations provided herein is solely for informational purposes and are not intended to be and must not be taken alone as the basis for an investment/trading decision. Trading and investing are subject to market risk and the securities discussed and opinions expressed herein may not be suitable for all investors. To read the full disclosure, please click here.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website