- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Saudi Company for Hardware or SACO headquartered in Riyadh, Saudi Arabia, stands as a leading import, export, wholesale, and retail provider of home improvement products in Saudi Arabia, known for its extensive reach. With a robust presence in 19 cities across the Kingdom, SACO operates a total of 35 stores, including five expansive SACO World superstores. Spanning from 2,000 to 24,500 square meters, these retail spaces offer an impressive selection of over 45,000 diverse products. Its wide range of offerings includes automotive, bed and bath, building materials, electrical and power supplies, electrical appliances, furniture, hardware, houseware, lawn and garden, lighting, outdoors, paint and sundries, plumbing supplies and fixtures, sports and accessories, storage and organization, tools, and toys. The company operates through two main segments: Sales and Services, which focuses on selling goods to retail and wholesale customers, and Logistic Services, which provides logistics solutions such as freight forwarding, transportation, and contract logistics to clients.

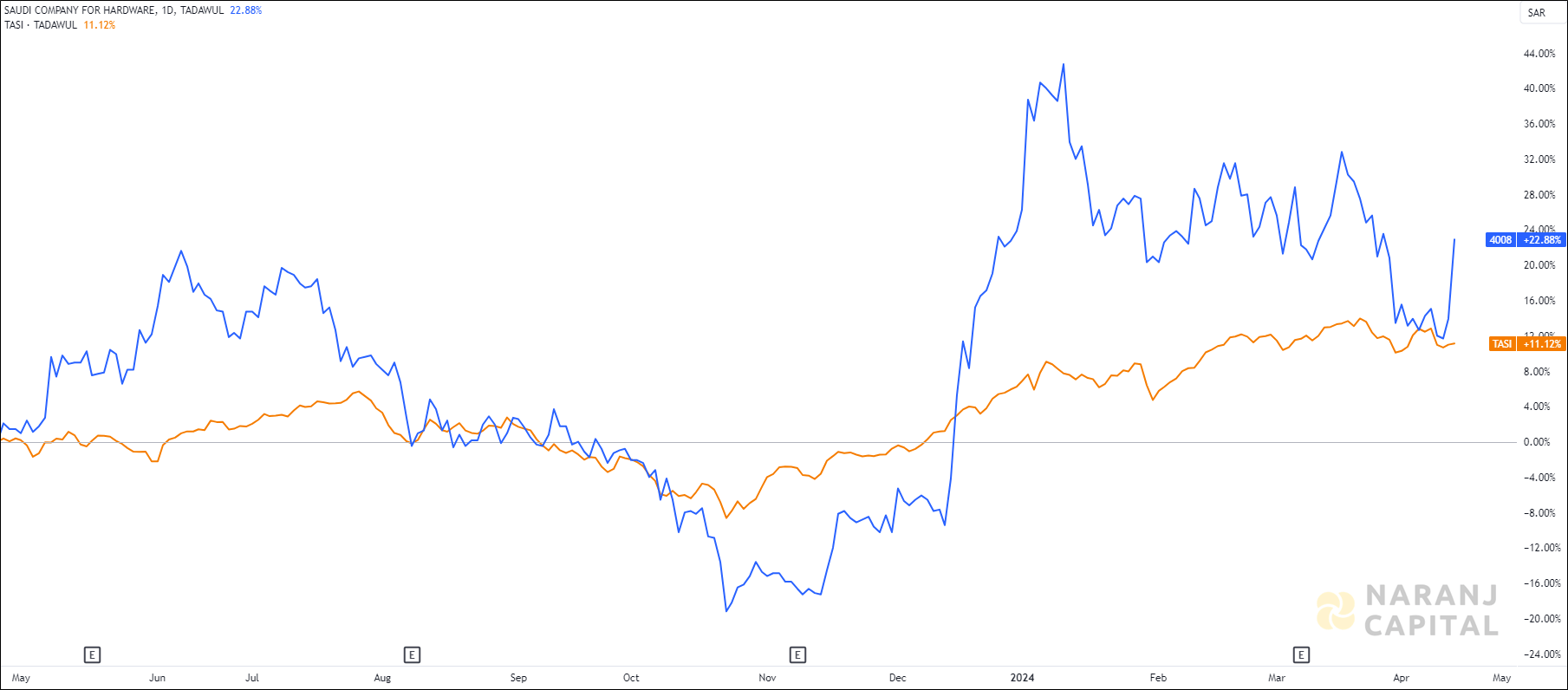

SACO — TASI —

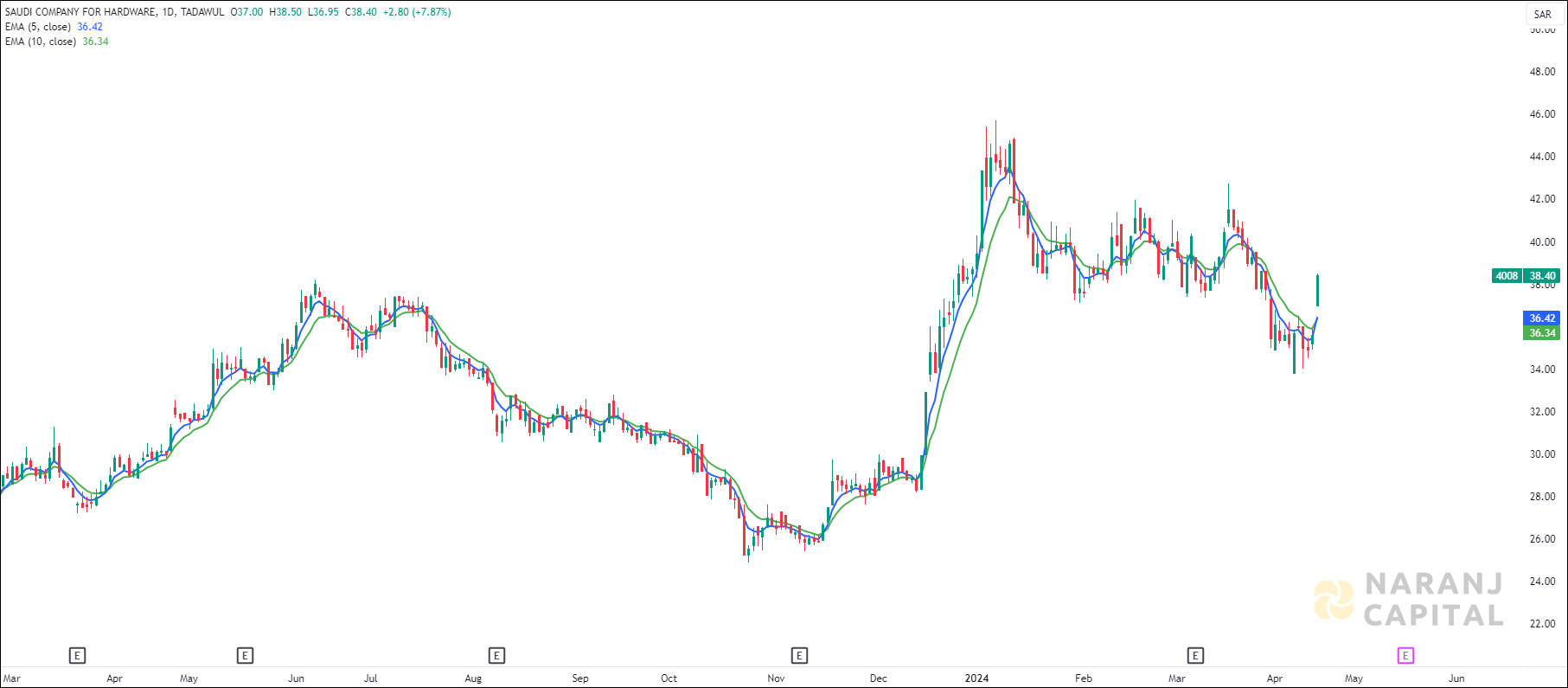

The short length exponential moving average (5 EMA) has crossed the long length exponential moving average (10 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

