- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

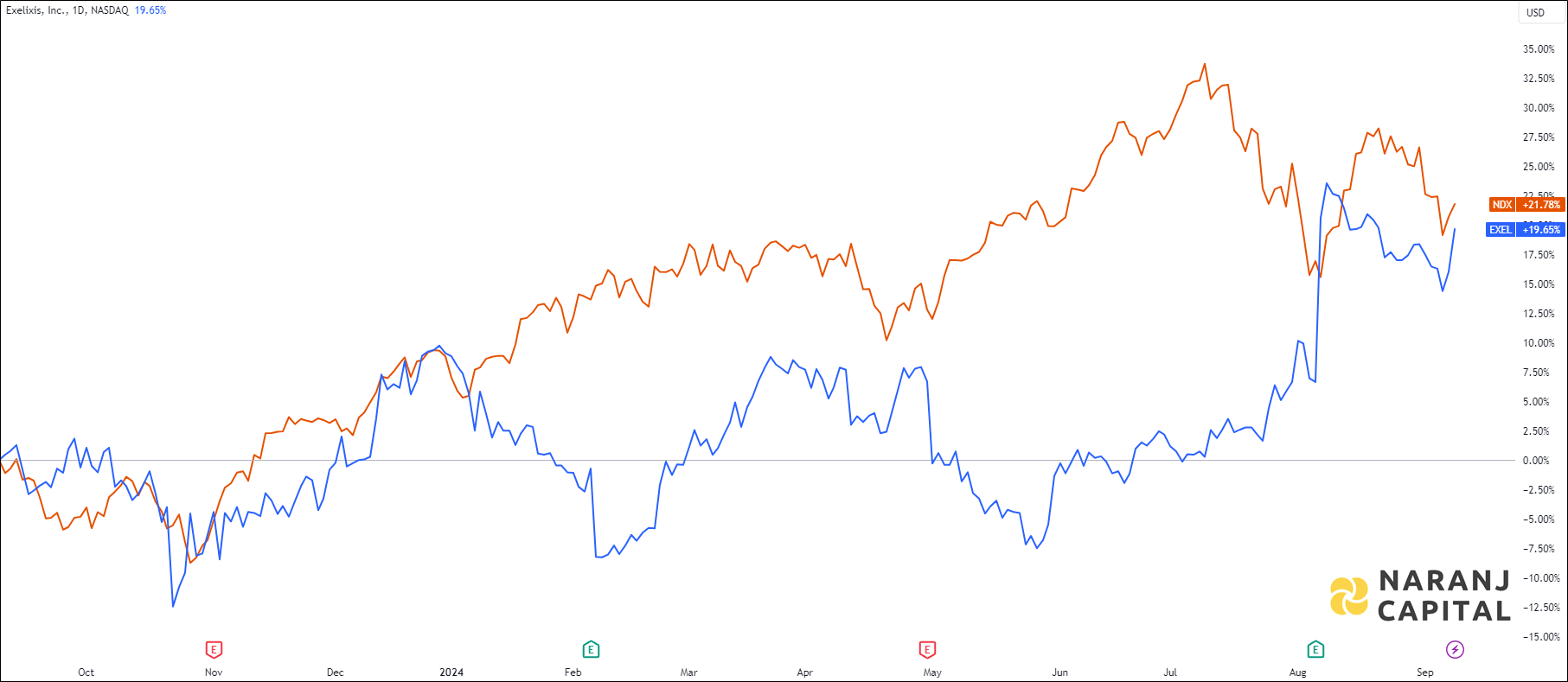

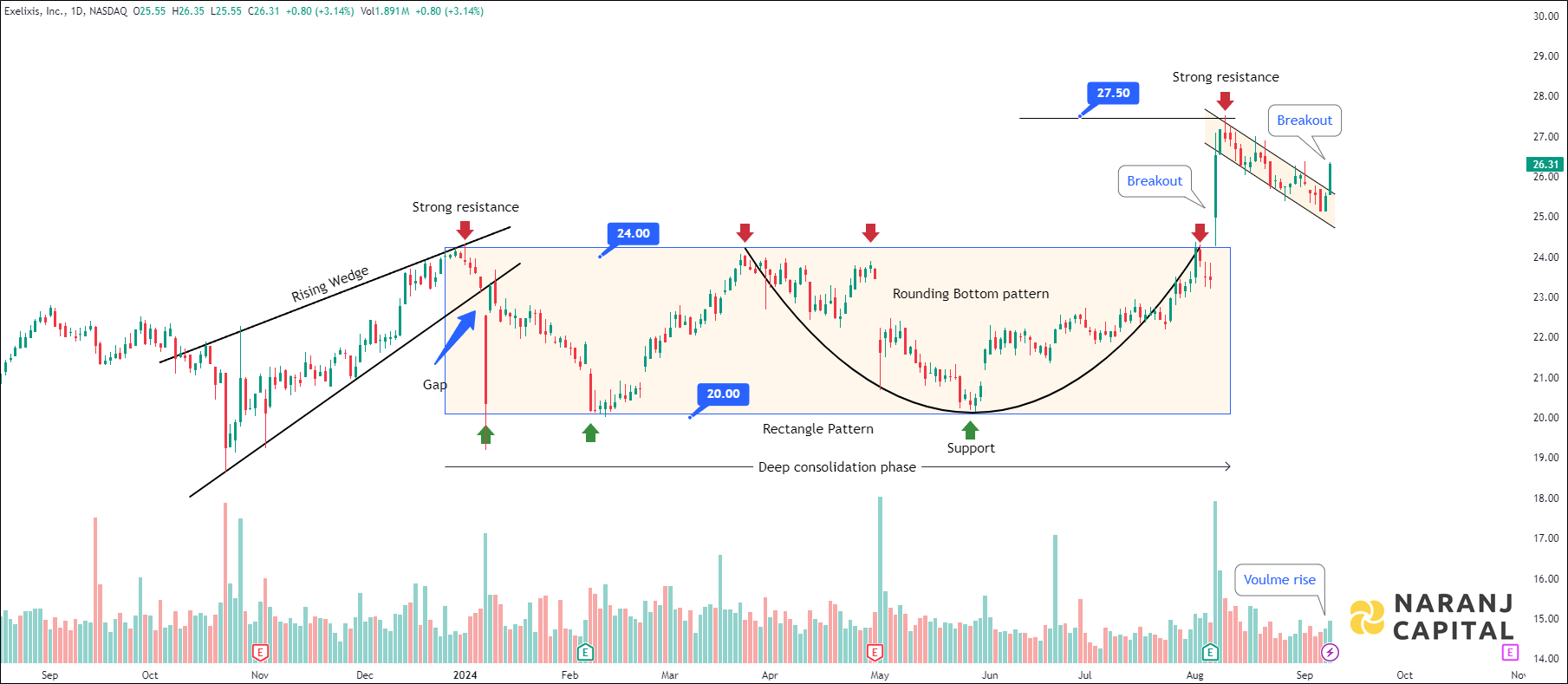

Exelixis, Inc. is an oncology company focused on finding and marketing new treatments for difficult cancers in the U.S. It offers CABOMETYX tablets for advanced renal cell carcinoma patients who have had prior anti-angiogenic therapy, and COMETRIQ capsules for progressive metastatic medullary thyroid cancer. Both drugs are based on cabozantinib, which blocks various tyrosine kinases like MET, AXL, RET, and VEGF receptors. The company also provides COTELLIC, a MEK inhibitor for some advanced melanoma cases, and MINNEBRO, an oral hypertension blocker in Japan. Exelixis is working on zanzalintinib, a next-gen oral tyrosine kinase inhibitor targeting VEGF and MET, as well as XB002, an ADC targeting tissue factor. It has partnerships with several pharmaceutical firms and a clinical agreement with Sairopa B.V. for ADU-1805. Founded in 1994 and originally named Exelixis Pharmaceuticals, Inc., it rebranded to Exelixis, Inc. in February 2000 and is based in Alameda, California.

