- NaranJ2024

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

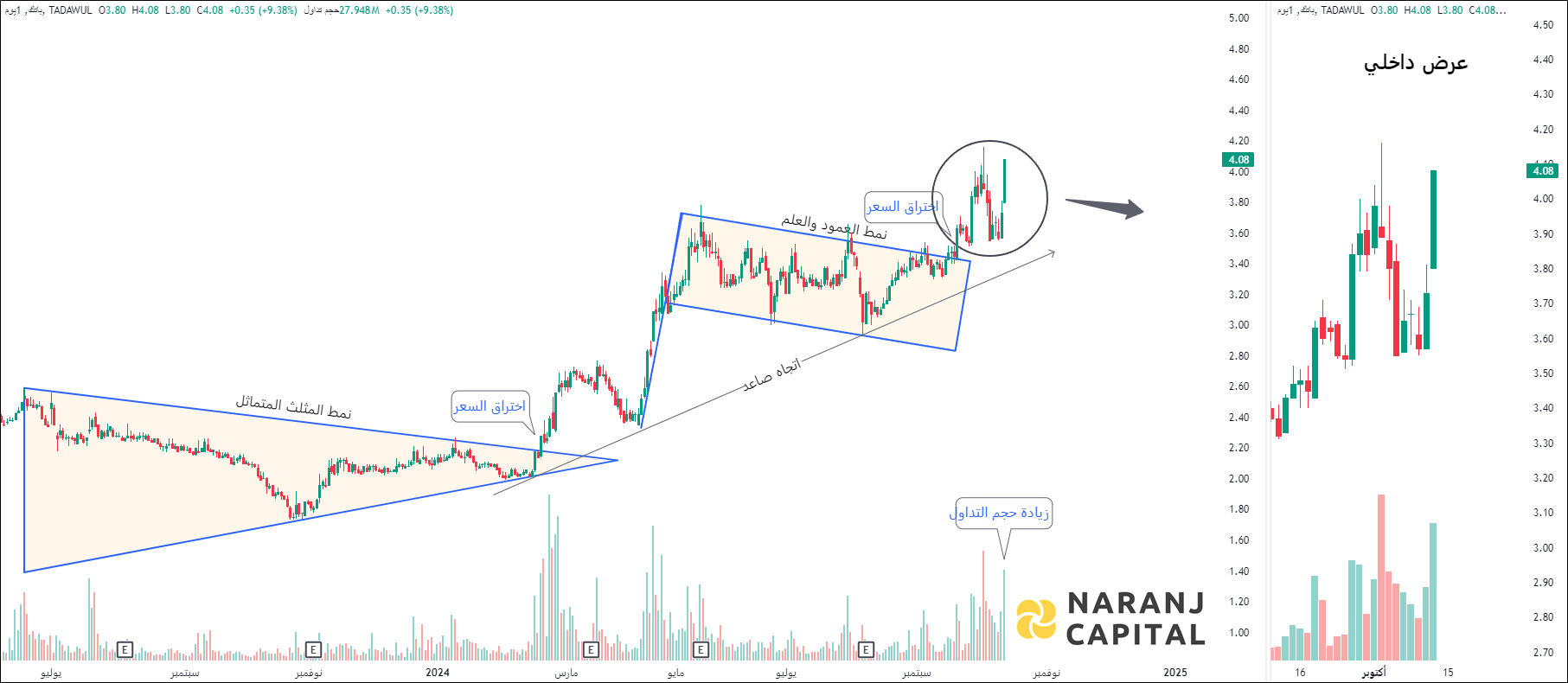

Batic Investments & Logistics Co. specializes in the development of residential and commercial properties. The company operates across various sectors, including Transportation, Real Estate, Security Services, ATM Management, Insurance Money Transfer, Currency Handling, Maintenance and Operations, and Medical Equipment Supply. The Transportation division offers a wide range of services, such as goods transportation, car and trailer rentals, cold storage rentals, fuel stations, maintenance workshops, and equipment sales and maintenance for road transport. In the Real Estate segment, the company acquires and sells land and constructs buildings. Additionally, the Security Services division provides reliable security guard and shift services to banks and businesses. The ATM Feeding division encompasses the provision of feeding and upkeep services for ATMs operated by banks. In the Insurance Money Transfer sector, this company specializes in delivering secure and insured transportation services for the transfer of valuable assets and funds. Their Maintenance and Operation segment excels in providing comprehensive building maintenance, efficient property management, and effective marketing solutions. The company is headquartered in Riyadh, Saudi Arabia.

