- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

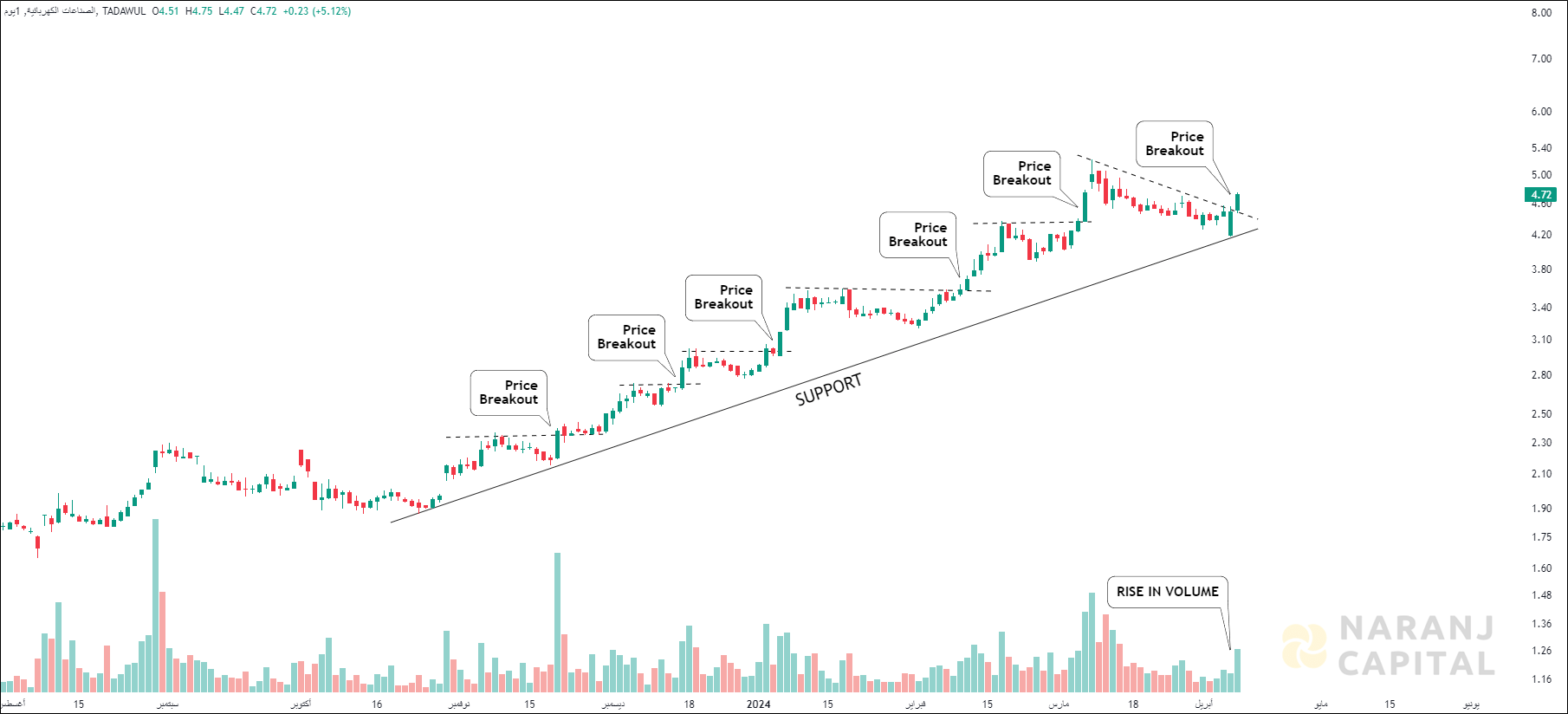

Electrical Industries Co. deals in manufacturing,delivery and repair of Electrical Transformers , compact Substations , Lv Control Panels , Cable Trays, Mv & Lv Switch gears , other electrical products and Service related to these activities.The company was founded on August 7, 2007 and is headquartered in Dammam, Saudi Arabia.