EXEL — NASDAQ —

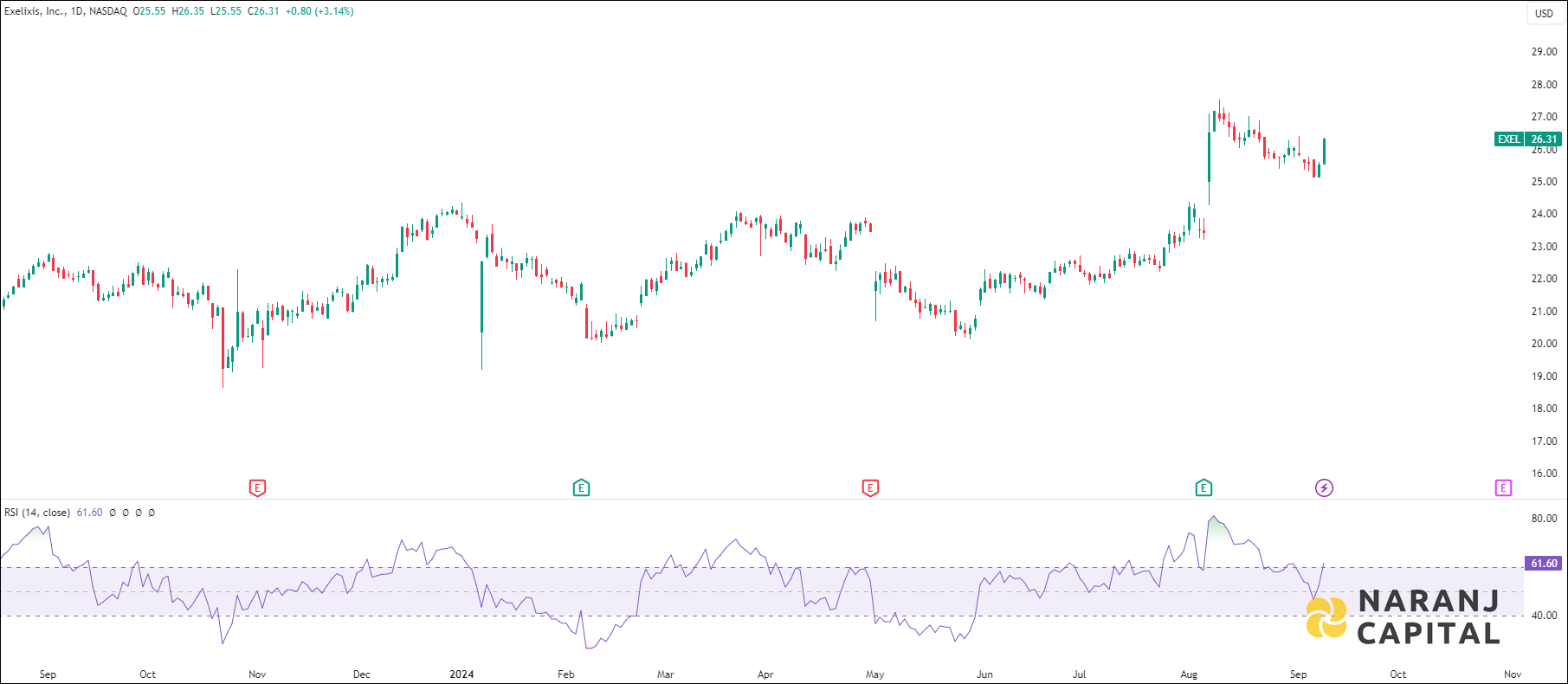

Current RSI of this stock is 61.60, which indicates the strength of buyers.

