- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

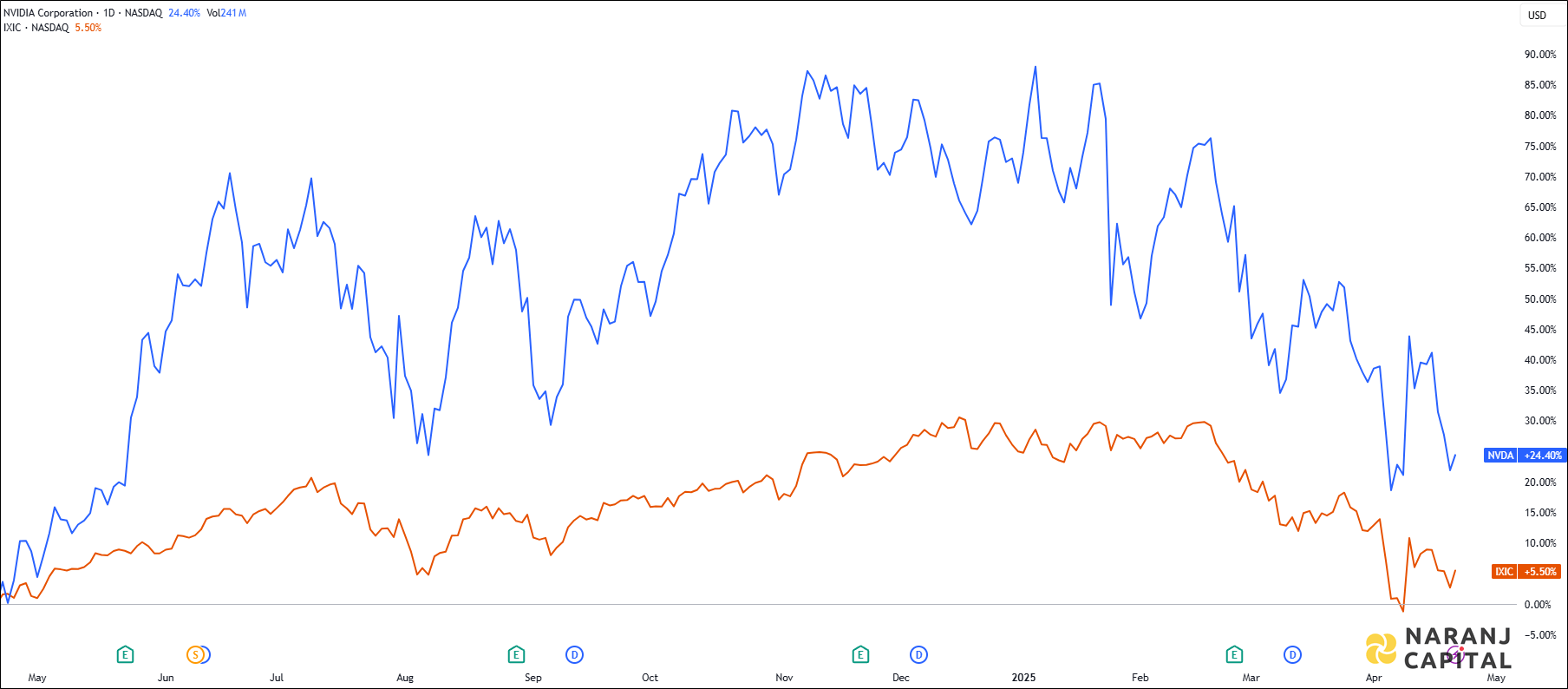

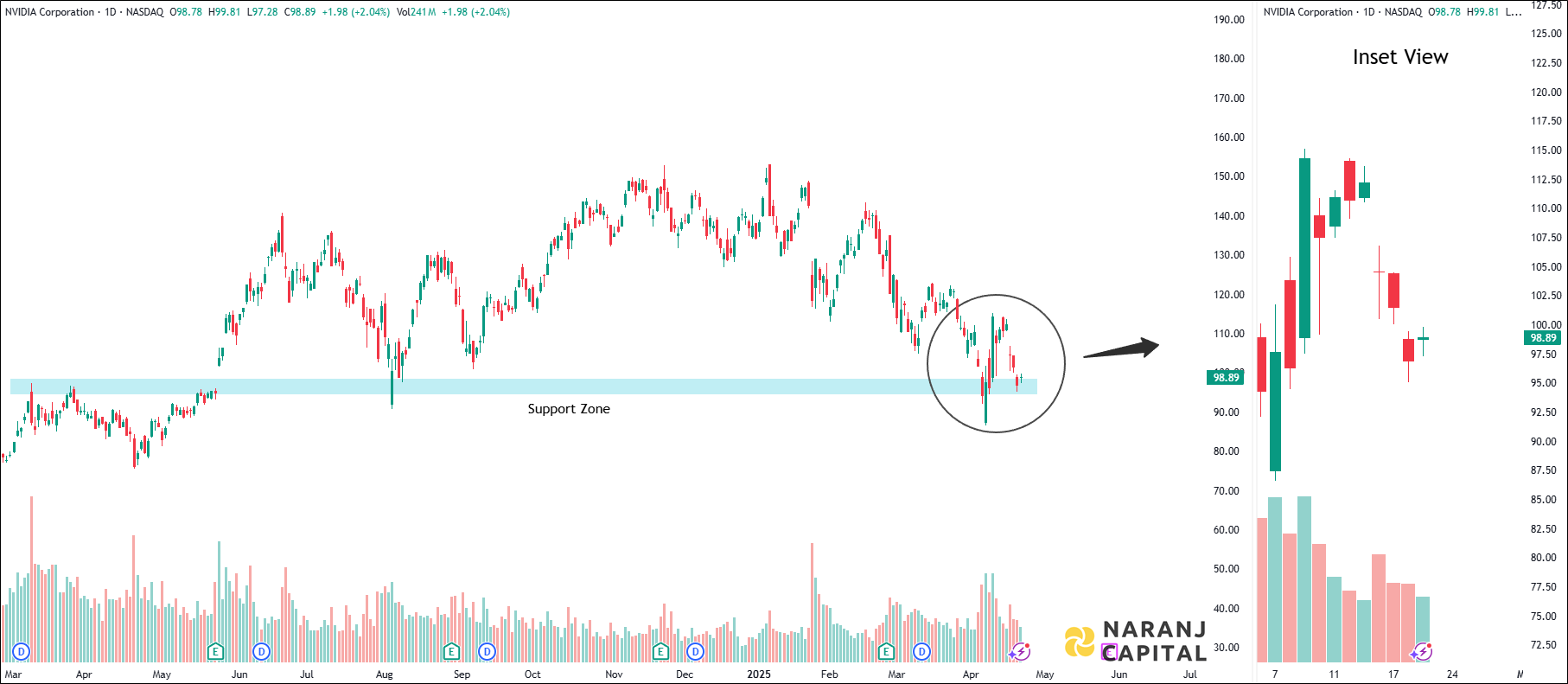

NVIDIA Corporation is a worldwide supplier of graphics, computing, and networking solutions. Its Graphics division provides GeForce GPUs for gaming and personal computers, Quadro/NVIDIA RTX GPUs for professional workstations, vGPU software for cloud visual and virtual computing, automotive platforms for entertainment systems, and Omniverse software for 3D design and virtual environments. The Compute & Networking division offers Data Center platforms for AI, high-performance computing, and accelerated computing, Mellanox networking products, automotive AI Cockpit, cryptocurrency mining chips, Jetson for robotics, and NVIDIA AI Enterprise software. NVIDIA sells its products to a range of manufacturers, retailers, distributors, independent software vendors, internet and cloud service providers, car manufacturers, mapping companies, and startups. Founded in 1993, NVIDIA is based in Santa Clara, California.

