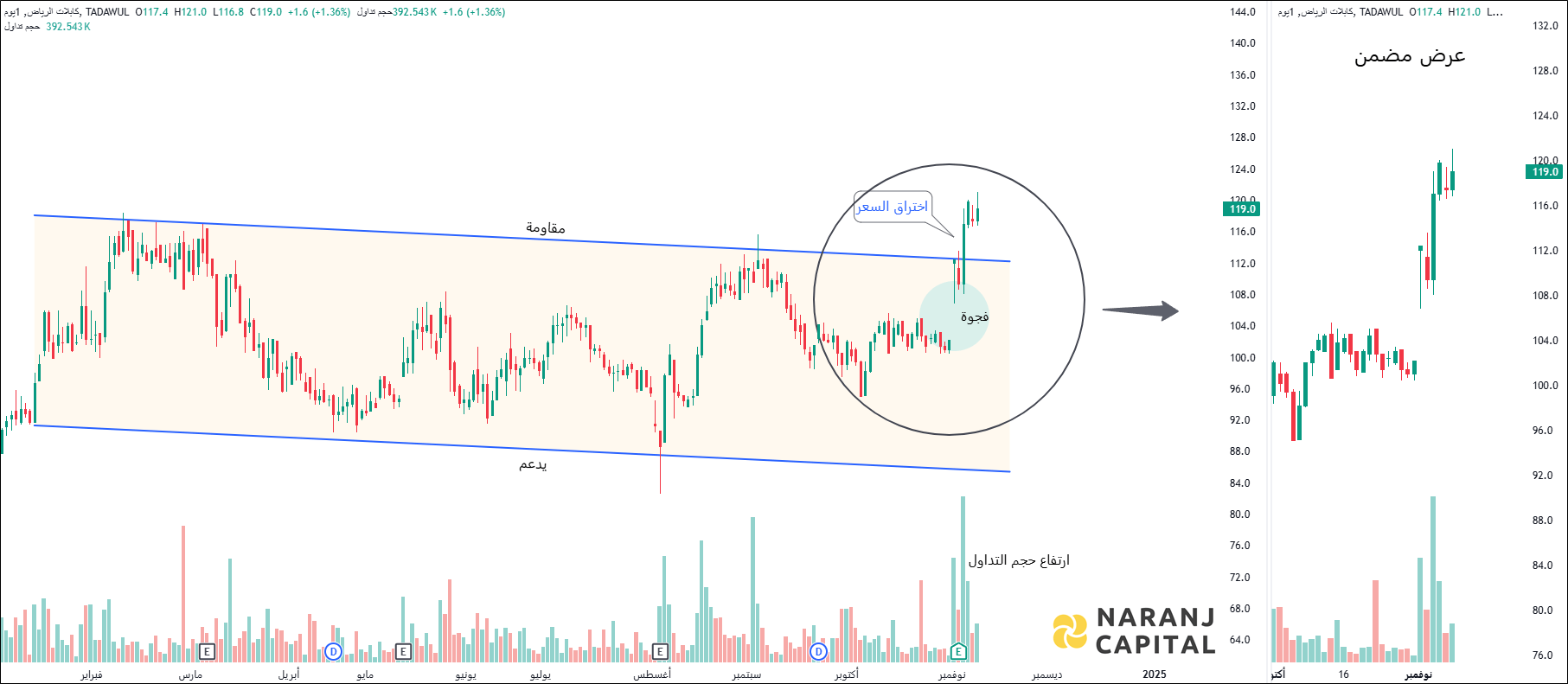

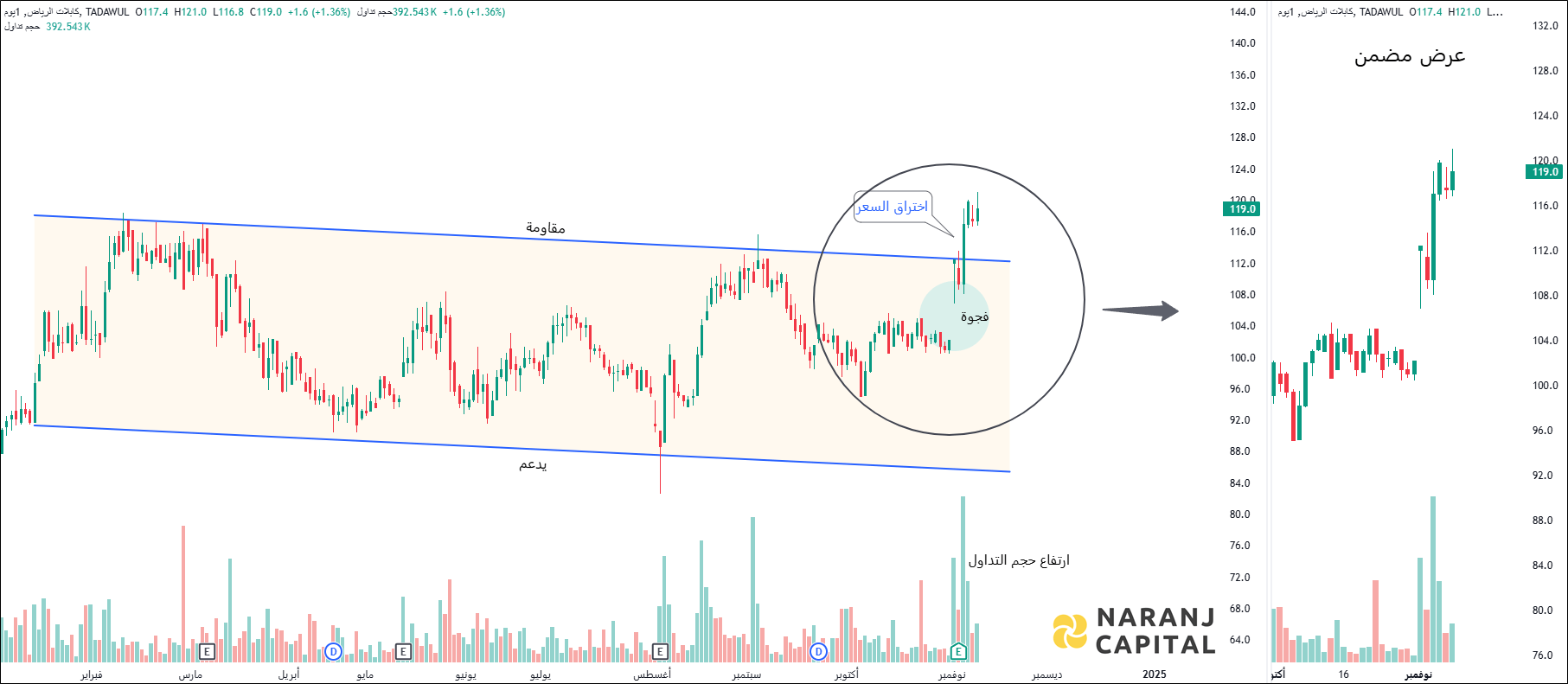

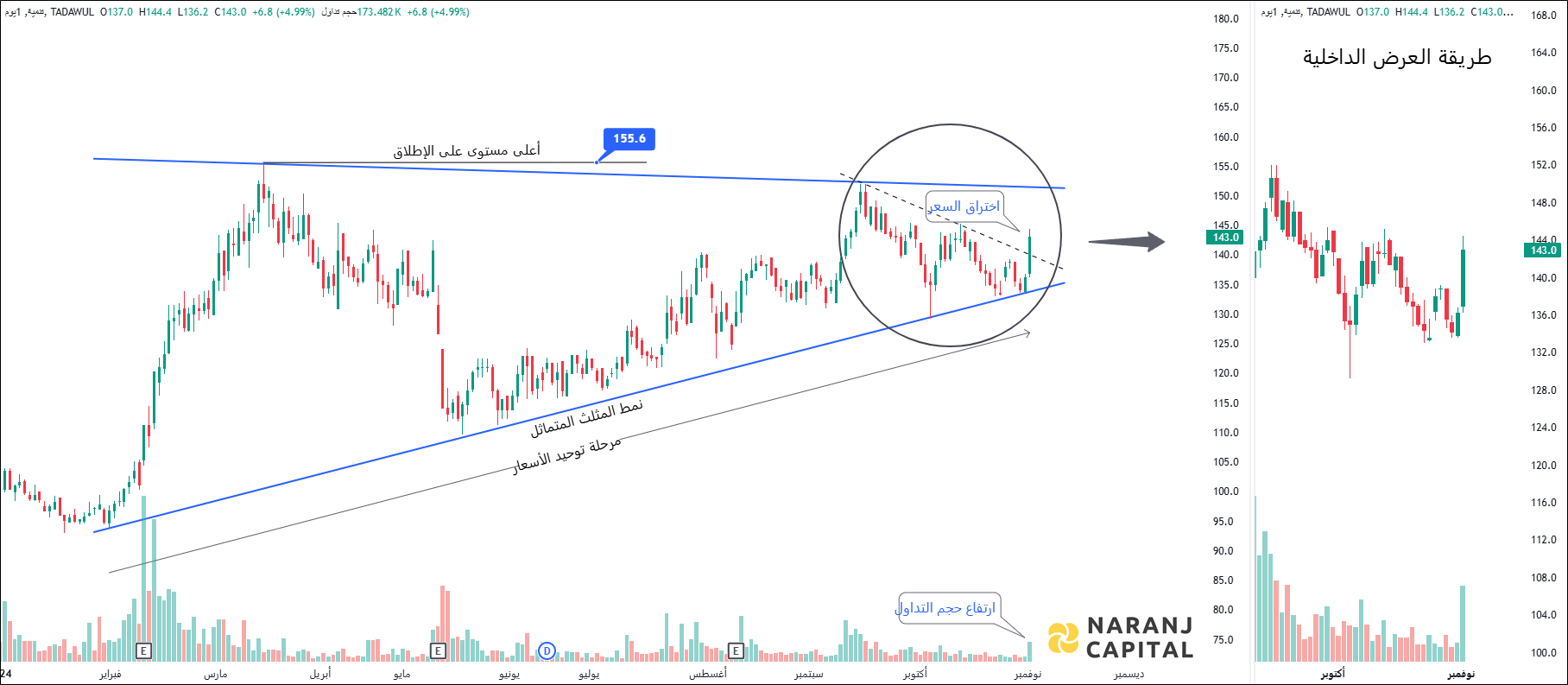

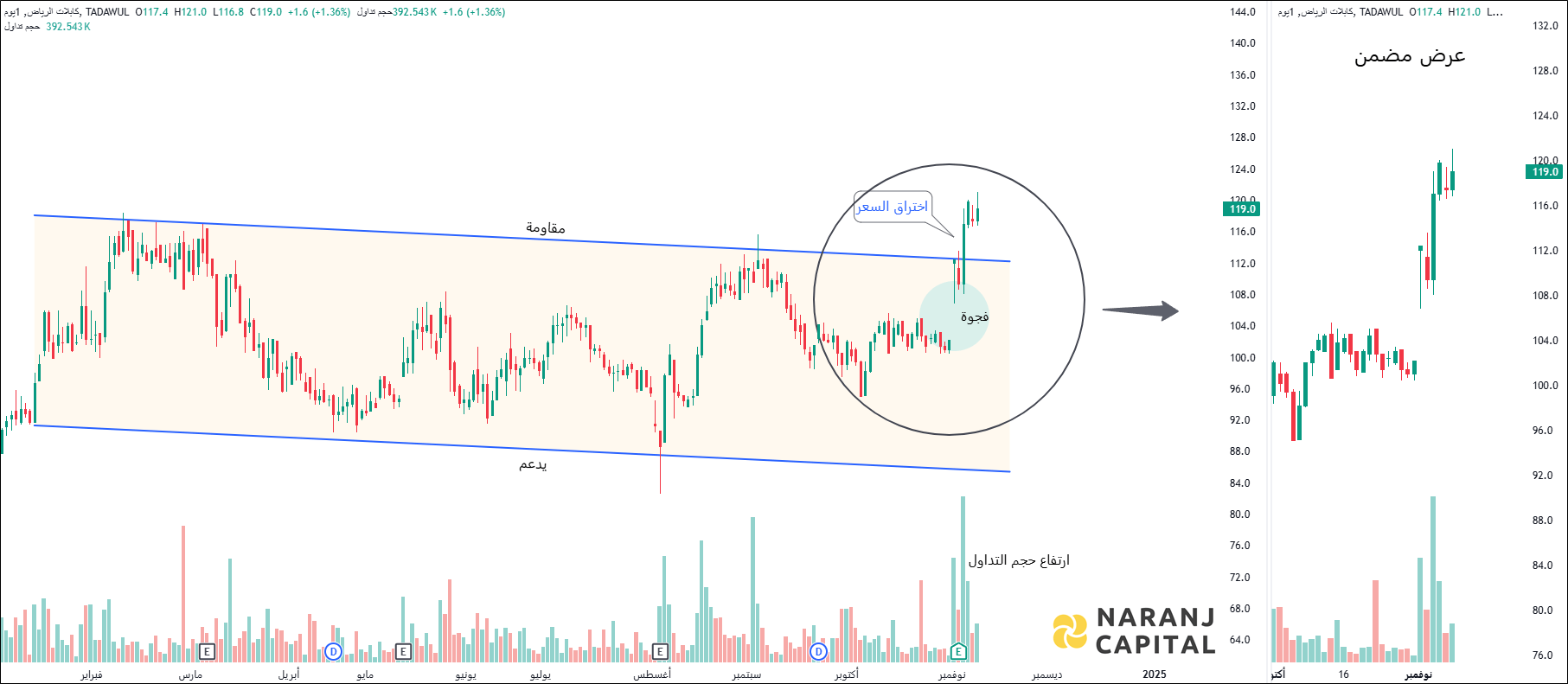

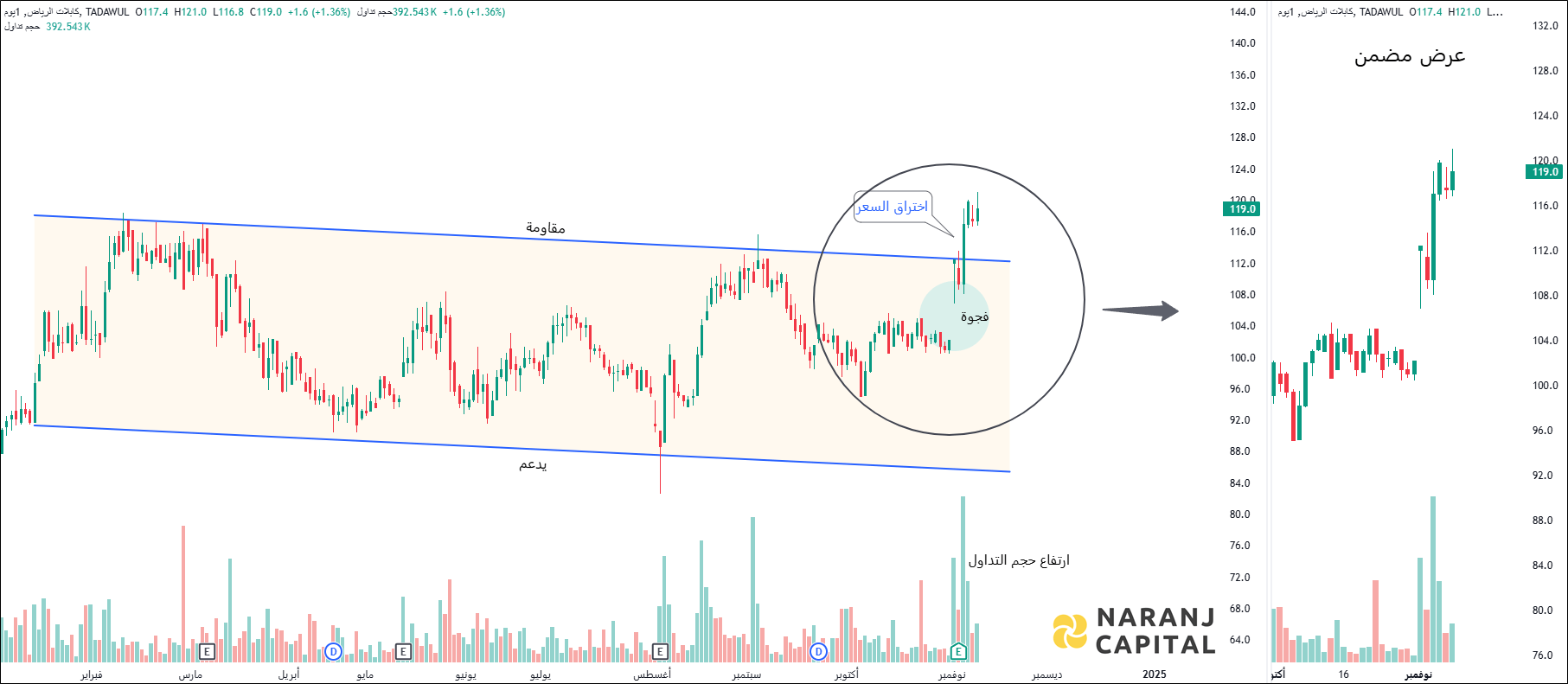

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

The U.S. construction and engineering sector is experiencing a significant boom, driven by infrastructure investments, rapid urbanization, and the rise of renewable energy projects. Leading companies such as Quanta Services (PWR), Comfort Systems USA (FIX), and Primoris Services Corporation (PRIM) are capitalizing on these trends, each demonstrating strong performance. Among them, PRIM stands out with exceptional financial health and attractive valuation metrics, positioning it as a compelling choice for investors. PWR and FIX are also performing well, benefiting from the sector’s growth momentum.