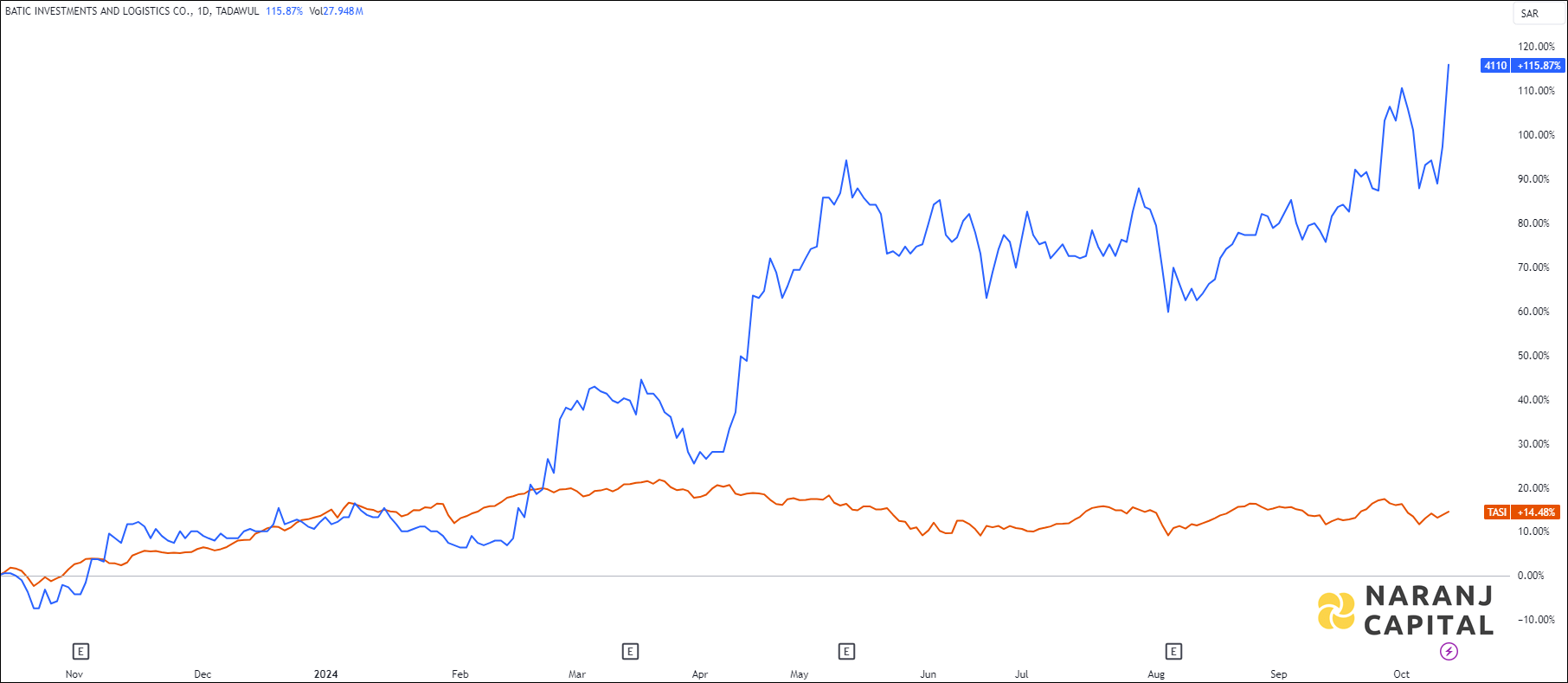

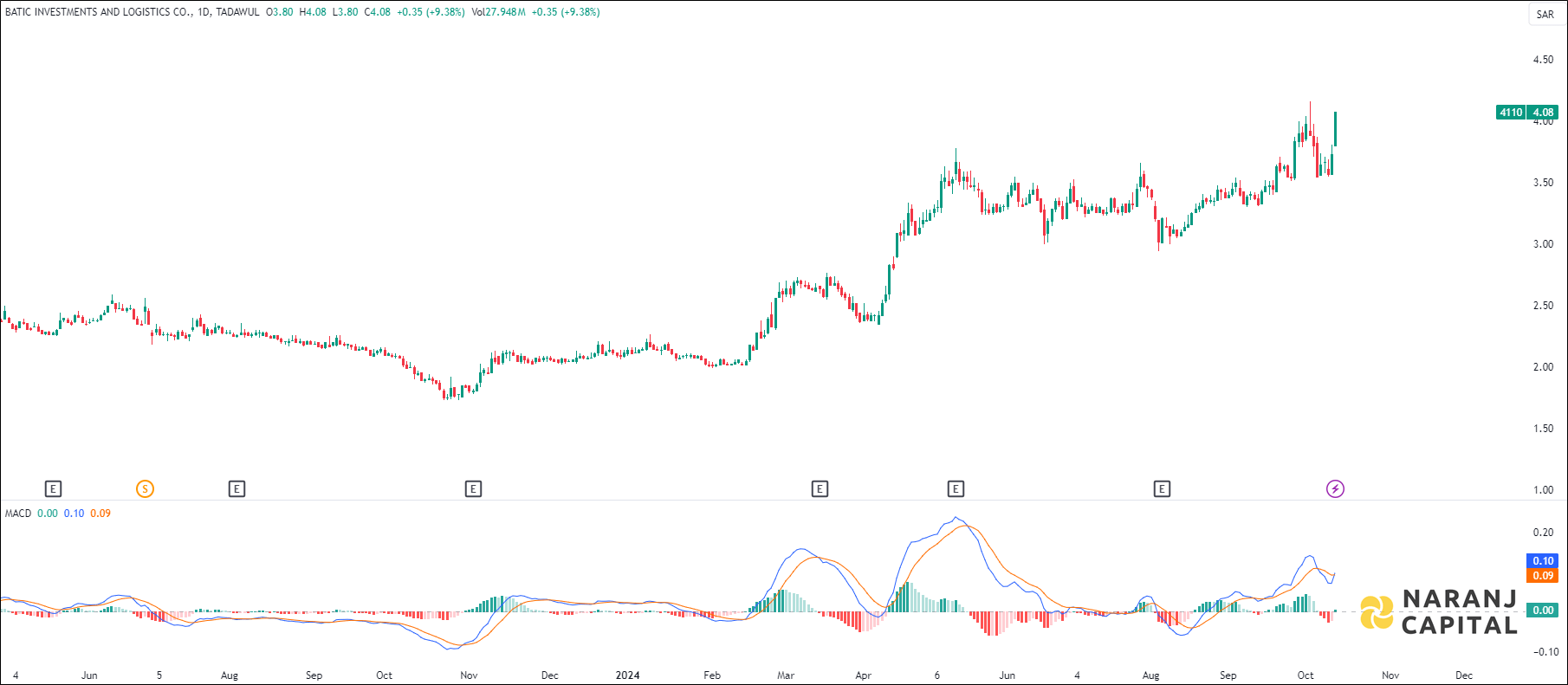

BATIC — TASI —

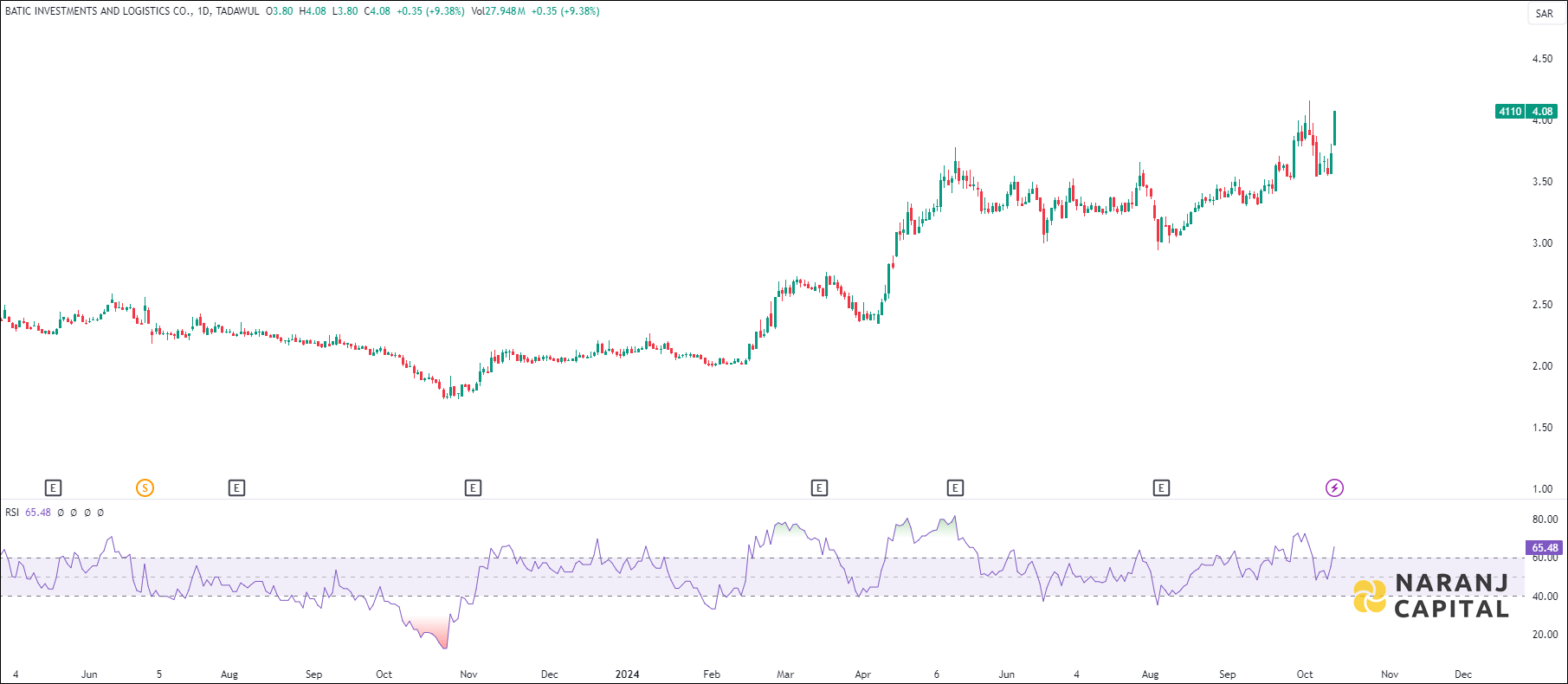