NVDA — NASDAQ —

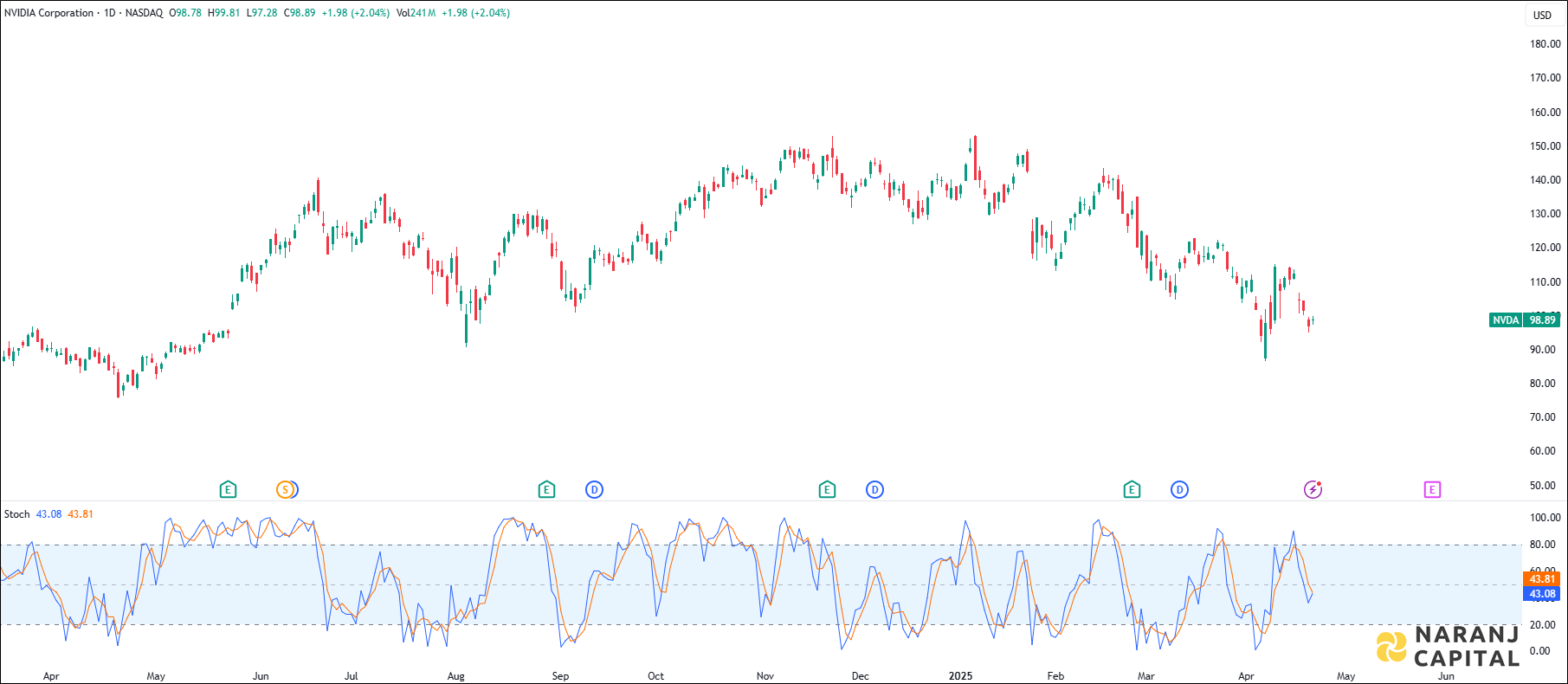

A bullish signal is generated as the K line (blue) crosses over the D line (orange) from below, indicating a reversal from oversold conditions.

Based on our stock trading advice in Saudi Arabia, Nvidia Corporation stock price target will be USD 110 - USD 114 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website