- NaranJ2024

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

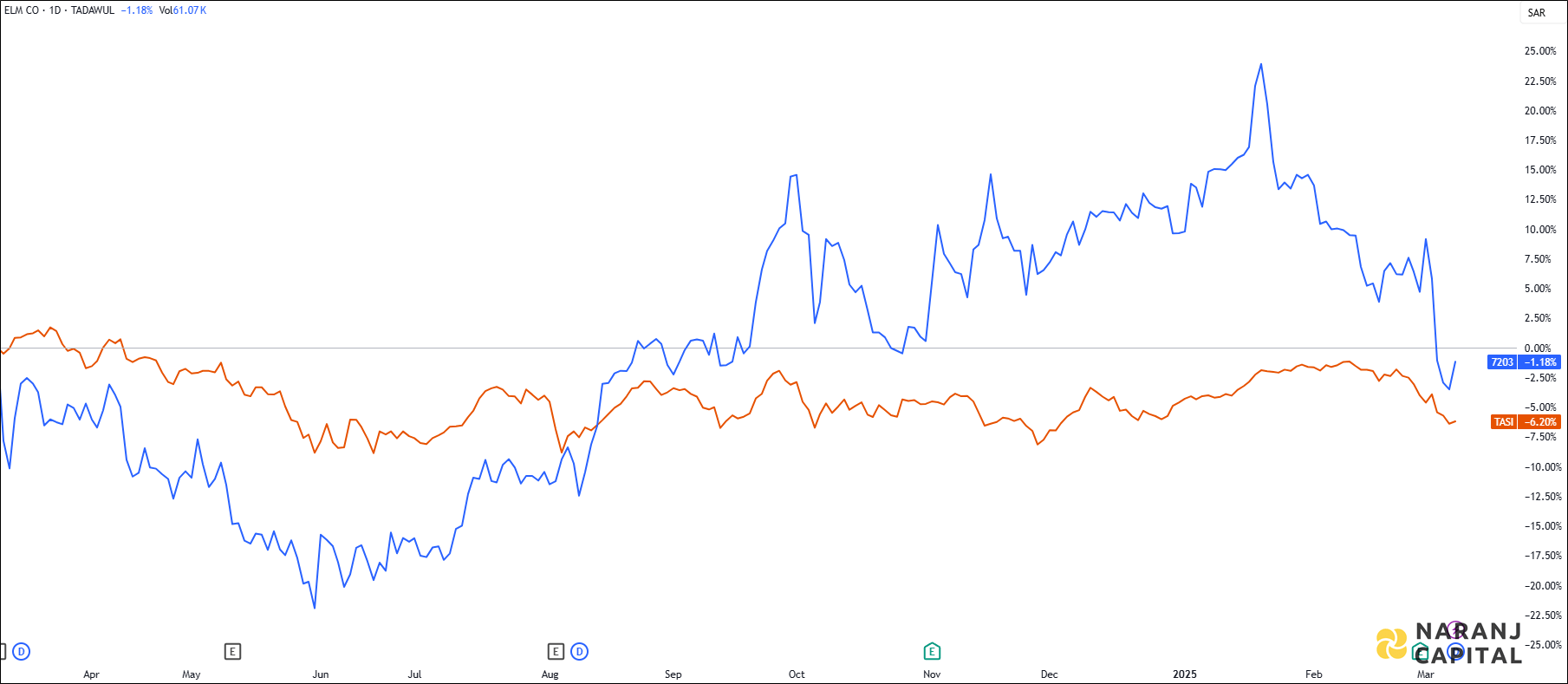

Elm Company delivers off-the-shelf and personalized digital solutions in Saudi Arabia. It provides technical services, online portals, electronic applications, and associated support operations, along with comprehensive technology business solutions to clients across both public and private sectors. Additionally, the company offers business process outsourcing services and expert advisory services in data analysis and artificial intelligence. Originally known as Al-ELM Information Security Company, Elm Company is currently headquartered in Riyadh, Saudi Arabia.

