- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

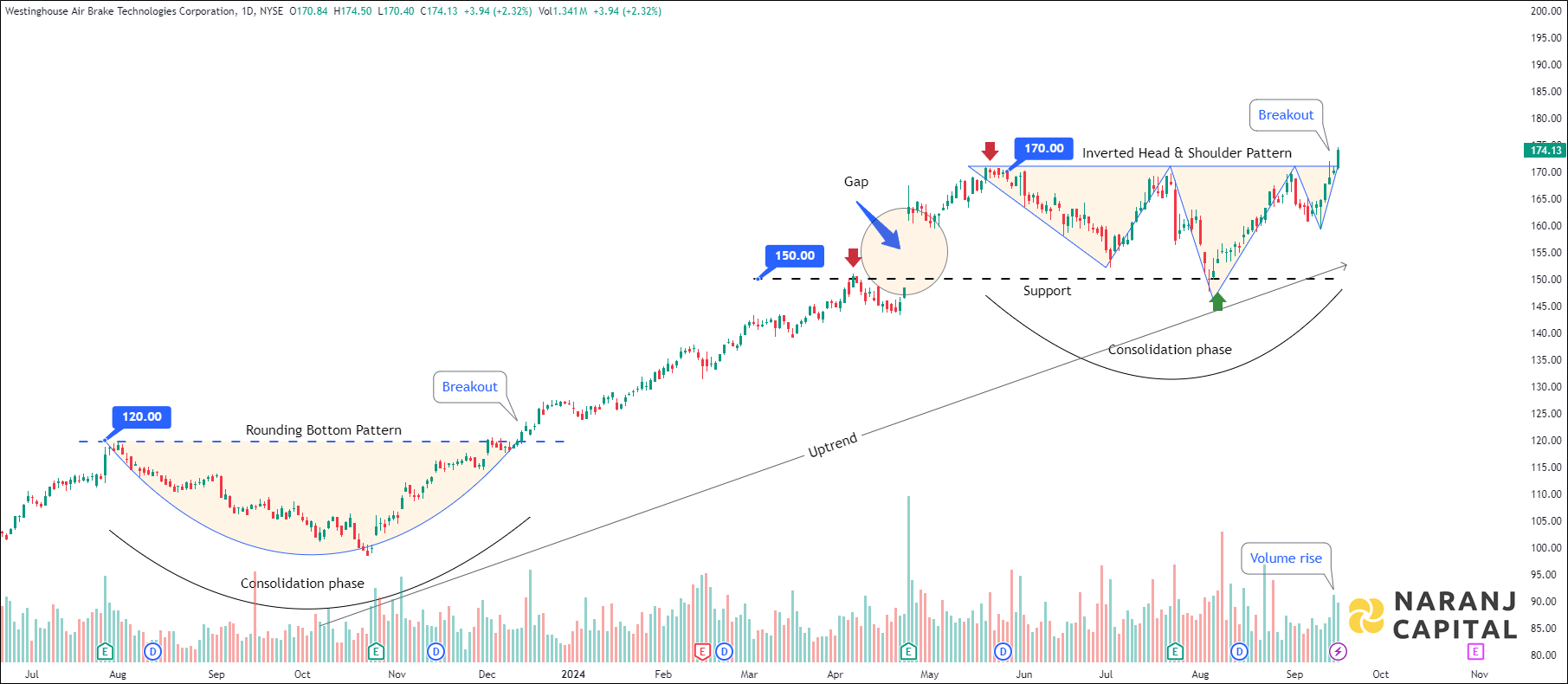

Westinghouse Air Brake Technologies Corporation, along with its subsidiaries, delivers innovative technology for locomotives, equipment, systems, and services across the global freight rail and passenger transit sectors. Their offerings include diesel-electric, battery, and LNG-powered locomotives, as well as engines, electric motors, and propulsion systems, plus products for marine and mining applications. The company specializes in positive train control, pneumatic braking, railway electronics, signal design, and engineering services. They also provide distributed locomotive power, train cruise controls, and remote controls, alongside IoT hardware and software solutions for asset performance management. Additional services encompass transportation management, port optimization, and network solutions. Their product range includes freight car trucks, braking systems, air compressors, heat transfer components, and new commuter locomotives. They also offer refurbishment and maintenance services for locomotives and cars, along with various railway braking components and HVAC systems. Founded in 1869, the company is based in Pittsburgh, Pennsylvania.