Current RSI of this stock is 65.48, which indicates the strength of buyers.

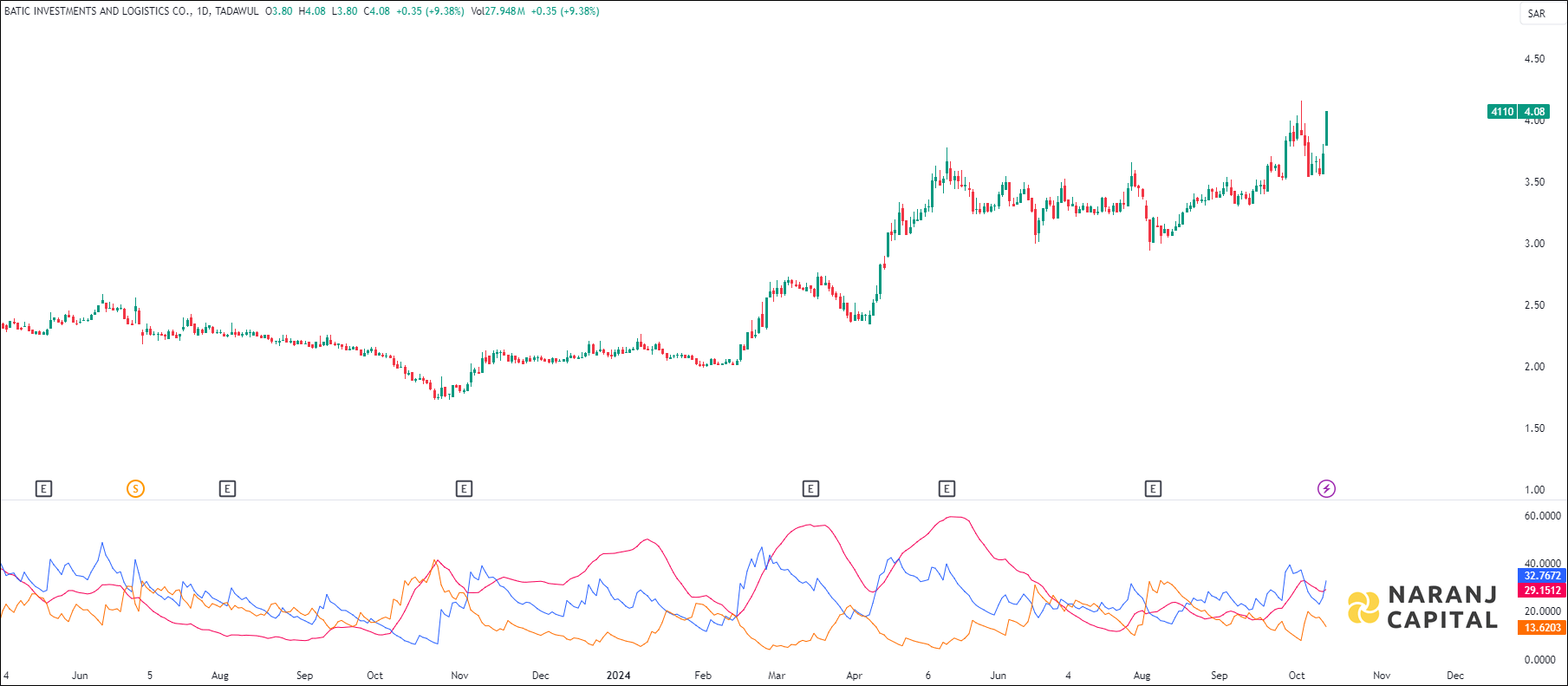

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

Based on our saudi stocks trading signals, Batic Investments and Logistics stock price target will be SAR 4.3 - SAR 4.4 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website