With substantial government spending and ongoing urbanization fueling demand, the sector presents promising opportunities for long-term investors. However, thorough research, clear investment goals, and effective risk management remain crucial to navigating this dynamic landscape successfully.

Both companies are poised for growth driven by increasing healthcare demands and infrastructure expansion.

- Founder, Narayan Healthcare

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliche, but the single most important reason that people lose money in the financial markets is that they don’t cut their losses short.

- Victor Sperandeo

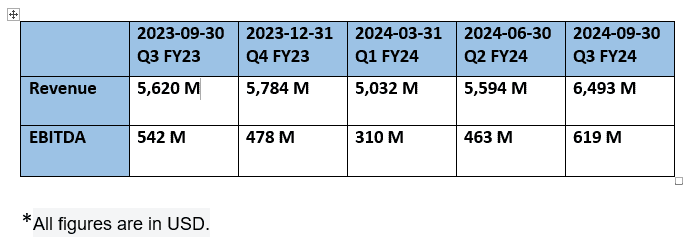

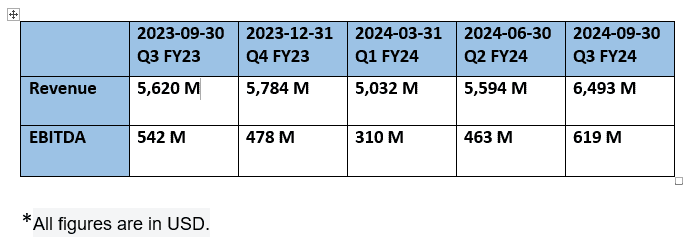

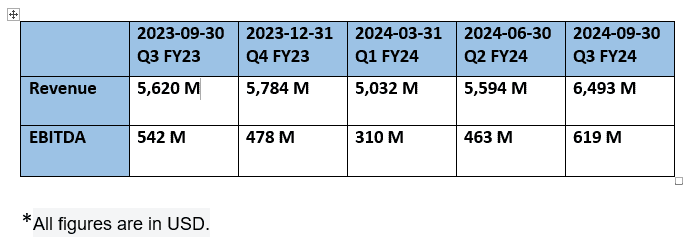

All three companies have reported significant improvements in operating cash flow for Q3 FY24:

This report provides a comparative analysis of Quanta Services, Comfort Systems USA, and Primoris Services Corporation, examining their competitive dynamics in the U.S. construction and engineering sector.

The U.S. construction and engineering sector is a vital component of the nation’s economy, driving infrastructure development, urbanization, and economic growth. It encompasses various activities, including residential, commercial, industrial, and infrastructure construction, as well as engineering services for design, planning, and project management. Recent trends shaping the sector include urbanization, sustainability, technological advancements, and government investments in infrastructure.

The U.S. construction and engineering sector is experiencing a significant boom, driven by infrastructure investments, rapid urbanization, and the rise of renewable energy projects. Leading companies such as Quanta Services (PWR), Comfort Systems USA (FIX), and Primoris Services Corporation (PRIM) are capitalizing on these trends, each demonstrating strong performance. Among them, PRIM stands out with exceptional financial health and attractive valuation metrics, positioning it as a compelling choice for investors. PWR and FIX are also performing well, benefiting from the sector’s growth momentum. With substantial government spending and ongoing urbanization fueling demand, the sector presents promising opportunities for long-term investors. However, thorough research, clear investment goals, and effective risk management remain crucial to navigating this dynamic landscape successfully. Both companies are poised for growth driven by increasing healthcare demands and infrastructure expansion. - Founder, Narayan Healthcare

Abstract

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliche, but the single most important reason that people lose money in the financial markets is that they don’t cut their losses short.

- Victor Sperandeo

All three companies have reported significant improvements in operating cash flow for Q3 FY24:

This report provides a comparative analysis of Quanta Services, Comfort Systems USA, and Primoris Services Corporation, examining their competitive dynamics in the U.S. construction and engineering sector.

The U.S. construction and engineering sector is a vital component of the nation’s economy, driving infrastructure development, urbanization, and economic growth. It encompasses various activities, including residential, commercial, industrial, and infrastructure construction, as well as engineering services for design, planning, and project management. Recent trends shaping the sector include urbanization, sustainability, technological advancements, and government investments in infrastructure.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website