- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

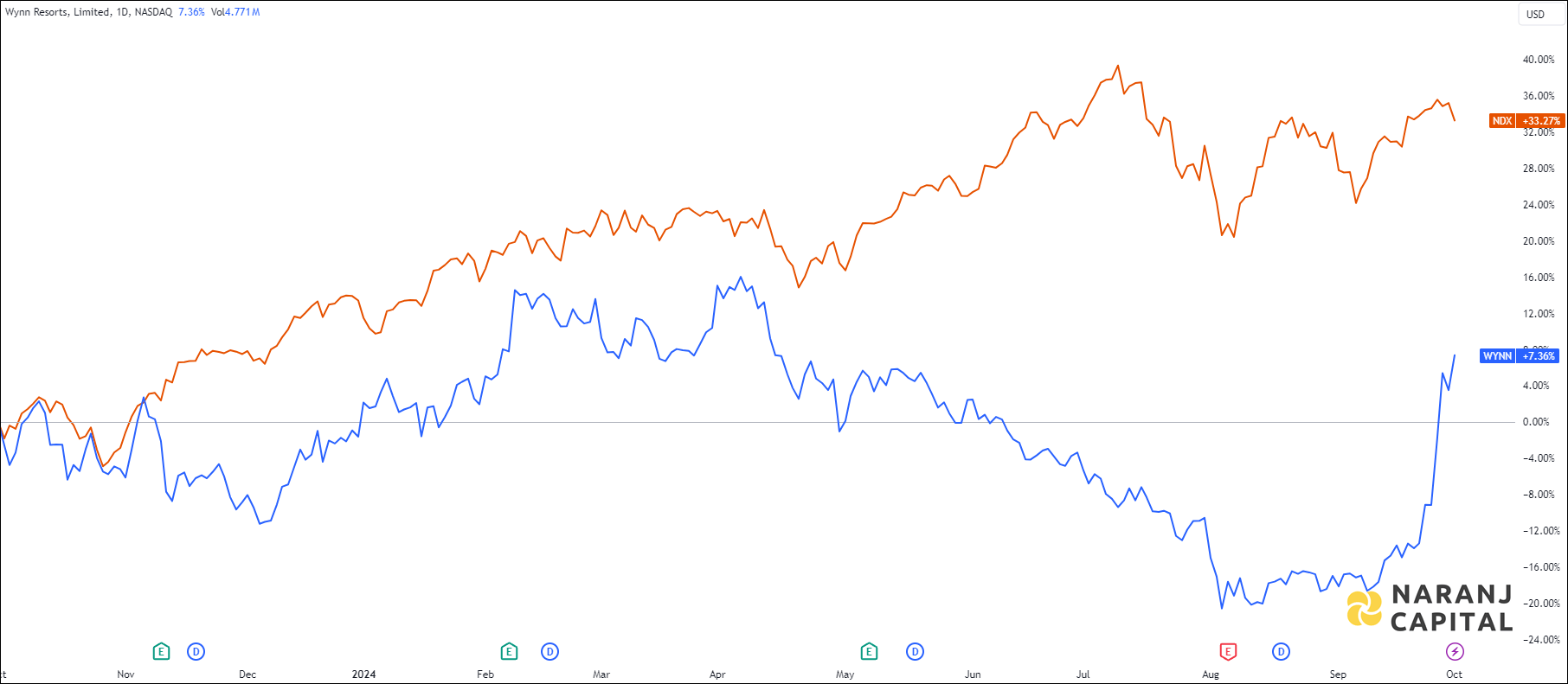

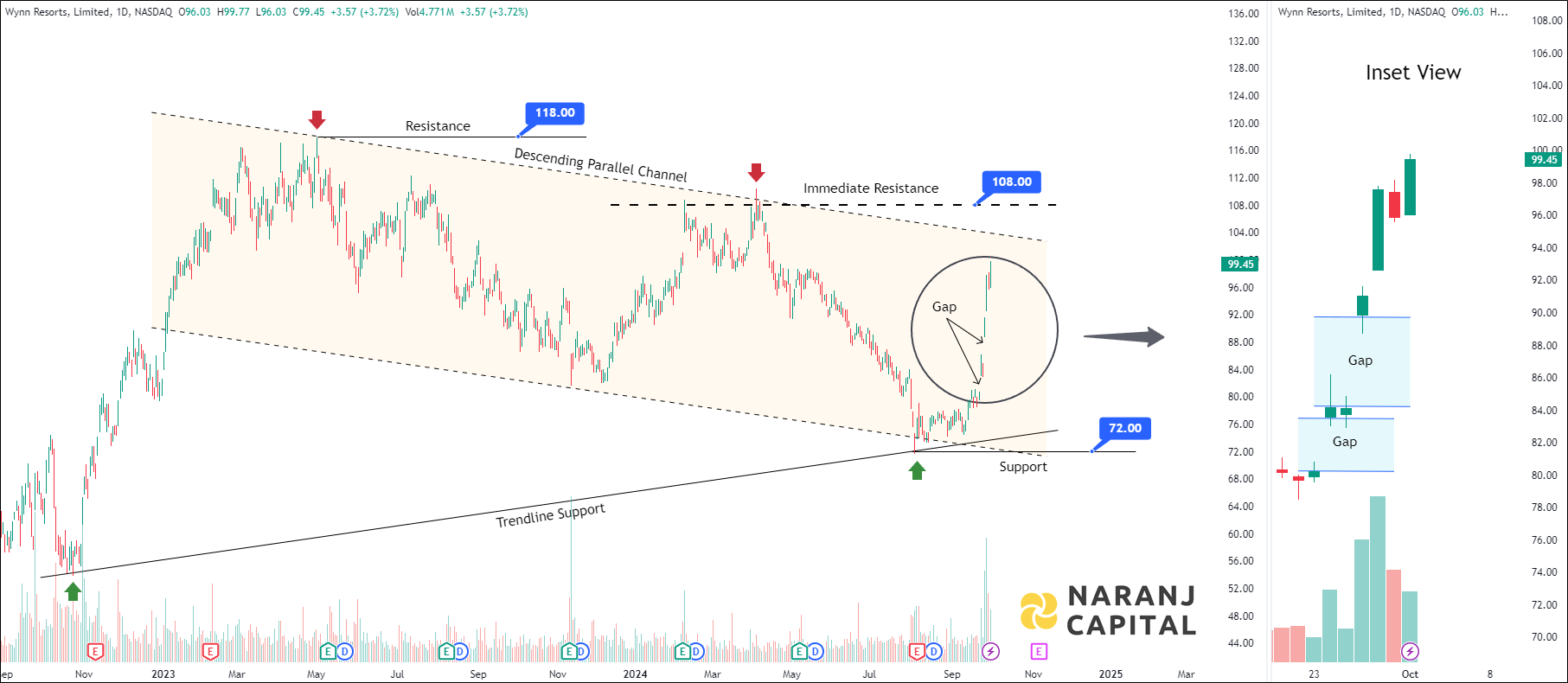

Wynn Resorts, Limited specializes in creating and managing integrated resorts. It operates through four main segments: Wynn Palace, Wynn Macau, Las Vegas Operations, and Encore Boston Harbor. Wynn Palace features exclusive gaming salons, sky casinos, a luxury hotel with suites and villas, a health club, spa, salon, pool, dining options, retail space, and event facilities, along with stunning lake and floral displays. Wynn Macau offers similar amenities, including private gaming areas, a luxury hotel, health and wellness facilities, dining, retail, and unique zodiac-themed attractions. The Las Vegas Operations segment includes casino spaces, a sky casino, a poker room, and a race and sports book, alongside a luxury hotel with pools, cabanas, spas, and a wedding chapel, plus various entertainment venues. Encore Boston Harbor features gaming areas, a poker room, a luxury hotel with spa services, dining, retail, event spaces, and a scenic waterfront park with floral displays and water shuttle service. Founded in 2002, Wynn Resorts is headquartered in Las Vegas, Nevada.

