- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

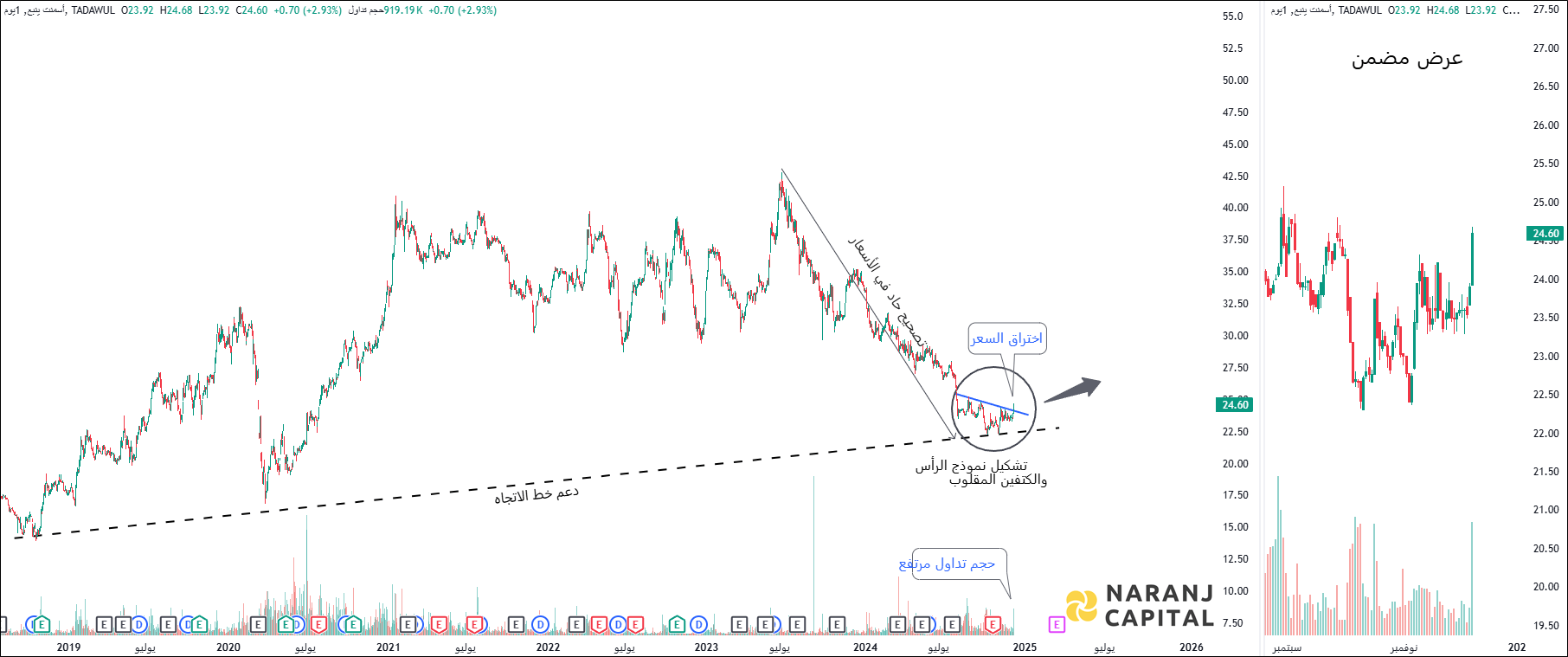

Yanbu Cement Company, along with its subsidiaries, specializes in the production, manufacturing, and trading of cement and related products both within the Kingdom of Saudi Arabia and on an international scale. The company provides a variety of cement types, including ordinary Portland, Pozzolana Portland, hydraulic, and sulphate-resistant options. Additionally, it engages in the production and wholesale distribution of cement paper, as well as the sale of packaged and bulk cement, along with cement bags. Established in 1977, Yanbu Cement Company is based in Jeddah, Saudi Arabia.

