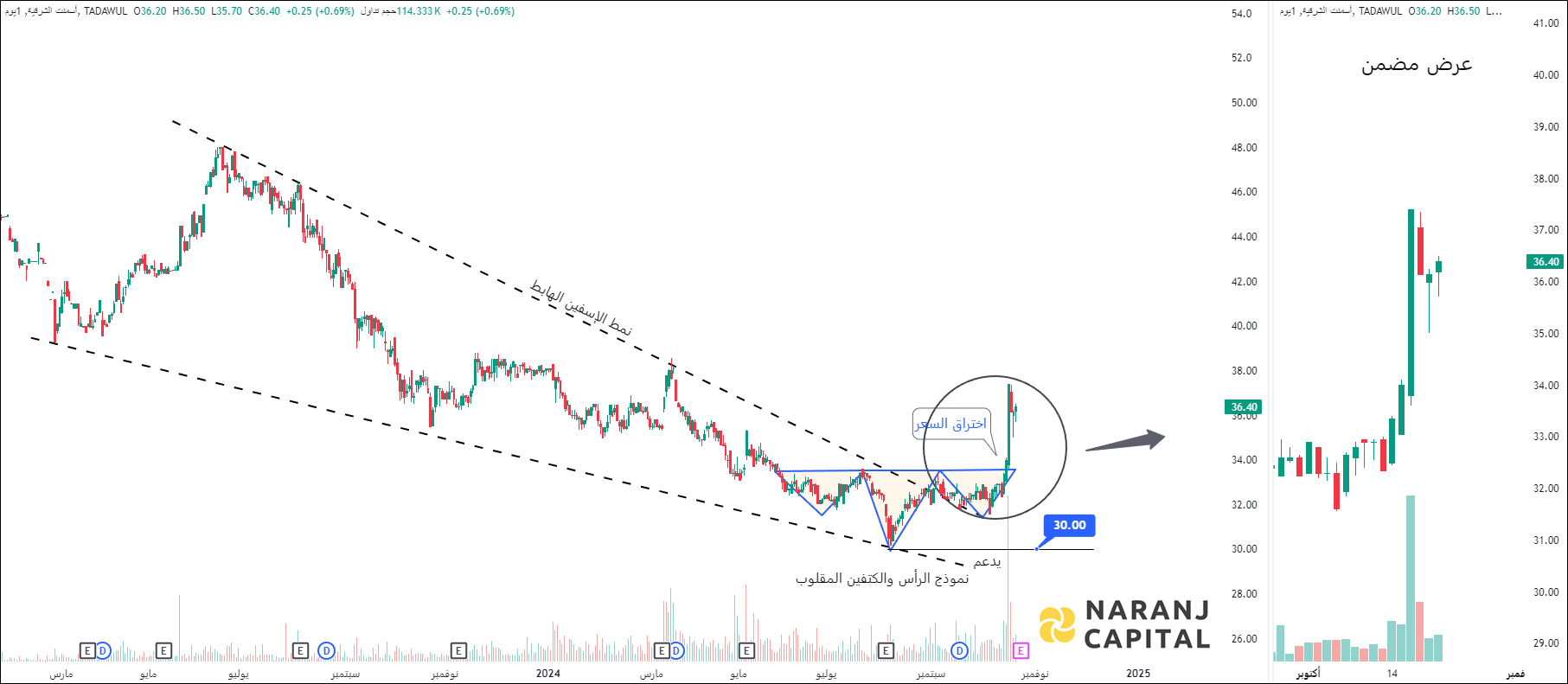

- 🇸🇦 Saudi Stock Market

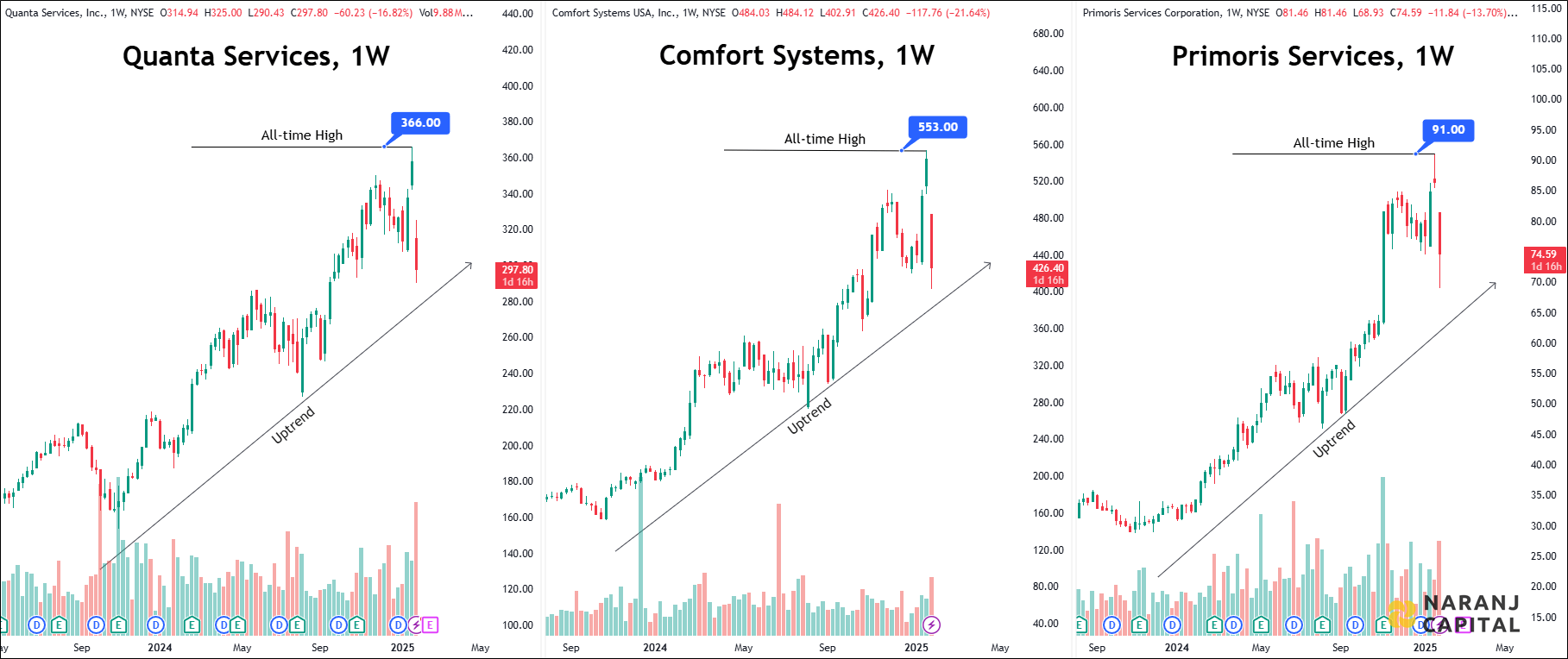

- 🇺🇸 USA Stock Market

India's hospital industry is growing rapidly, valued at ₹8.35 lakh cr. ($98.98 B) in 2023, with a projected CAGR of 5.8-8.0% from 2024 to 2032. Apollo Hospitals and Narayana Hrudayalaya are two leading players, with Apollo being the largest private hospital network and Narayana Hrudayalaya known for cost-effective cardiac care. Narayana Hrudayalaya appears undervalued with a P/E ratio of 33.5 and more profitable (ROCE: 27%), making it an attractive investment option. Apollo Hospitals seems overvalued with a P/E ratio of 83.4 but remains viable for strategic entry points.

Both companies are poised for growth driven by increasing healthcare demands and infrastructure expansion.

- Founder, Narayan Healthcare

The hospital industry in India is experiencing significant growth, with the market valued at approximately ₹8.35 lakh cr. ($98.98 B) in 2023. Projections indicate a robust compound annual growth rate (CAGR) of 5.8% to 8.0% from 2024 to 2032, potentially reaching between 13.87 lakh cr. and 16.33 lakh cr. ($164.4 B - $193.6 B) by 2032, depending on various market analyses.

Rising public and private spending on healthcare, with government health expenditure aiming for 2.5% of GDP by 2025.

Expanding middle class with higher disposable incomes and greater access to health insurance.

Adoption of healthcare technologies such as telemedicine and robotic automation, improving service delivery.

National Digital Health Blueprint promoting innovations in e-health.

Favourable government policies allowing 100% FDI in healthcare, attracting significant investments.

Public-private partnerships enhancing healthcare access, especially in underserved areas.

Increasing incidence of lifestyle diseases driving demand for specialized healthcare.

Growth in medical tourism as India becomes a preferred destination for cost-effective treatments.

These factors are collectively propelling the growth of the hospital industry in India, positioning it for a promising future.

Apollo Hospitals leads the sector with a market capitalization of approximately ₹98,646 Cr, establishing itself as the largest private hospital network in India.