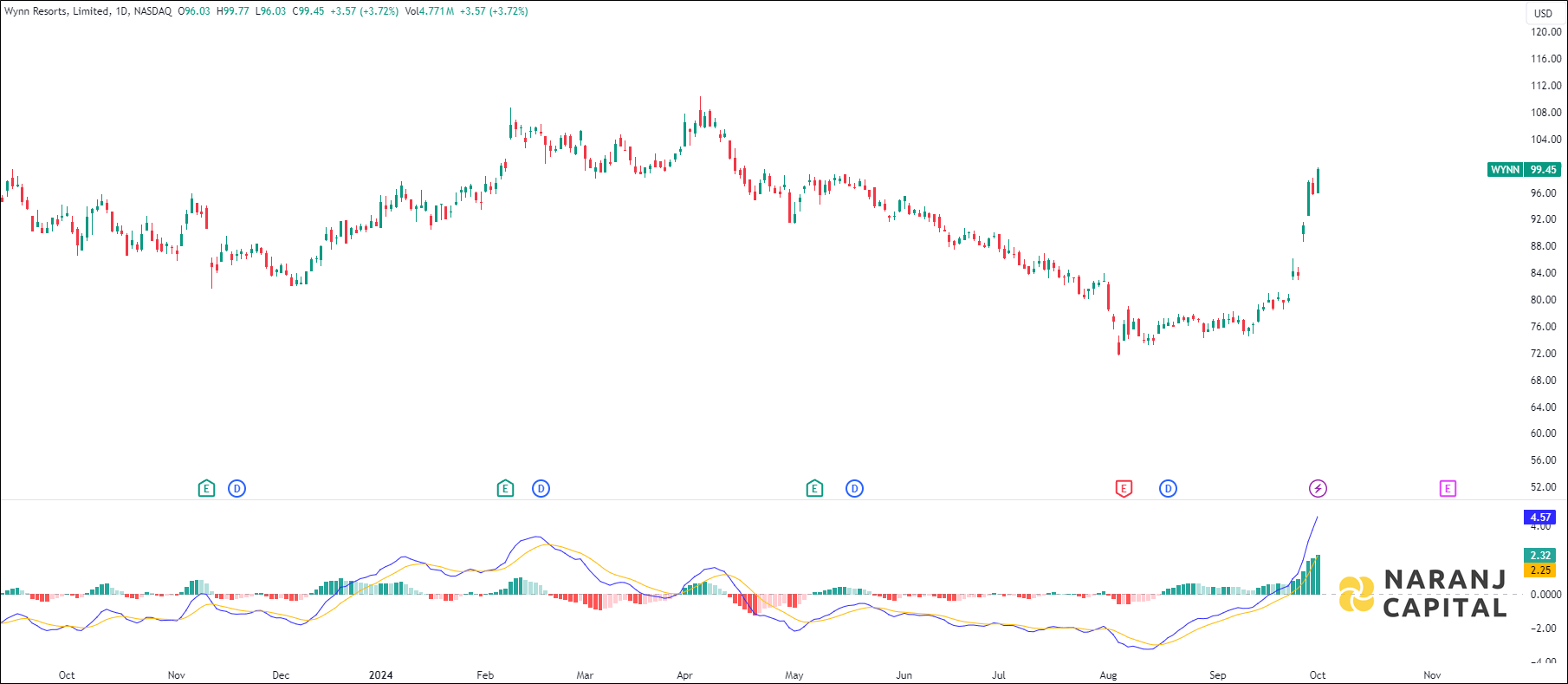

WYNN — NASDAQ —

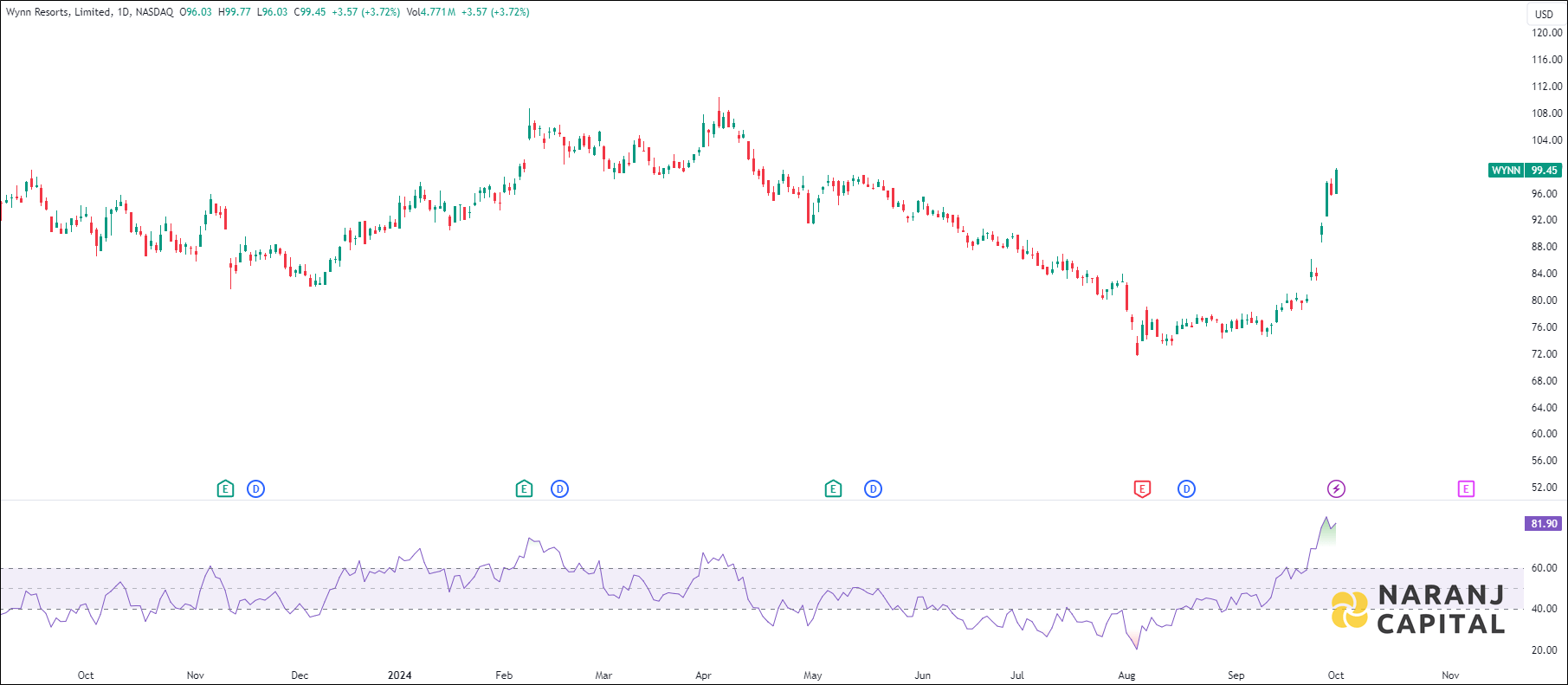

Current RSI of this stock is 81.90, which indicates the strength of buyers.

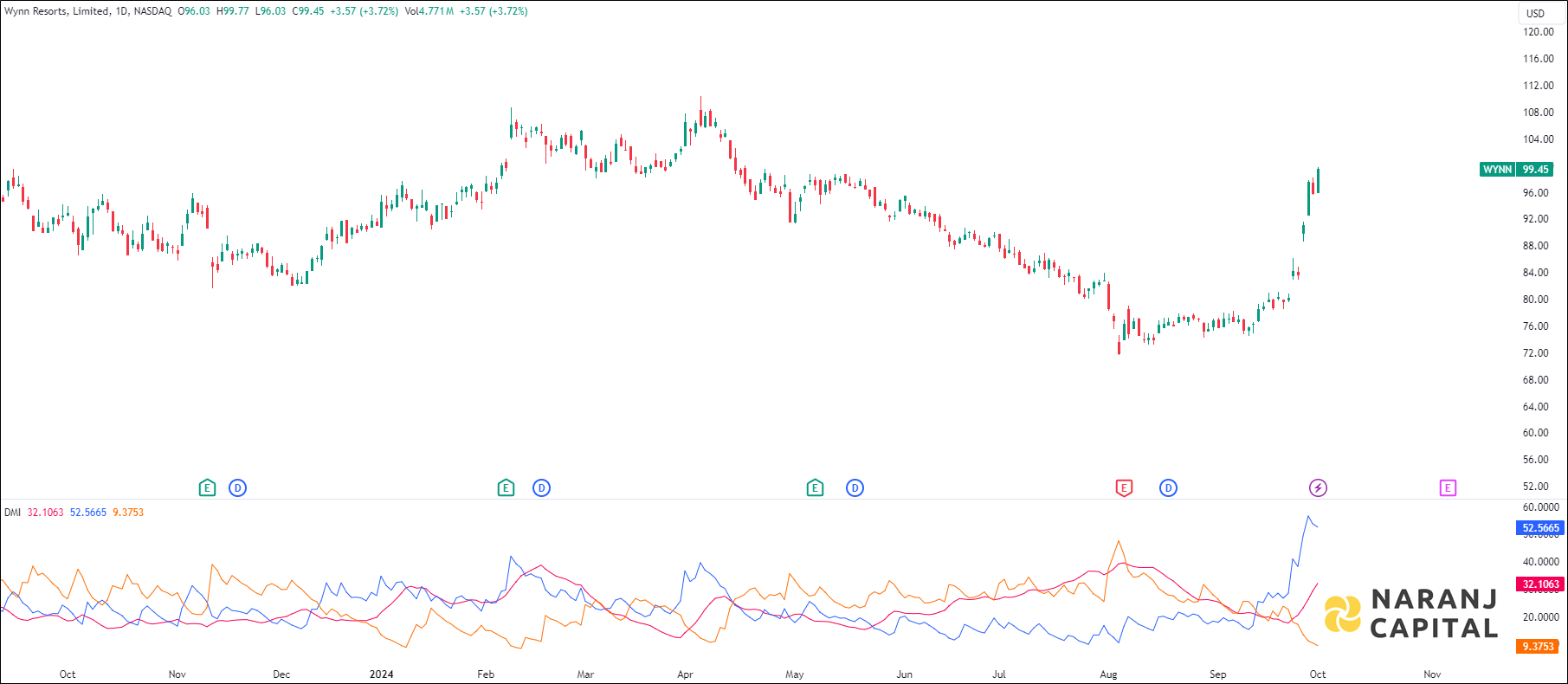

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

MACD line has crossed the signal line from the below, generates bullish signal.

Based on our swing stock trading tips in USA stocks, Wynn Resorts stock price target will be USD 104 - USD 105 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website