- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Walaa Cooperative Insurance Company headquartered in Al-Khobar, Saudi Arabia operates as a joint-stock corporation offers cooperative insurance, reinsurance, and investment activities in various lines of business including motor, general, health, protection, and savings. In May 2017, the name of the company previously recognized as Saudi United Cooperative Insurance Company was altered to Walaa Cooperative Insurance Company. This company’s products include various insurance products such as property all-risk, fire and specified perils property damage, loss of business insurance, engineering insurance products like erection and construction all-risk, contractor’s plant and machinery/equipment insurance, machinery breakdown insurance (MBD), loss of profit following MBD, and deterioration of stock following MBD. Additionally, it offers motor insurance products including commercial and private motor comprehensive, and third party liability policies, marine insurance products like marine cargo and hull insurance policies, medical insurance, and miscellaneous accidents insurance products such as comprehensive general liability, professional indemnity, medical malpractice, directors and officers liability, security and private protection, fidelity guarantee, money, personal accident, workmen’s compensation and employers liability, travel, aviation hull, education, saving, critical illness, and other insurance products.

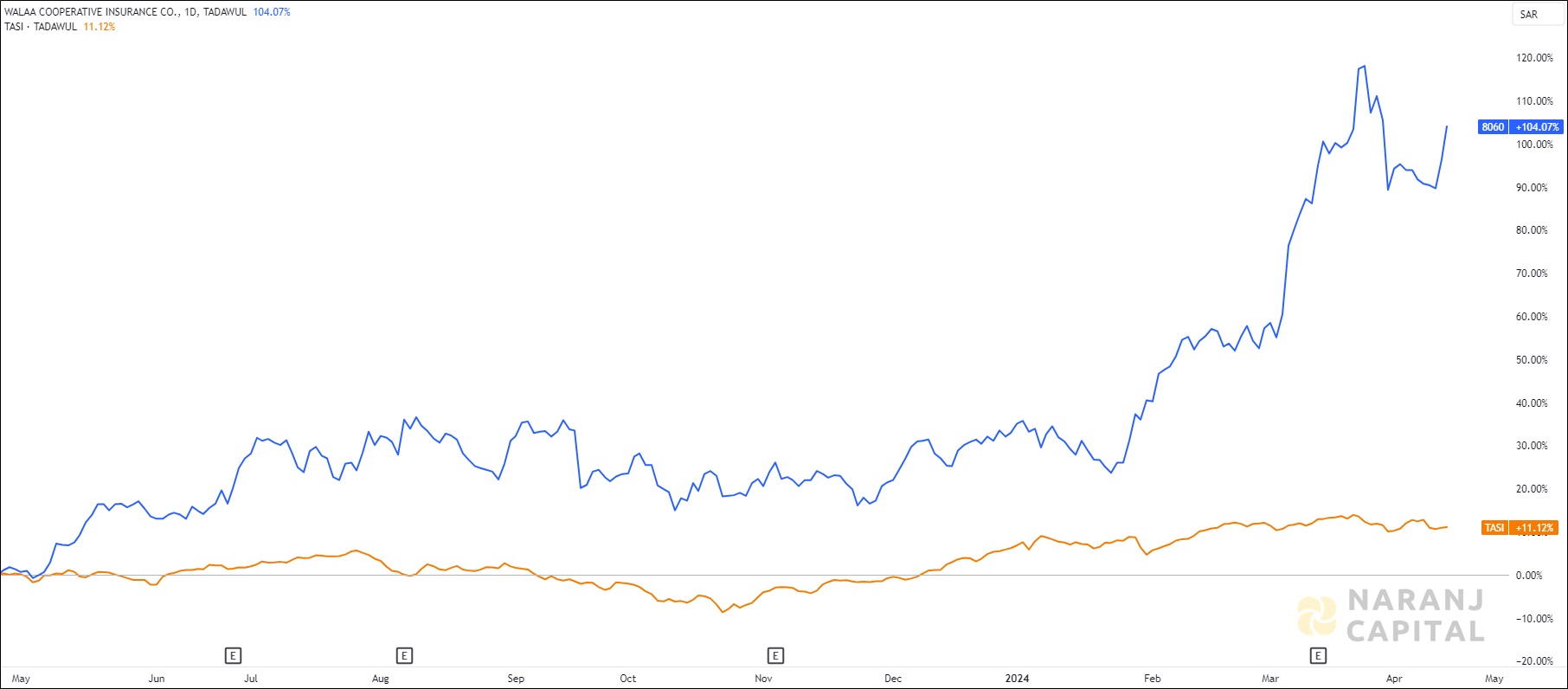

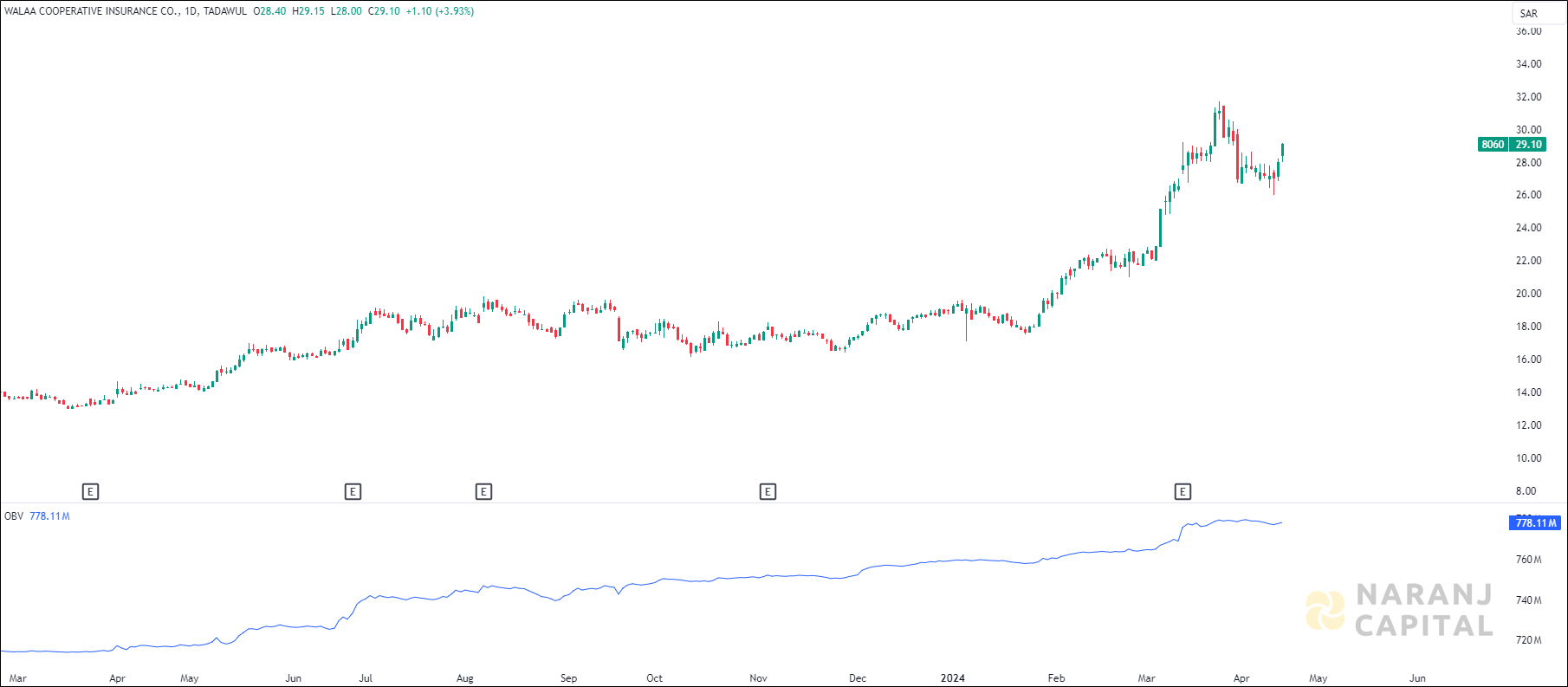

WALAA — TASI —

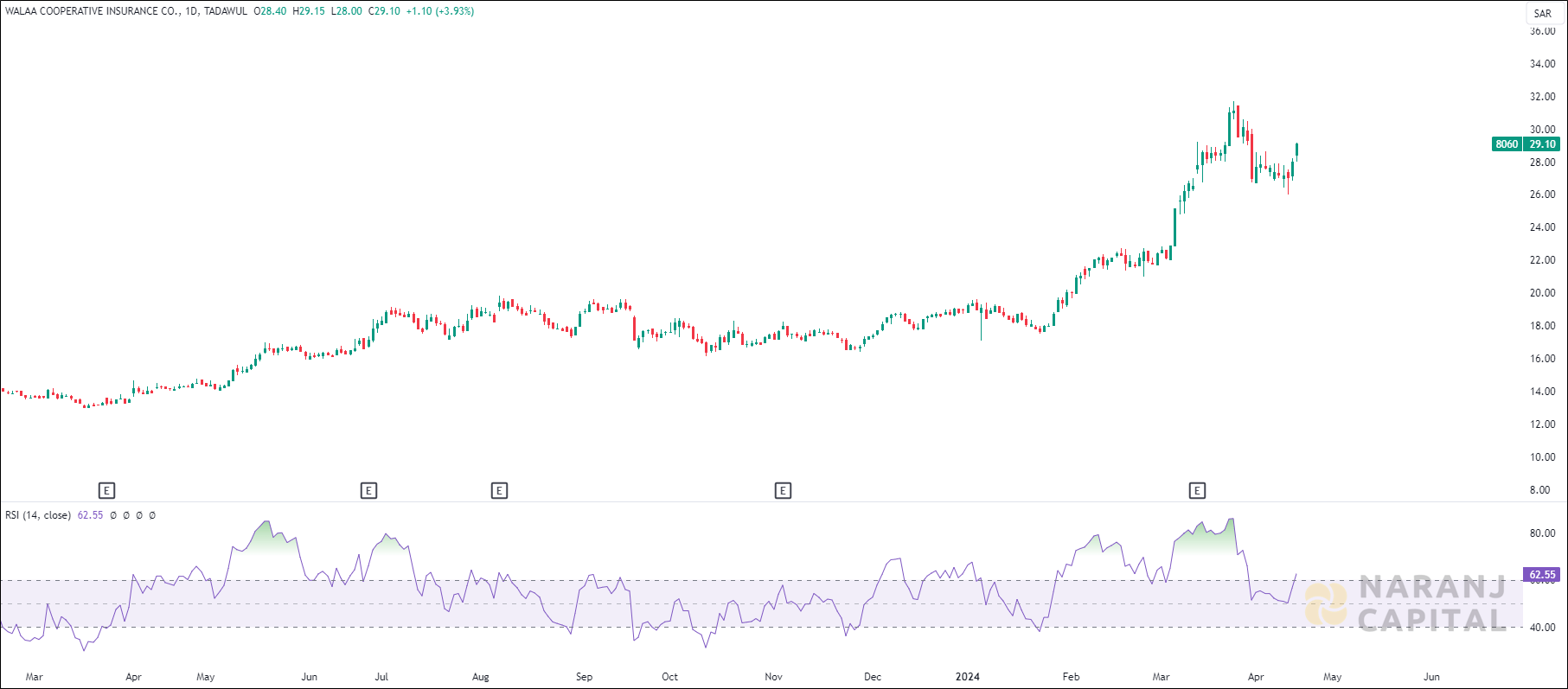

Current RSI of this stock is 62.55, which indicates the strength of buyers.