Max Healthcare closely follows, boasting a market capitalization of around ₹97,820 Cr.

Fortis Healthcare is another key participant in the market, with a market capitalization of ₹48,249 Cr.

Global Health also ranks among the premier healthcare institutions, holding a market capitalization of ₹28,786 Cr.

Narayana Hrudayalaya is recognized for its cost-effective cardiac care services and maintains a notable market share with a market capitalization of ₹26,086 Cr.

In this report, we will conduct an in-depth analysis and comparison between two of India's leading healthcare providers, Apollo Hospitals and Narayana Hrudayalaya. This comprehensive evaluation will assess their technical and fundamental aspects,

Rasan Information Technology Company is a fintech firm offering insurance and financial services in Saudi Arabia. It operates Tameeni for comparing and purchasing insurance, Treza for motor leasing solutions, Awalmazad for online auto auctions of salvage and repossessed vehicles, RS for business intelligence and pricing models, and Warshti for car repairs. Additionally, it specializes in software design for computer systems and communication equipment, program and database development, vehicle auctioning, towing, storage, electronic publishing, online wholesale, and custom software solutions. Established in 2016, the company is headquartered in Riyadh.

Life insurance is just like an investment for your family’s future. It is a contract between a policyholder and an insurer where the policyholder pays premiums for the plan chosen. In return, an insurance company promises an assured sum of money to the beneficiary of policy upon the policyholder’s unforeseen death. This, it’s important to choose a good life insurance plan catering to your preferences and needs.

There are life insurance plans like insurance plans that help you achieve desired financial goals, and Term Insurance Plans that provide affordable and comprehensive coverage, ensuring financial security for your loved one in case of unforeseen events. If you are new to investing, you can get expert advice from IRDAI certified insurance advisors to make an informed decision.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website