- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Dallah Healthcare is a Saudi Arabian company that provides and operates healthcare programs and utilities. It was founded in 1995 and has sectors in hospitals, pharmaceuticals, management, operation, and Dallah Healthcare operates six hospitals in Saudi Arabia, including its flagship Dallah Al Nakheel and Dallah Namar hospitals in Riyadh. The total bed capacity in its hospitals reached 901, compared to 600 beds at the end of 2020. Dallah Healthcare has 2,068 employees.

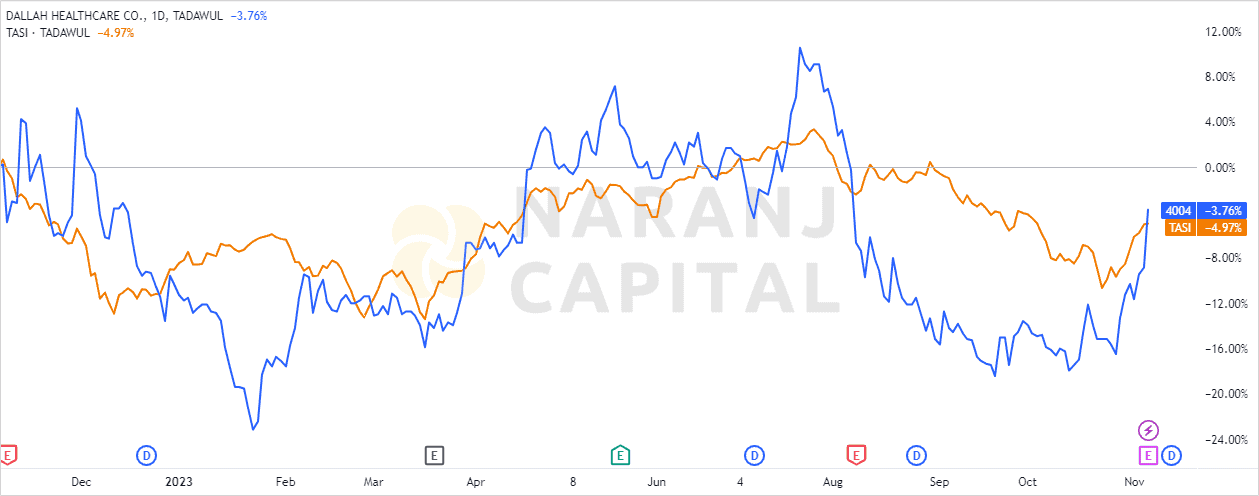

DALLAH — TASI —

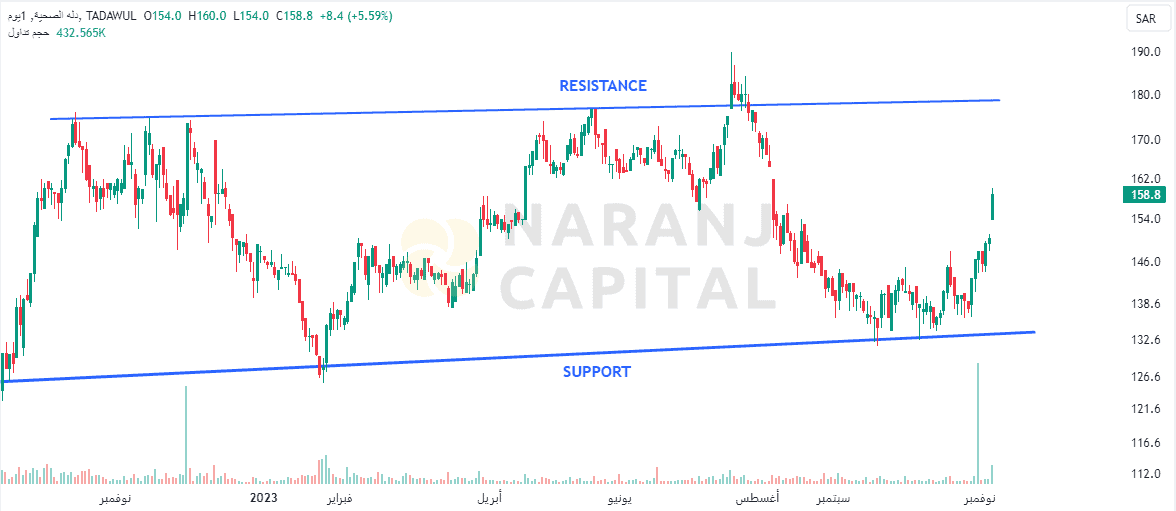

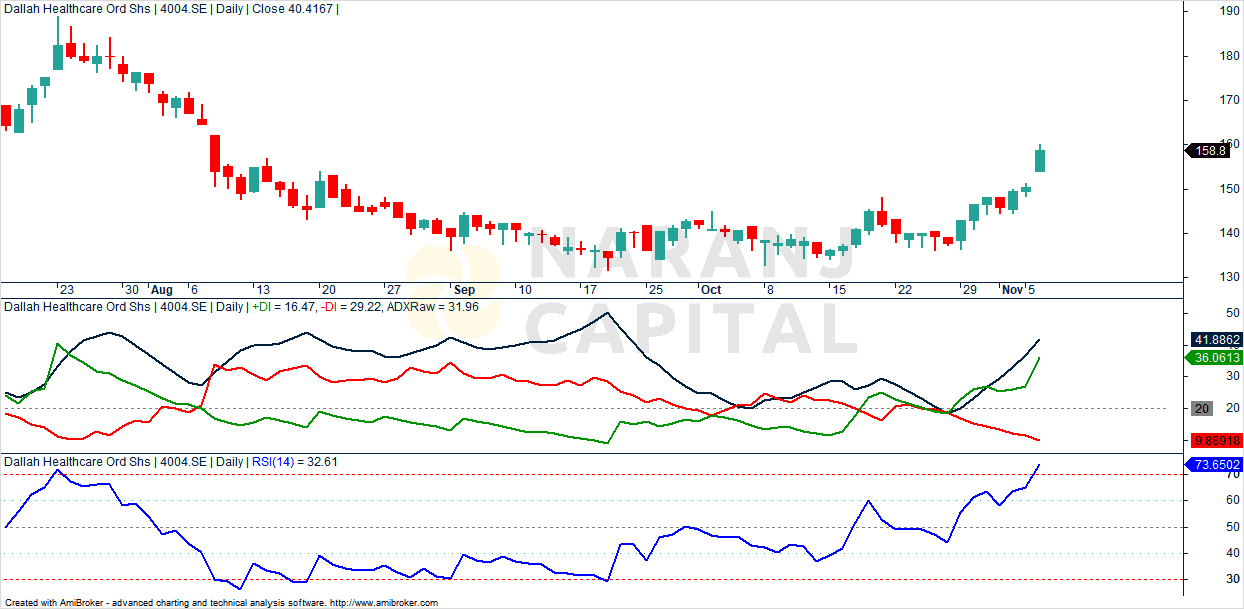

As seen in the Dallah Healthcare chart analysis, stock price has been moving in a larger sideways range in the last 8 months and the stock price was showing lack of strength to sustain the upmove during this period.

The current RSI of this stock is 73.65, which indicates strength.

Based on our Saudi stock trading ideas, Dallah Healthcare stock price target will be SAR 166 - SAR 170 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website