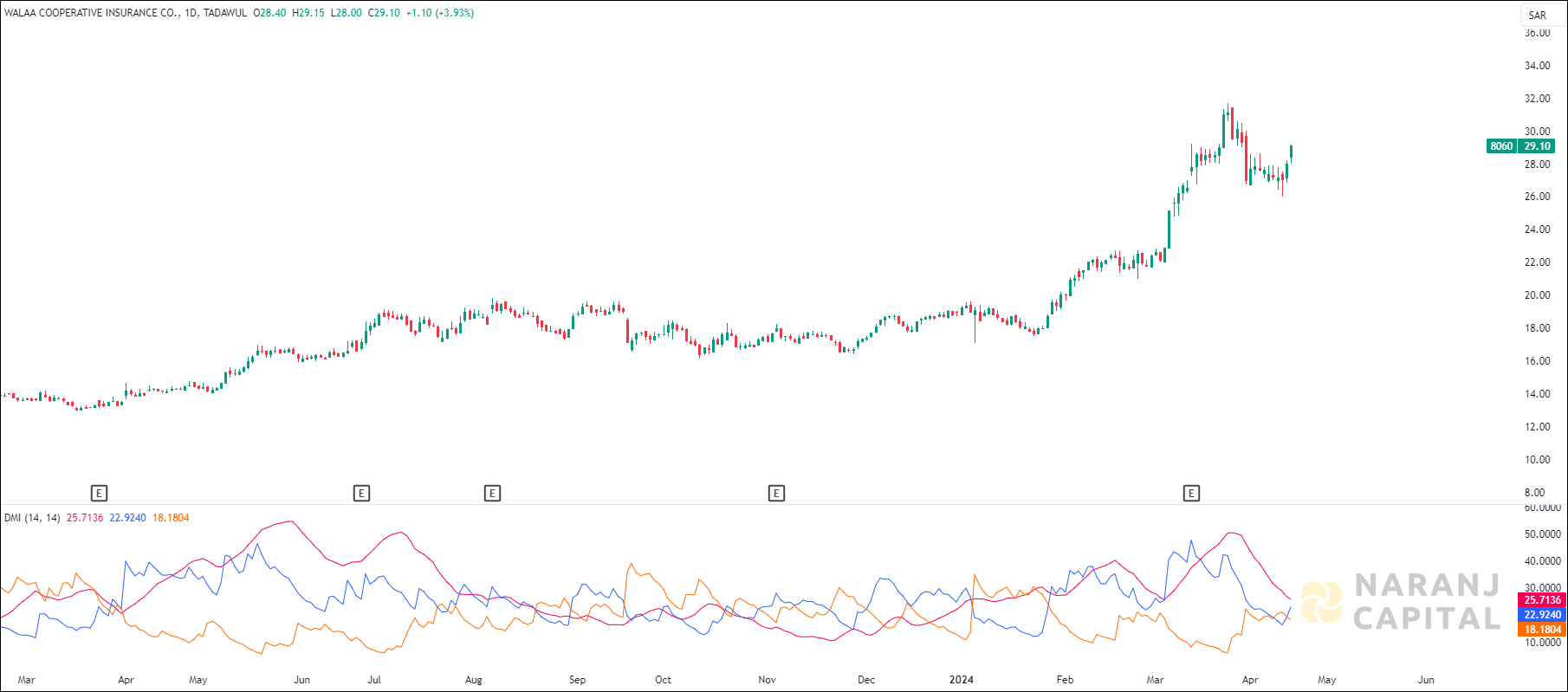

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

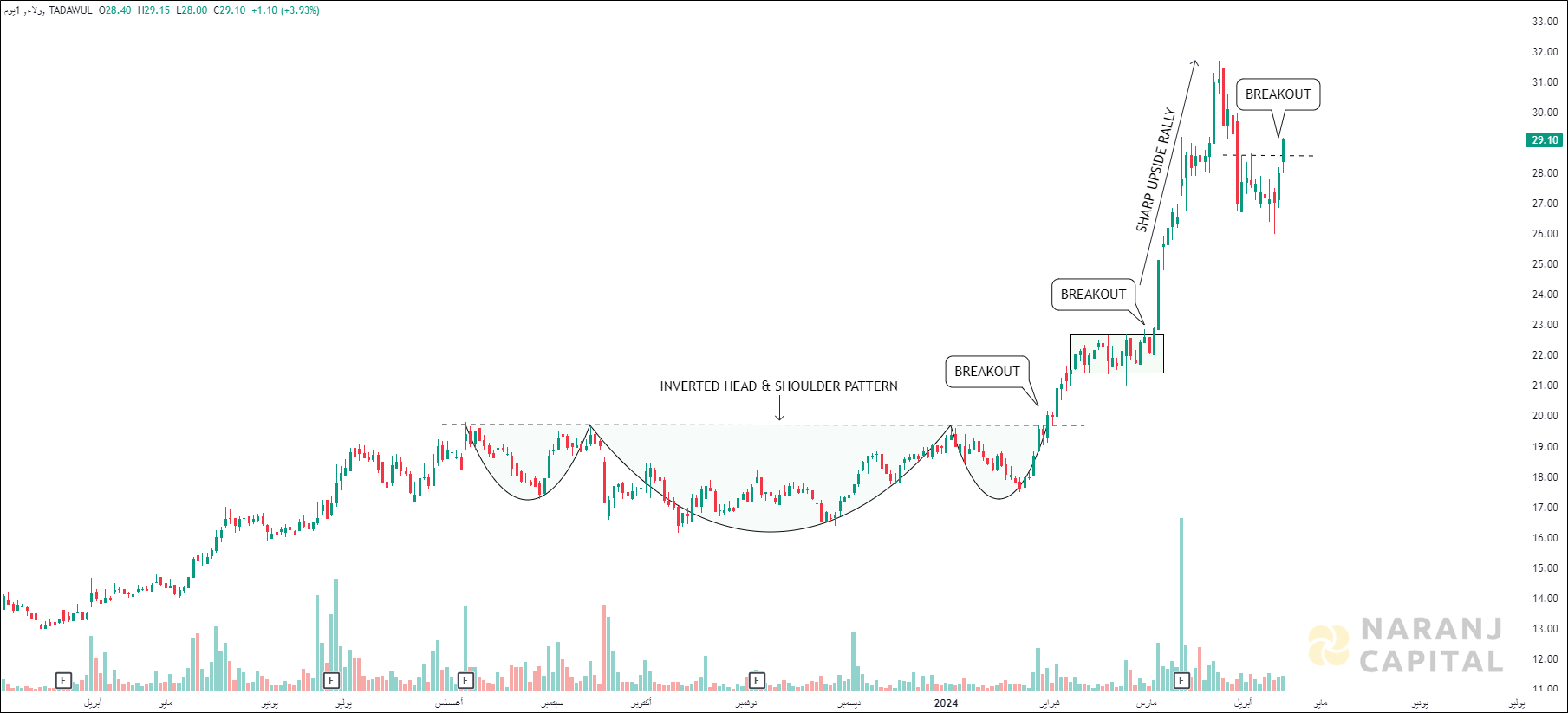

Based on our swing trade signals for Tadawul, Walaa Cooperative Insurance stock price target will be SAR 31.5 - SAR 32 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website