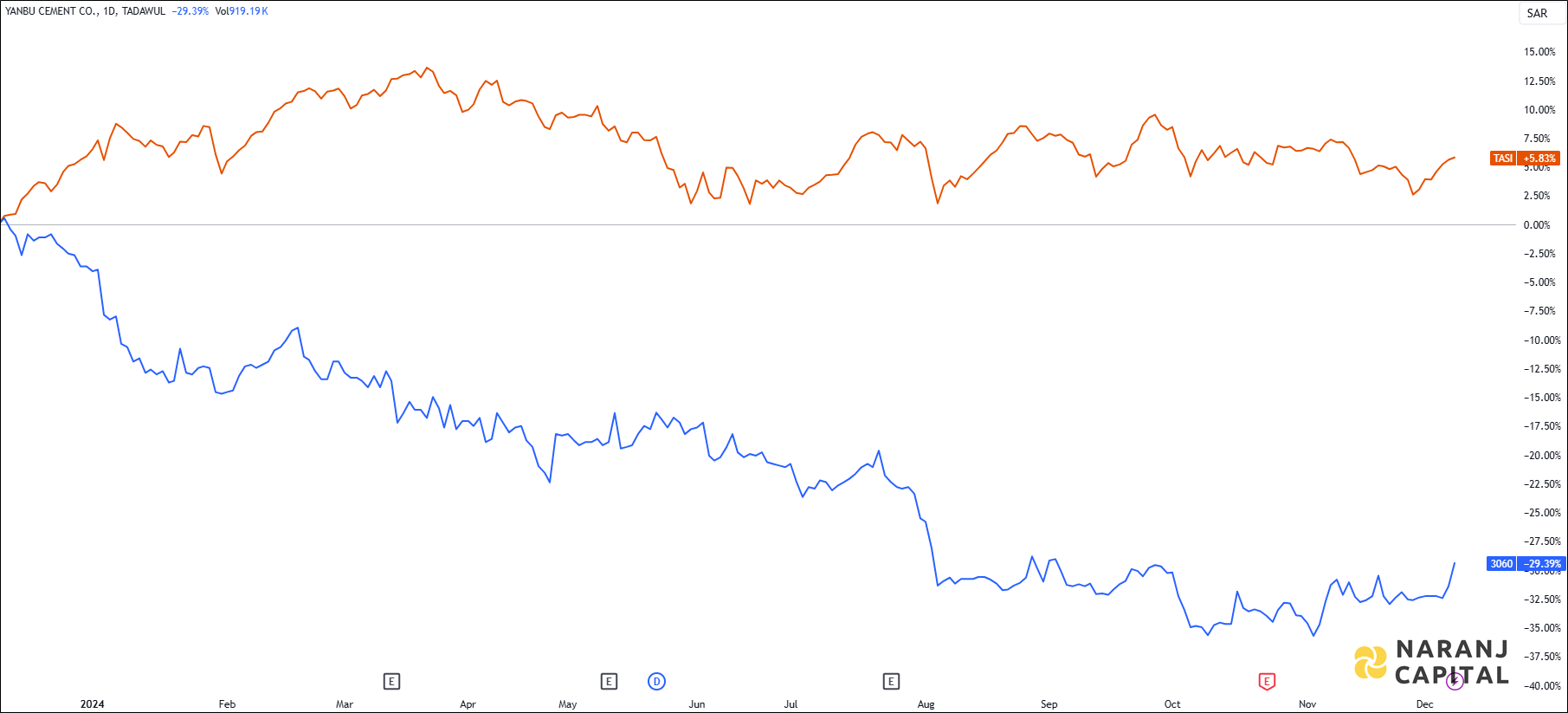

YCC — TASI —

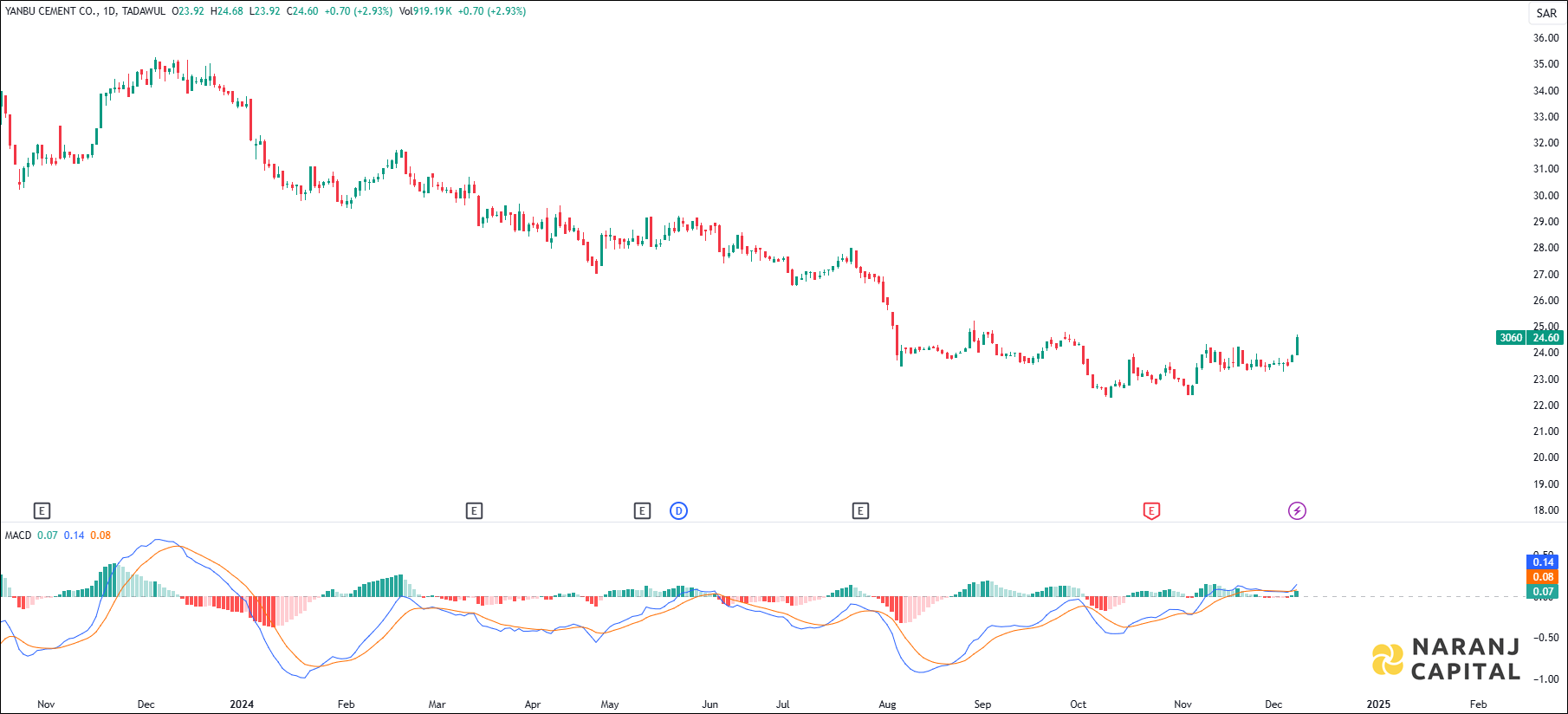

Current RSI of this stock is 74.10, which indicates the strength of buyers.

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

Based on our saudi stocks trading signals, Yanbu Cement stock price target will be SAR 25.5 - SAR 25.75 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website