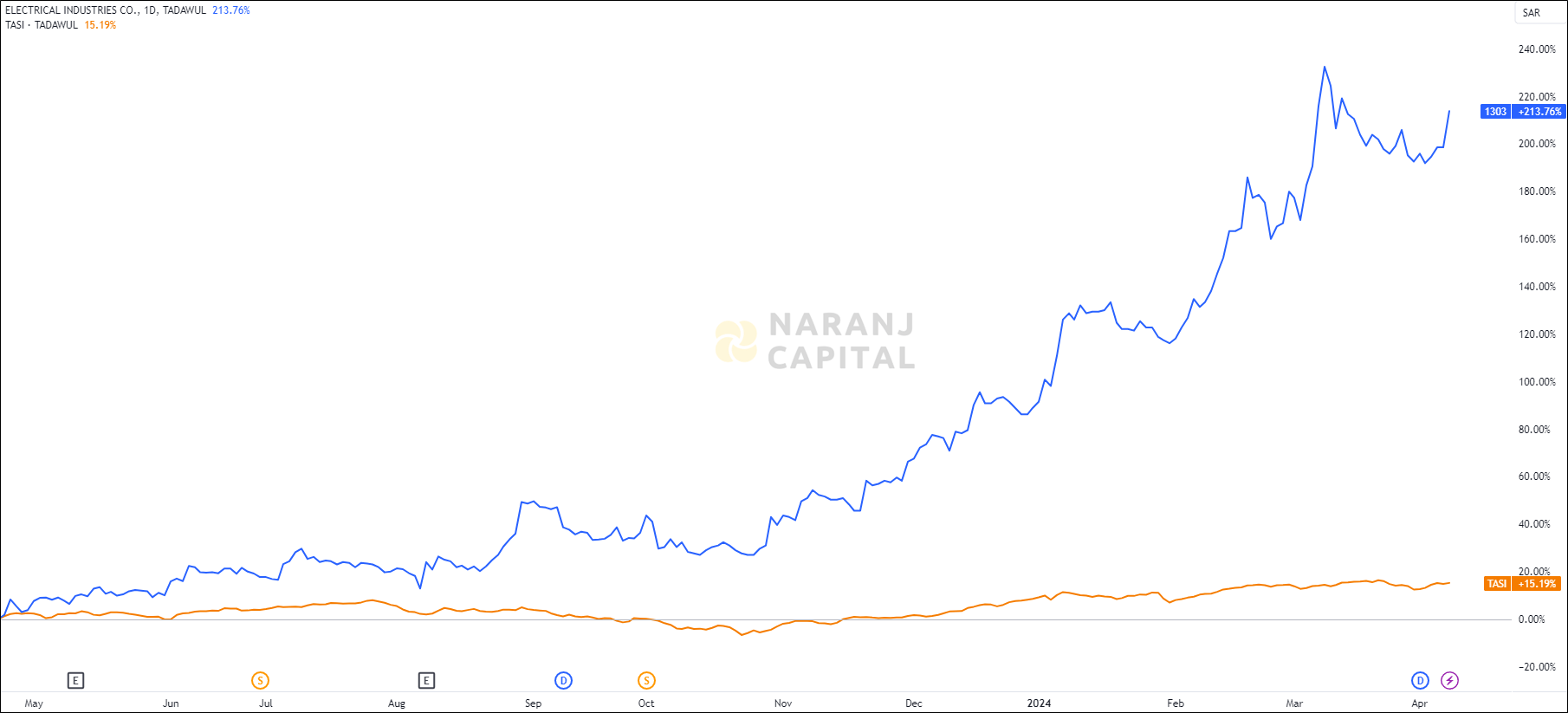

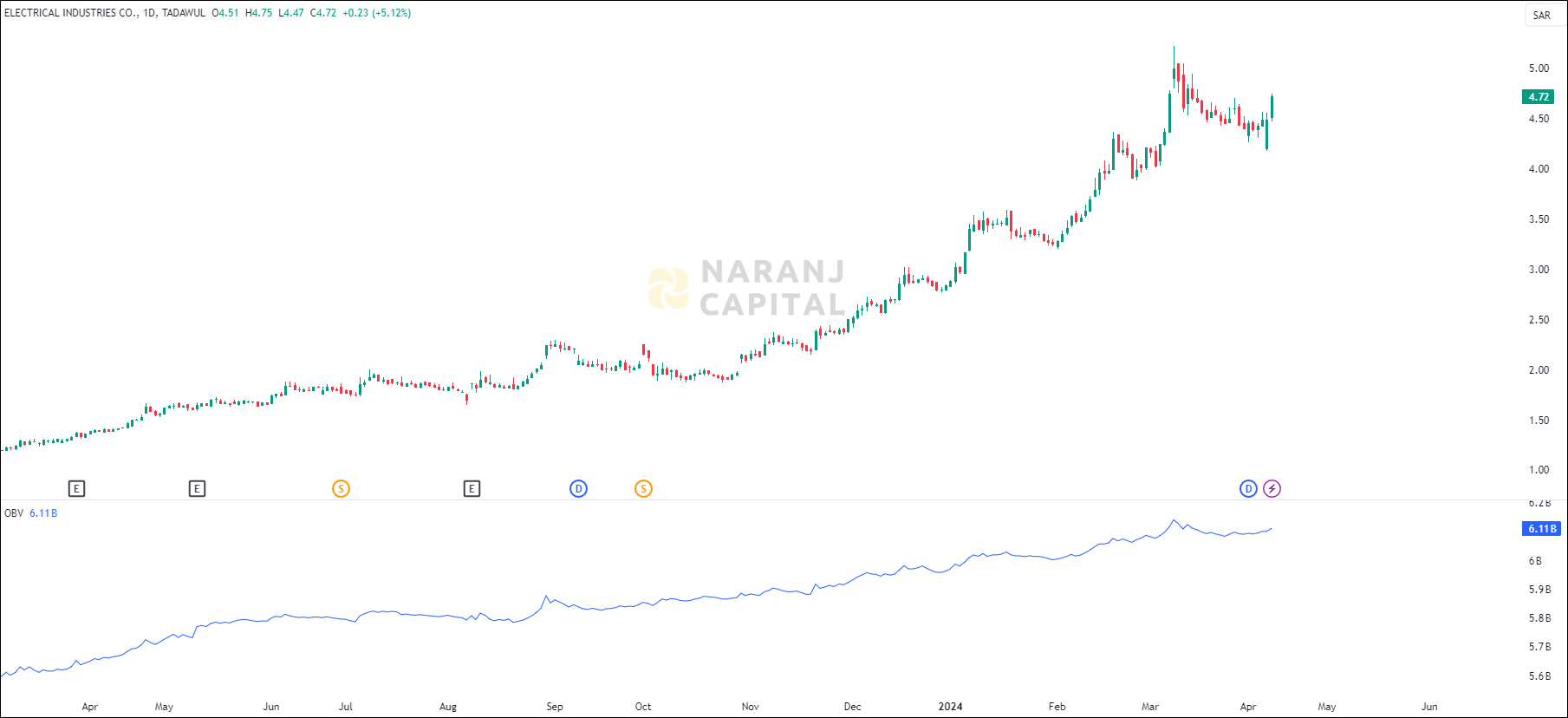

EIC — TASI —