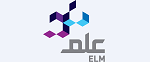

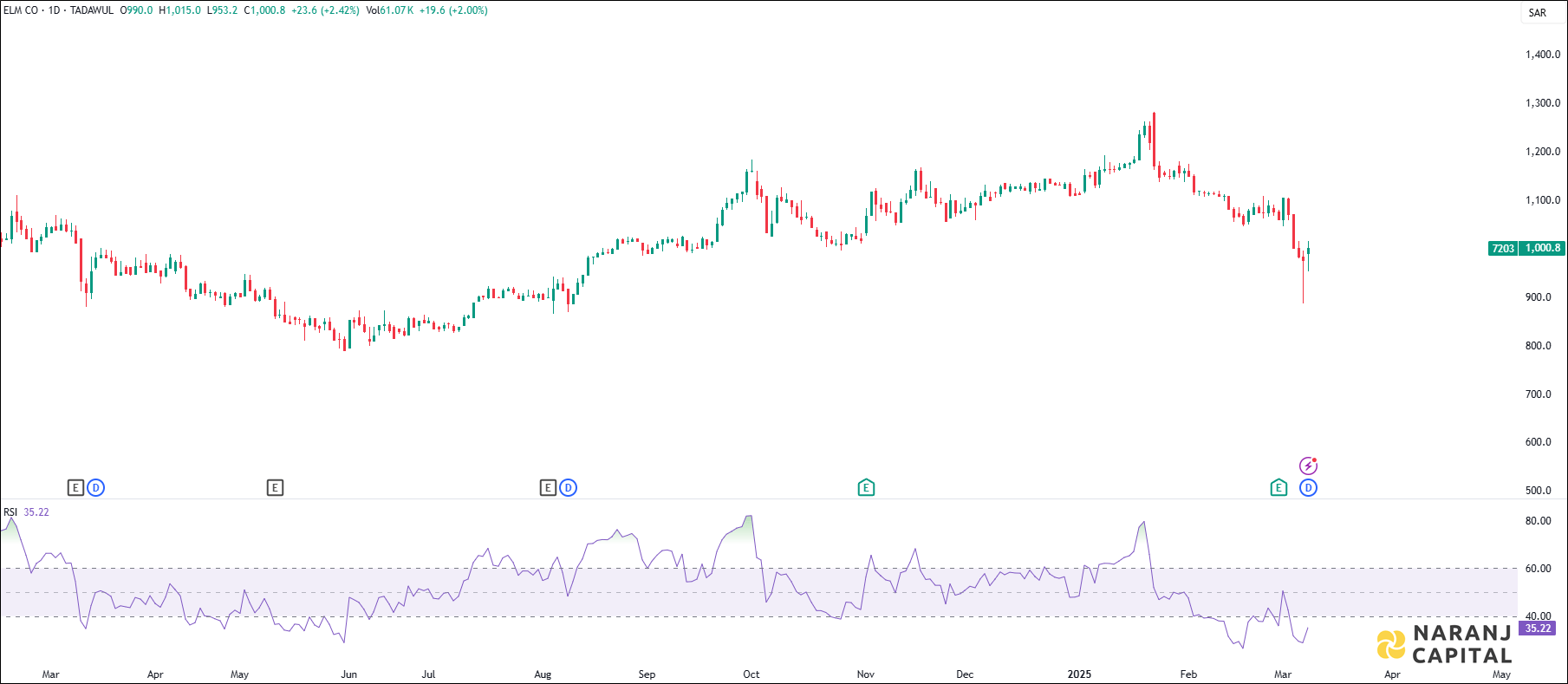

ELM — TASI —

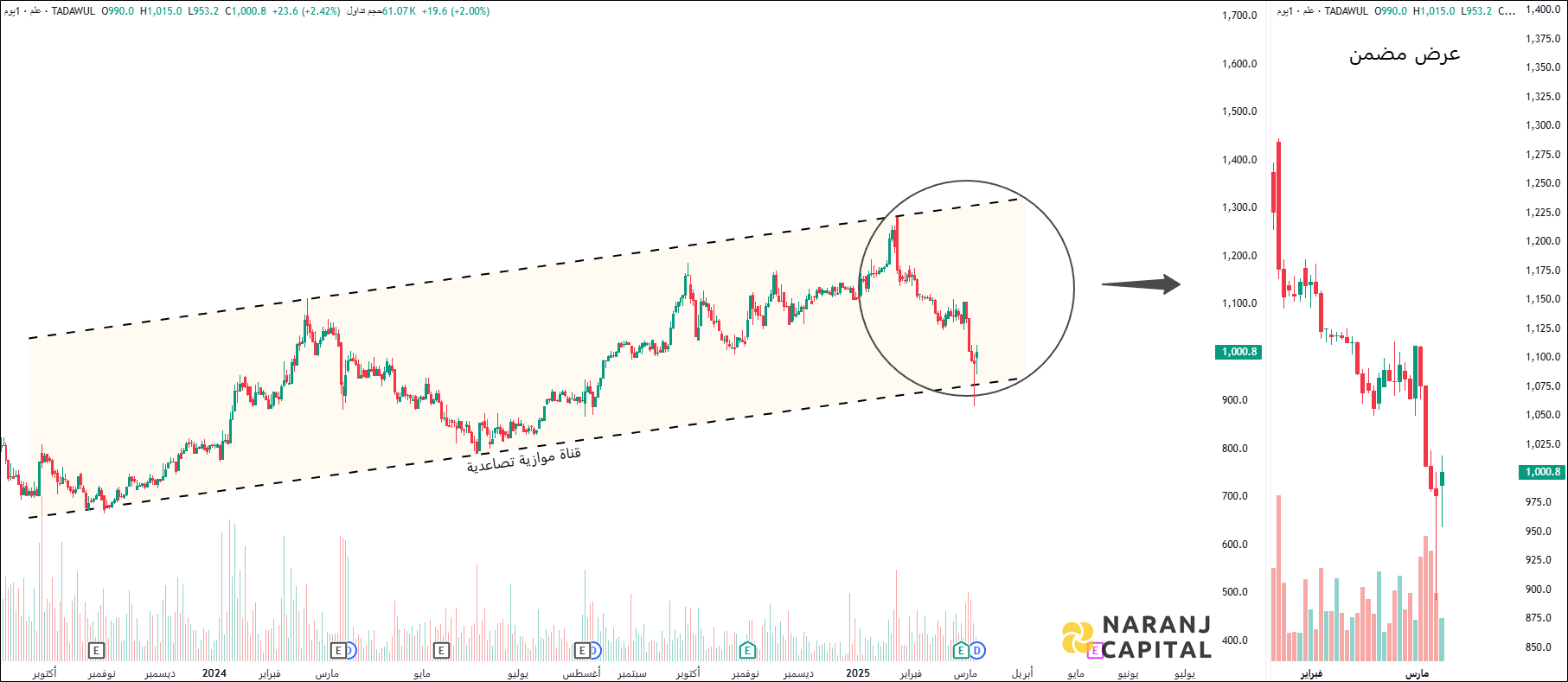

The K (Blue) line is crossing the D (Orange) line from the below, generates bullish signal.

The RSI line is crossing the oversold line from the below, generates bullish signal. The current RSI of the stock is 35.22.

Based on our Saudi Stocks Trading Guidance, Elm Co stock price target will be SAR 1050 - SAR 1060 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website