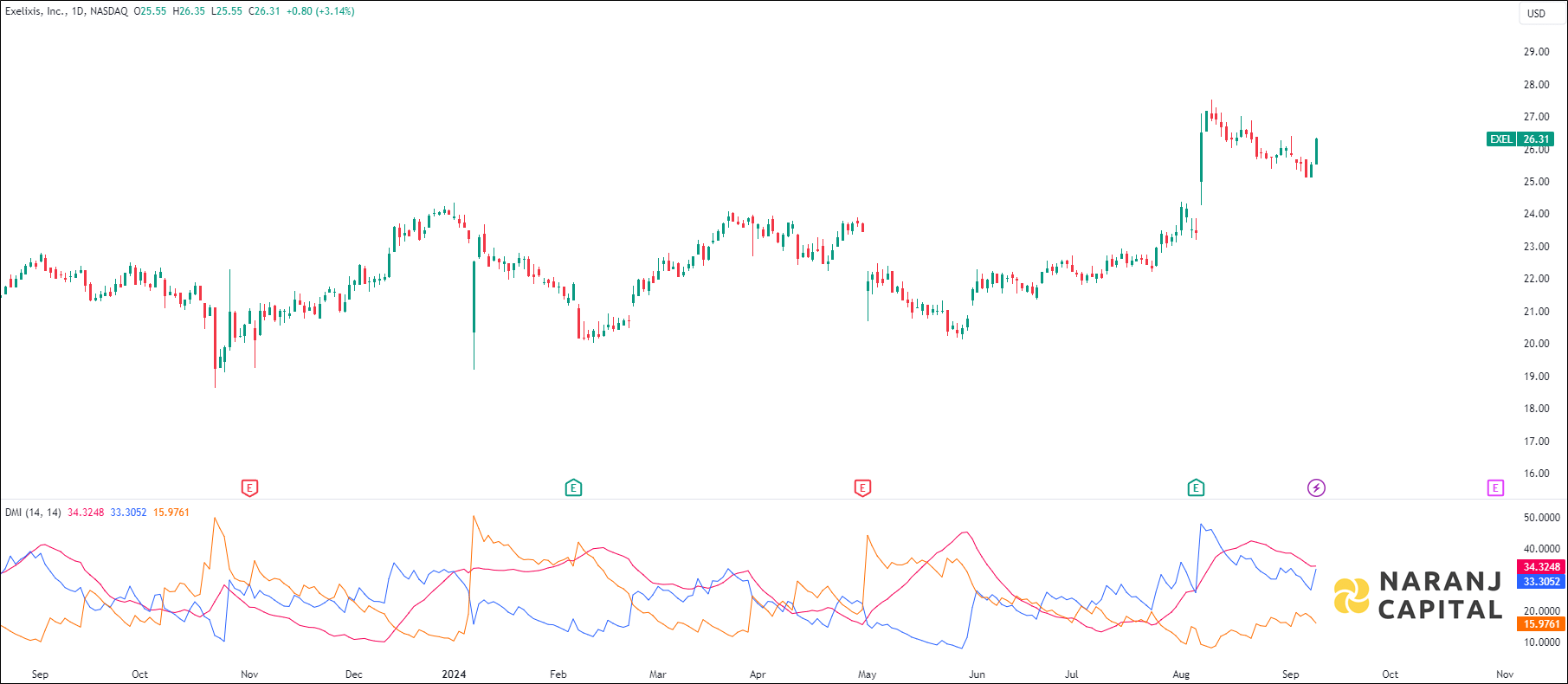

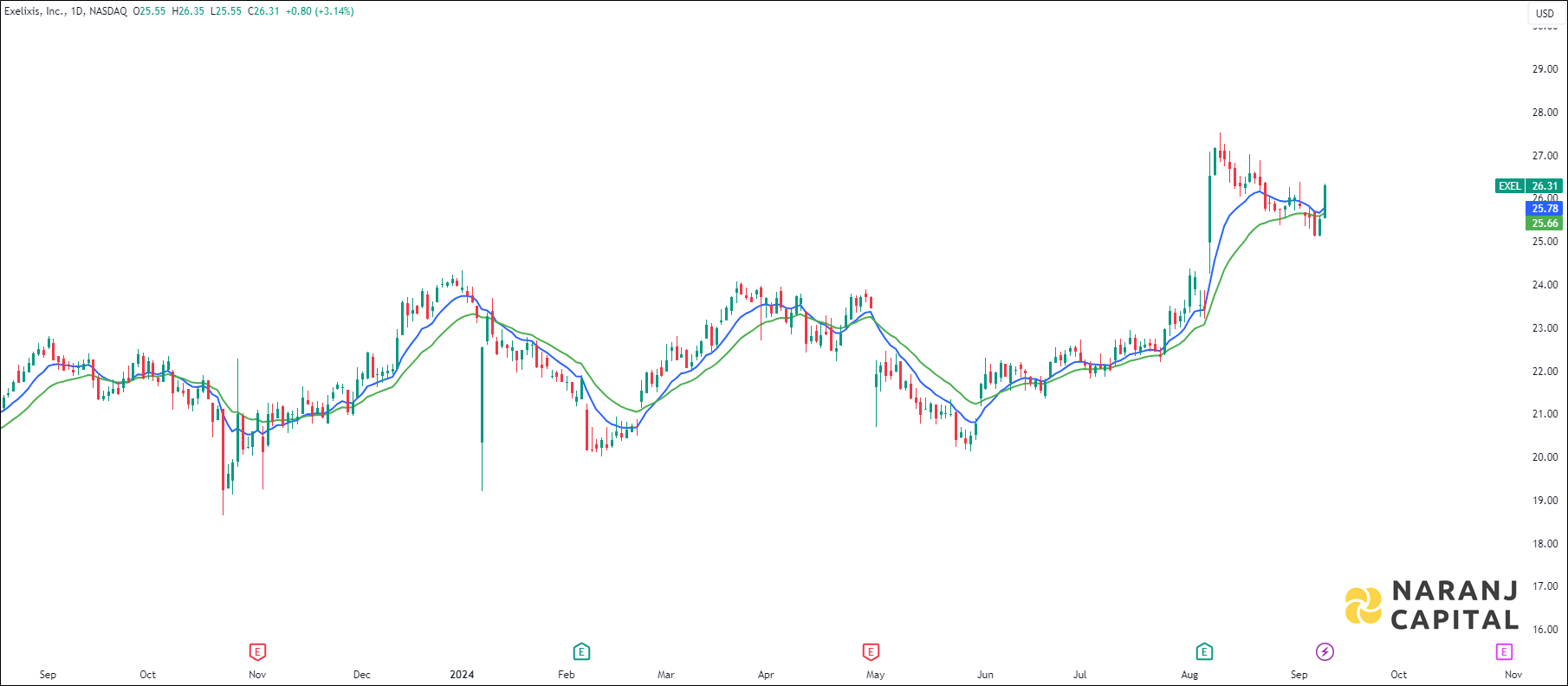

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The short length exponential moving average (10 EMA) has crossed the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our positional trading in USA stocks, Exelixis stock price target will be USD 27.75 - USD 28 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website