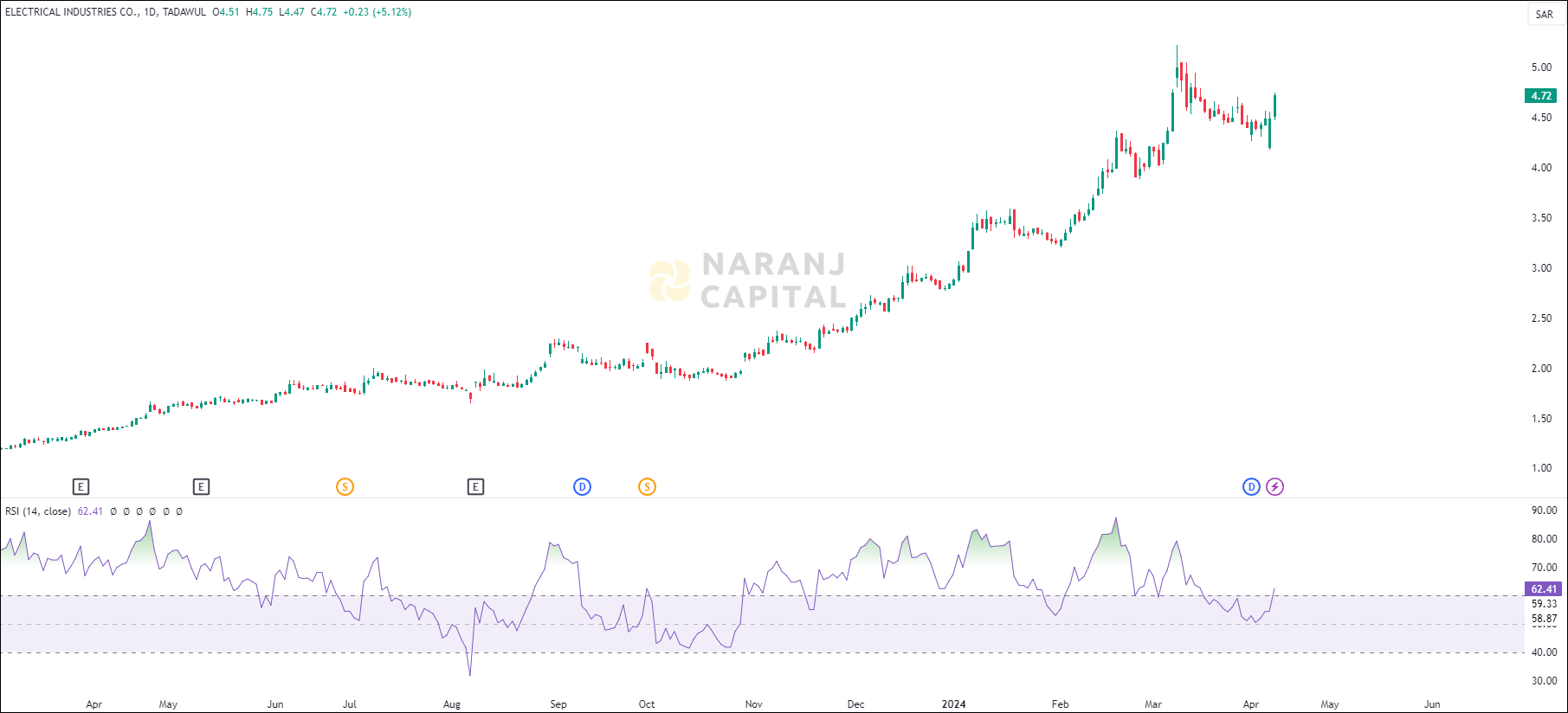

Current RSI of this stock is 62.41, which indicates the strength of buyers.