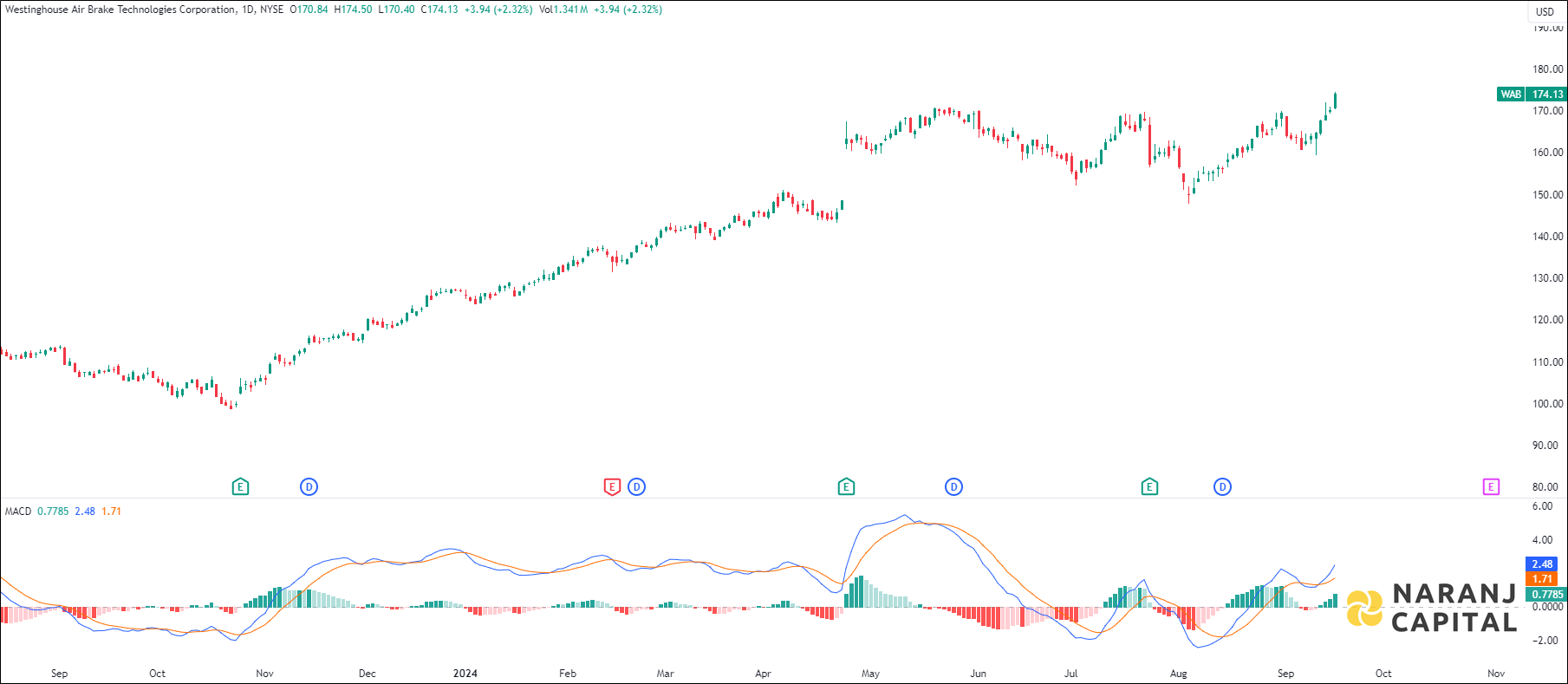

WAB — NYSE —

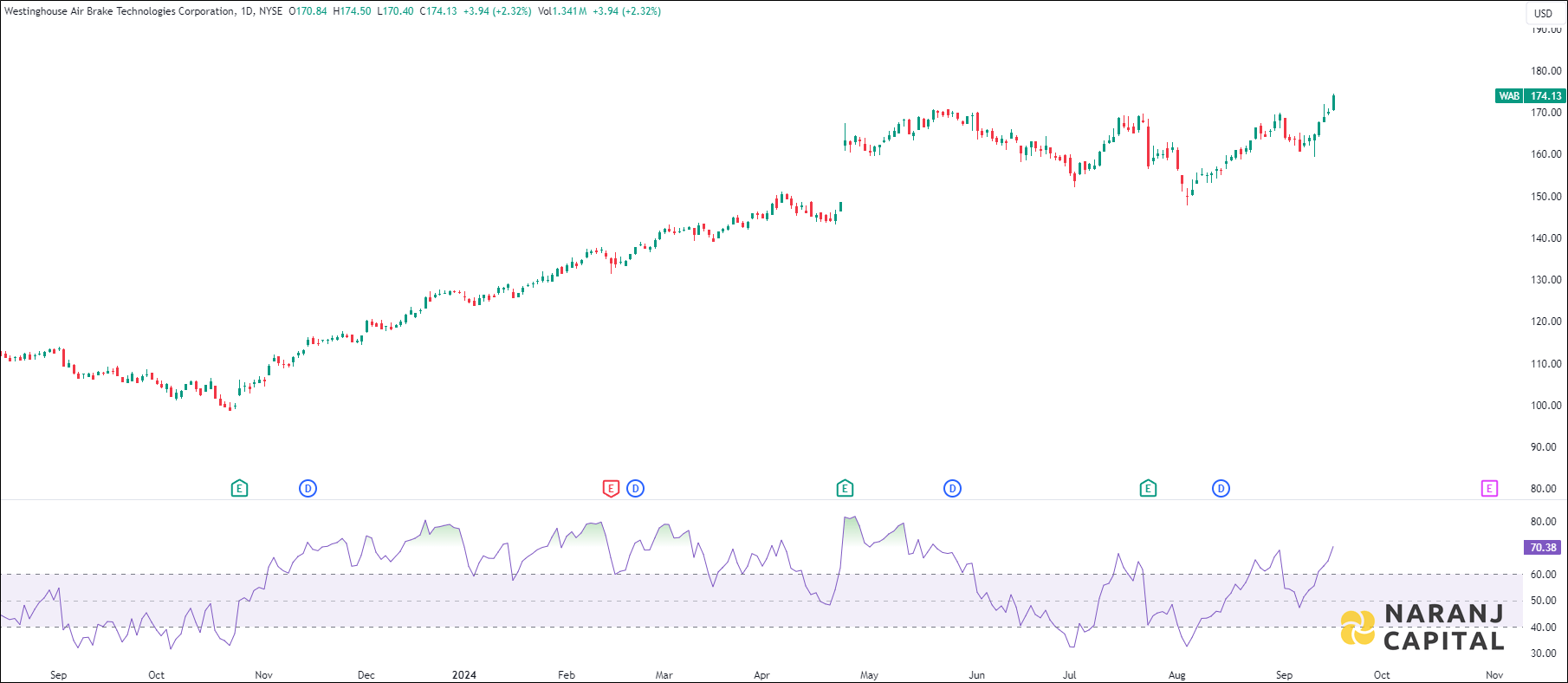

Current RSI of this stock is 70.38, which indicates the strength of buyers.

