- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Etihad Atheeb Telecom, also known as GO Telecom, is a Saudi Arabian telecommunications company that provides fixed services including voice, broadband services and voice over IP services in the Kingdom of Saudi Arabia. It has a WiMAX network covering over 20 areas and a fiber-optic network for businesses and industries. The company was established in 2008 as a Saudi joint stock company, and its major shareholders include Atheeb Trading Company, Batelco, Al-Nahla Trading Company, and Traco Trading Ltd Co. Other founding shareholders include Saudi Internet Ltd, Atheeb Ltd. for Computer and Communication, and Atheeb Maintenance and Service.

Etihad Atheeb Telecom was one of ten applicants to bid for a public fixed services license on March 10, 2007, and the Communications and Information Technology Commission (CITC) approved the list of eligible applicants for fixed services licenses on April 15, 2007, which included Etihad Atheeb Telecom and two other operators.

Following the license announcement, Etihad Atheeb Telecom acquired a 3.5 GHz frequency spectrum covering thirteen regional divisions across Kingdom of Saudi Arabia valued at over 500 million riyals (US$138 million). In January 2009, Etihad Atheeb Telecom announced an IPO of 30% of the company’s shares with a total value of 300 million riyals, at a price of 10 riyals per share. Etihad Atheeb Telecom is headquartered in Riyadh and has a strong financial solvency.