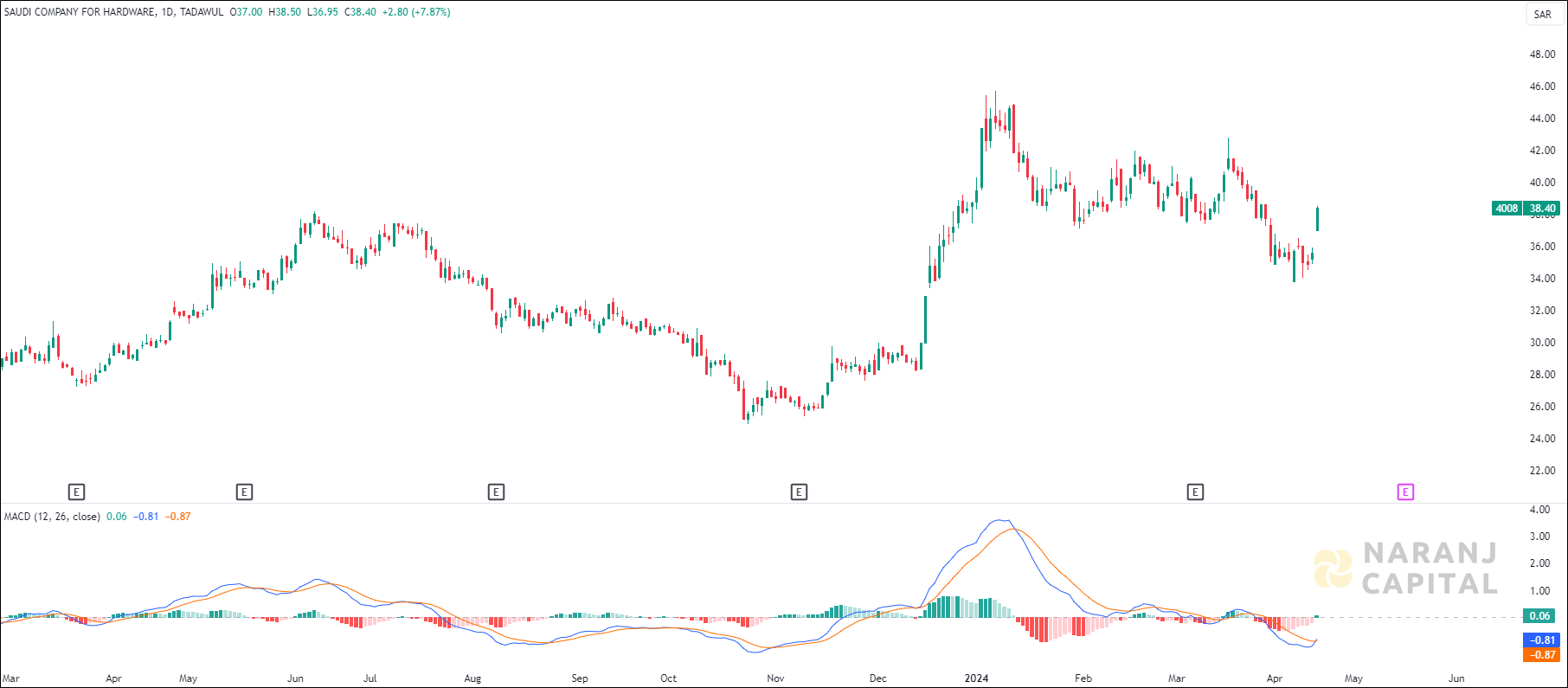

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

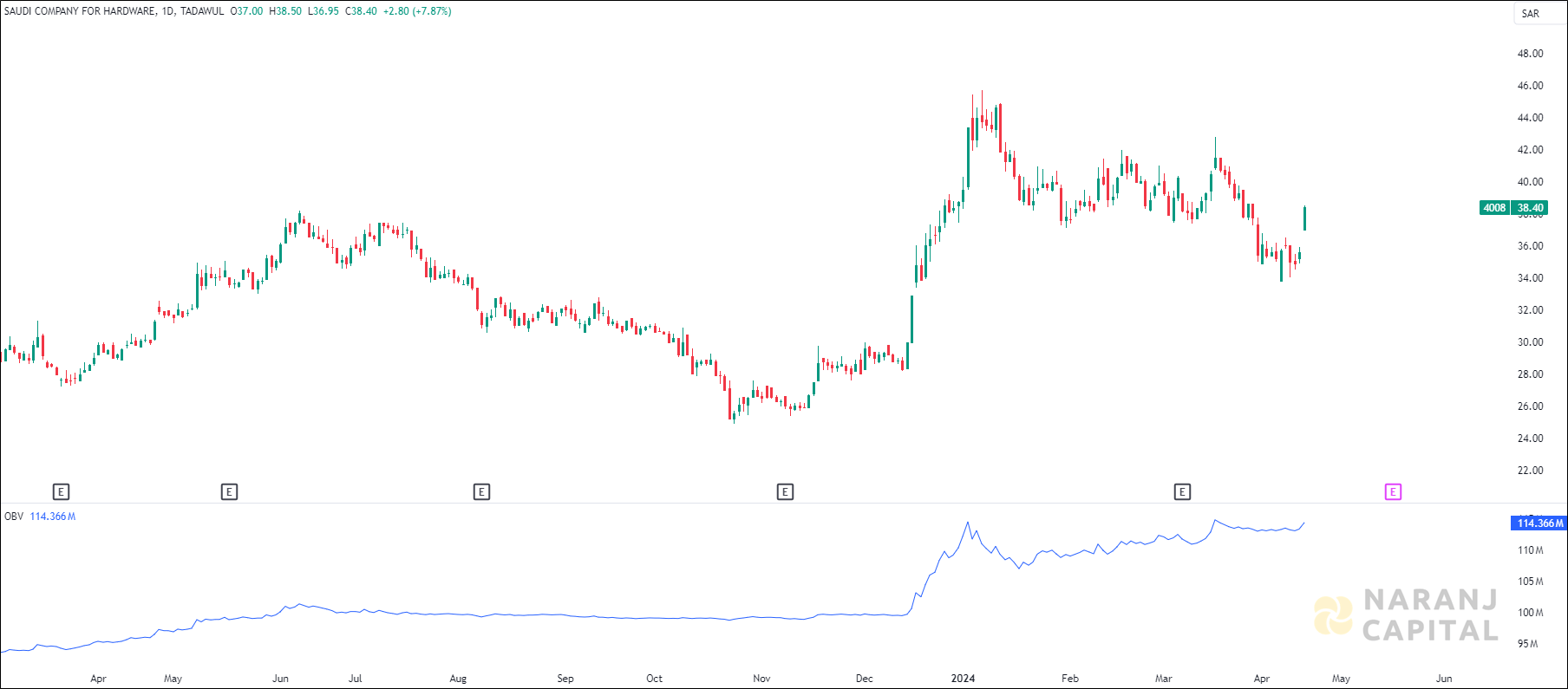

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our stock selection for KSA Tadawul, Saudi Company for Hardware stock price target will be SAR 40.5 - SAR 41 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website