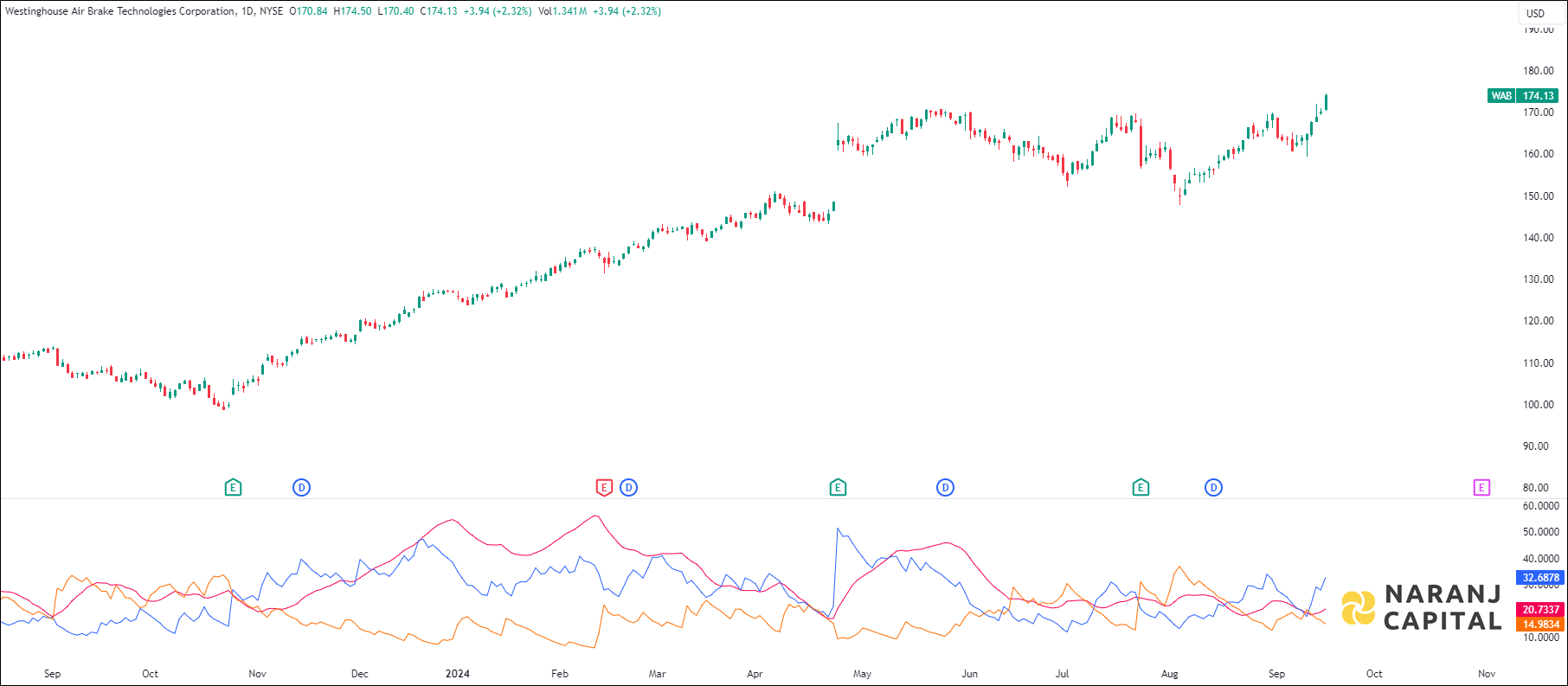

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

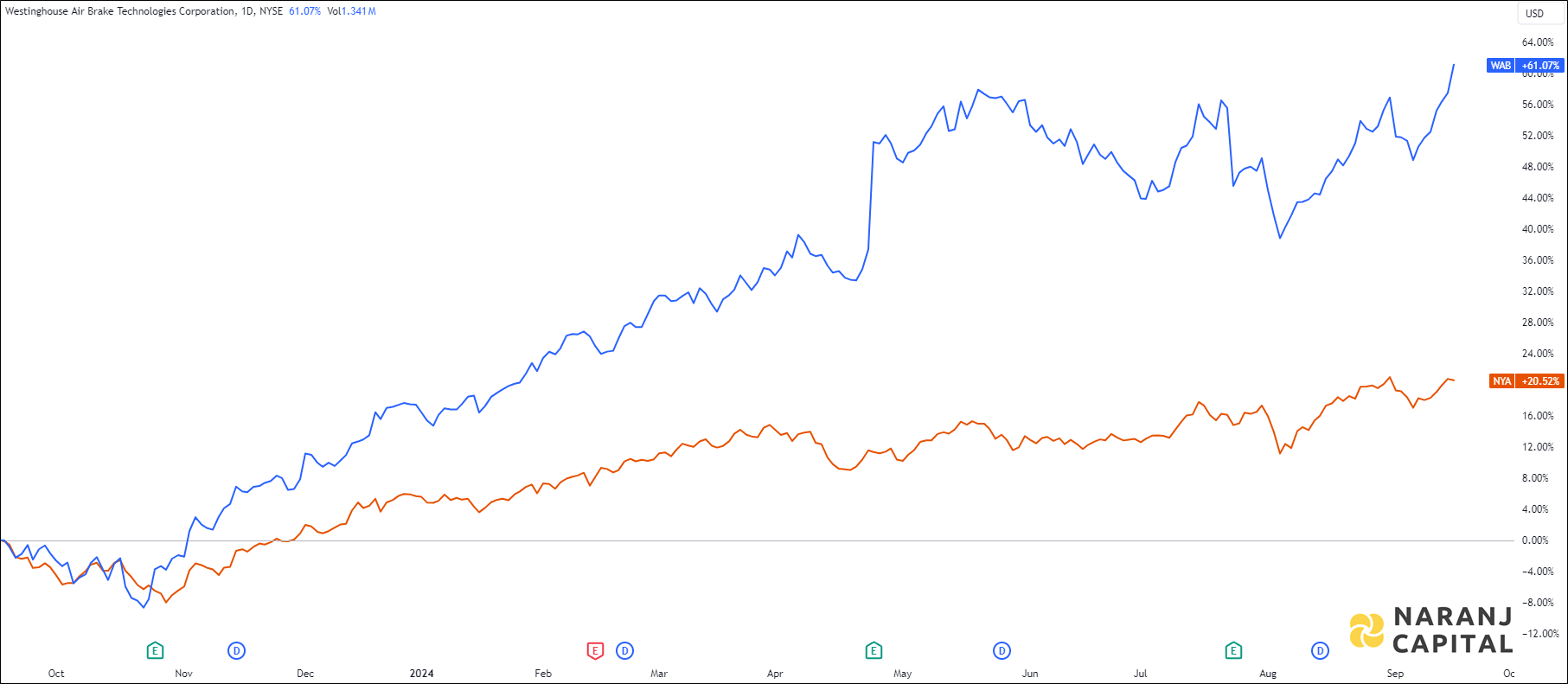

Based on our swing stock trading picks in USA, Westinghouse Air Brake Technologies stock price target will be USD 180 - USD 182 in the next 8-10 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website