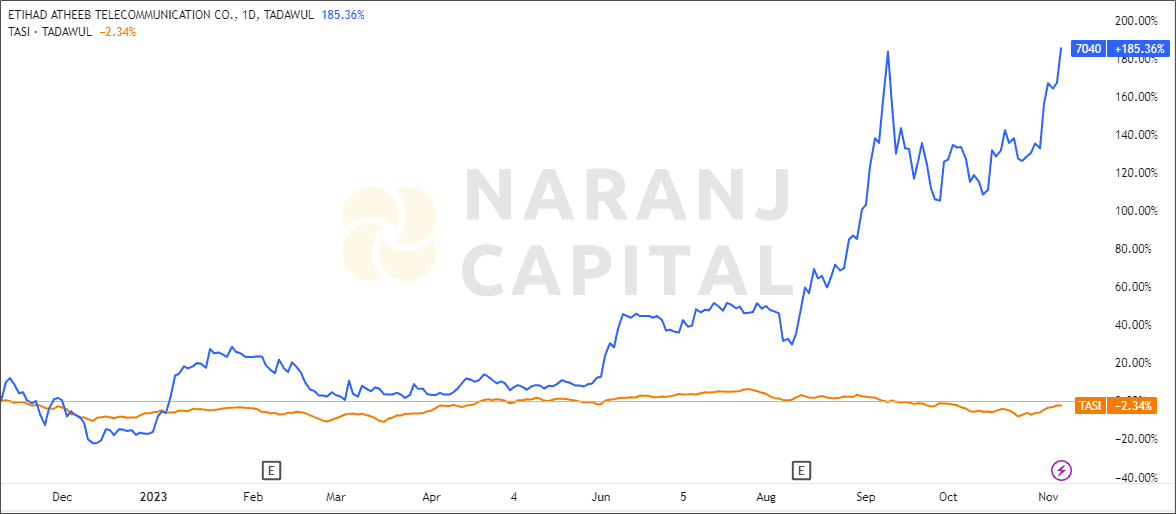

GO TELECOM — TASI —

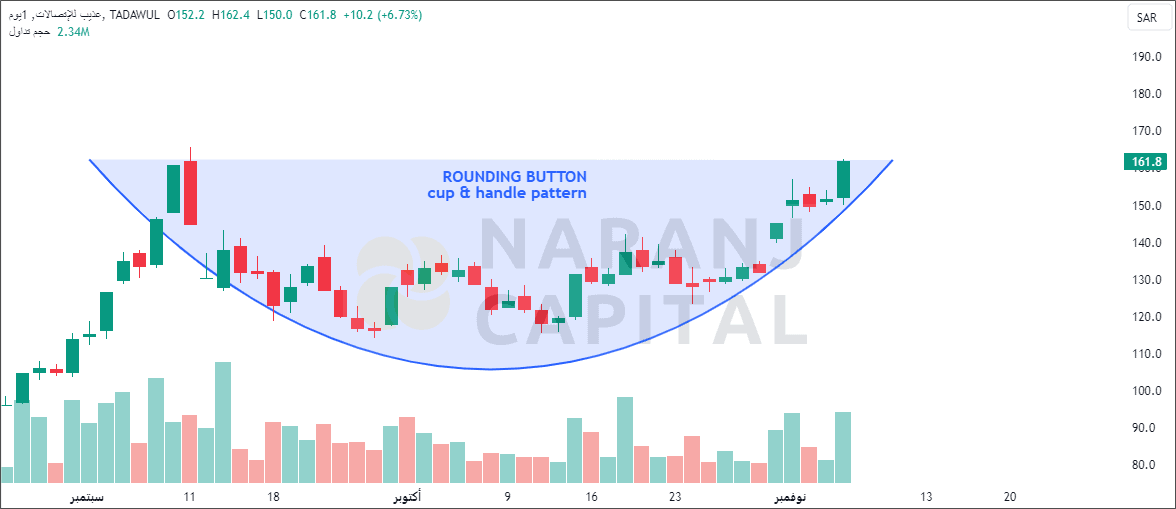

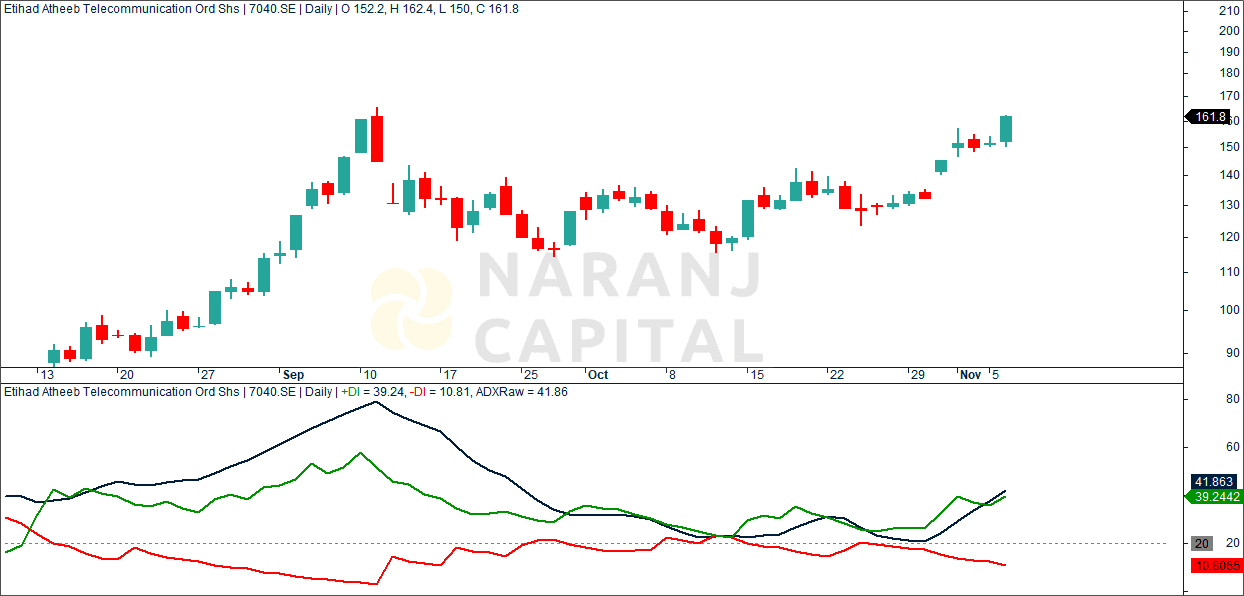

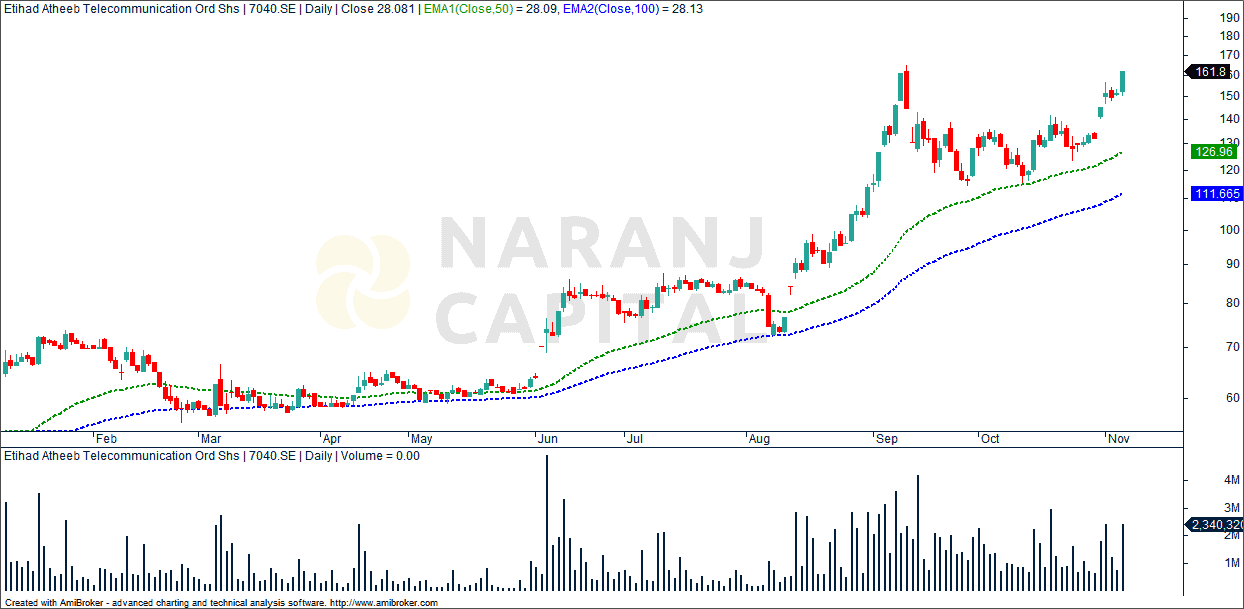

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The current stock price moves above its moving average. This often suggests that the stock’s momentum is starting to move upward, indicating a potential buying opportunity.