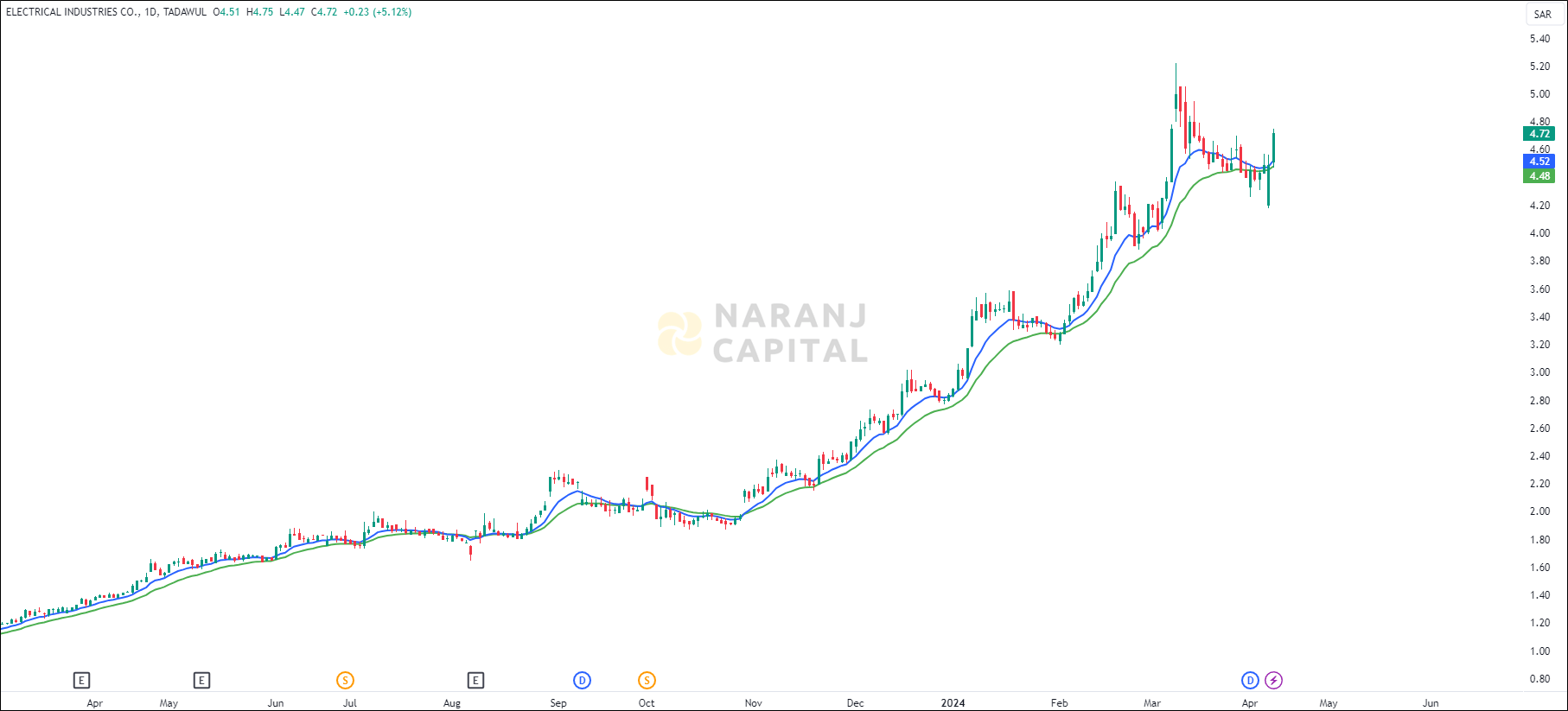

The short term exponential moving average (10 EMA) is going upside by touching the long term exponential moving average (20 EMA) and the last day’s candle is closed above all the moving averages. This suggests buyers are taking interest in this stock.

The OBV line is moving in the same upward direction which means there is a positive sentiment in the market. Also the significant price up move accompanying with increasing OBV volume suggests strong buying pressure.

Based on our stock recommendations for Saudi Tadawul, Electrical Industries stock price target will be SAR 5 - SAR 5.1 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website