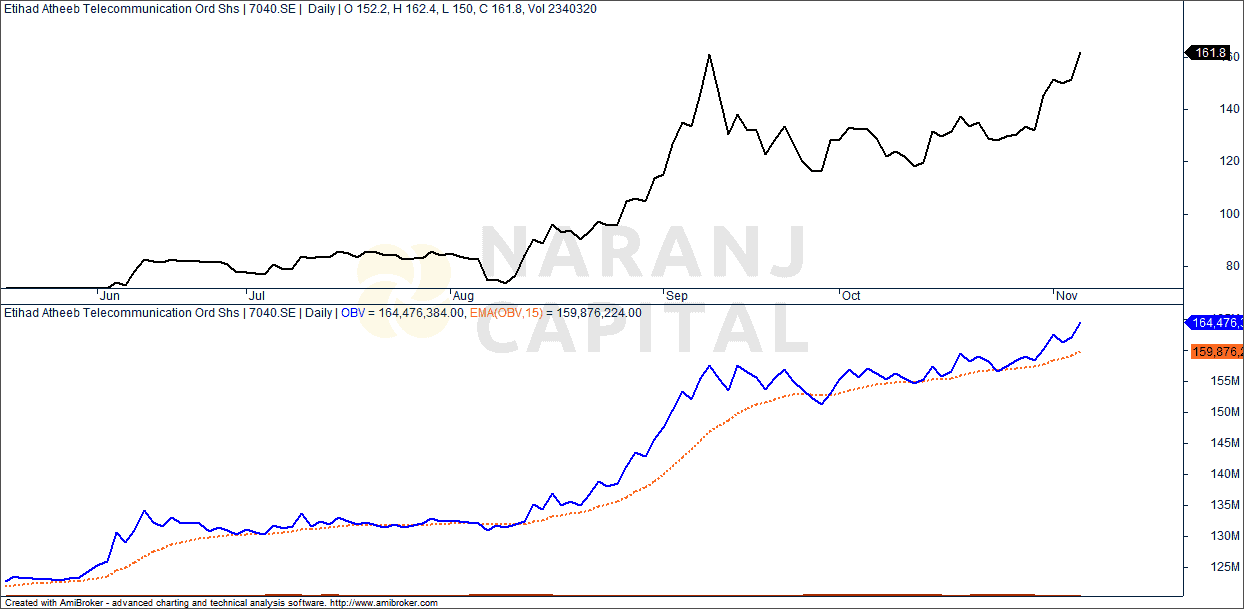

As seen in the Etihad Atheeb Telecom chart analysis, the OBV is trading above the 15 days MA of it’s on balance volume. Buying pressure is visible as the positive volume exceeds negative volume, and the OBV line rising upwards.

Based on our trading tips for Saudi stocks, Etihad Atheeb Telecom stock price target will be SAR 175 - SAR 180 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website