- 🇸🇦 Saudi Stock Market

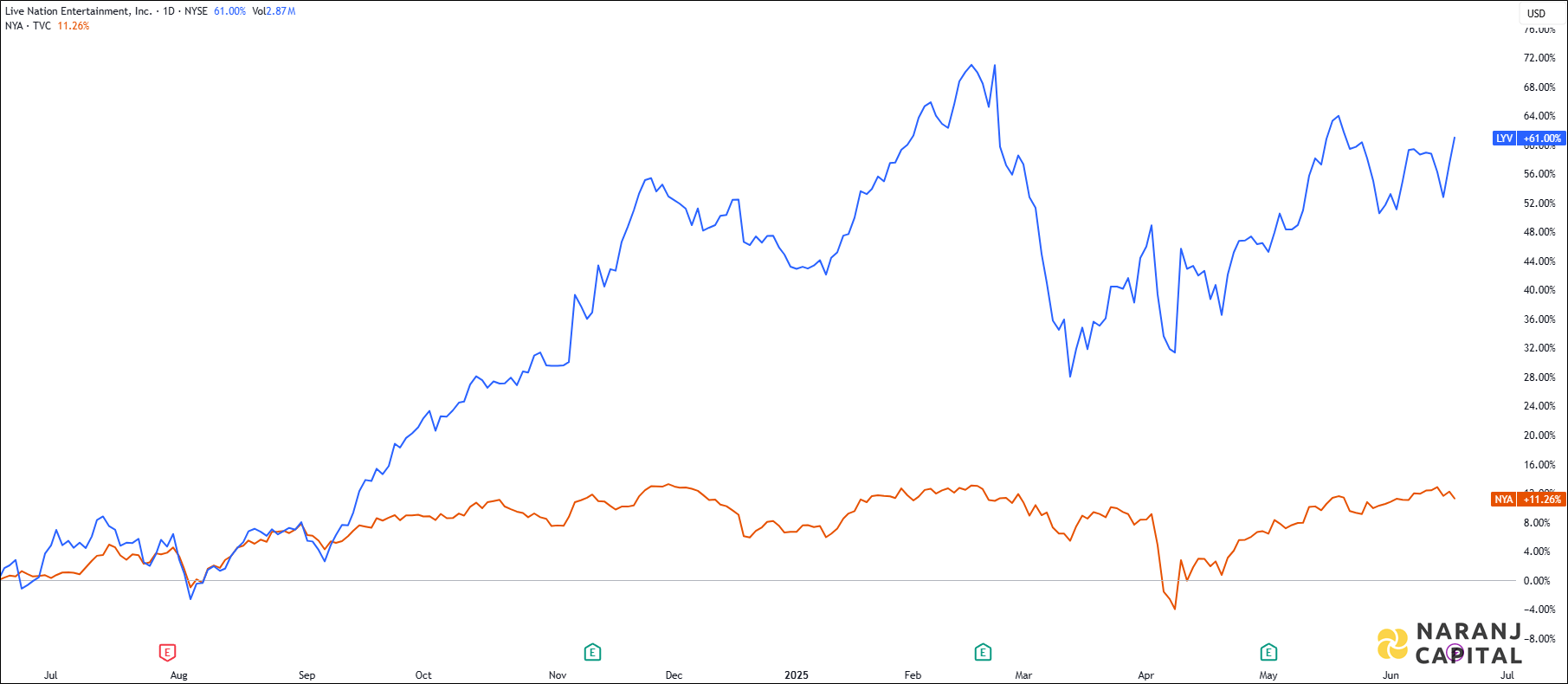

- 🇺🇸 USA Stock Market

Live Nation Entertainment, Inc. is a leading global live entertainment company headquartered in Beverly Hills, California. Founded in 2005, the company operates through three key segments: Concerts, Ticketing, and Sponsorship & Advertising.

The Concerts segment promotes live music events across both owned/operated and third-party venues. It manages music venues, produces music festivals, develops related content, and offers artist management and support services.

The Ticketing segment operates ticket sales and distribution primarily through its platforms, including Ticketmaster.com and LiveNation.com, as well as mobile apps and retail outlets. It provides ticketing services for a wide range of venues and events, including concerts, sports, performing arts, museums, and theaters.

The Sponsorship & Advertising segment delivers local to international brand partnerships through venue signage, digital ads, live streaming, and custom promotional events. It develops strategic marketing programs and branded experiences across its event and venue network.

Previously known as Live Nation, Inc., the company adopted its current name in 2010 following the merger with Ticketmaster. Today, it owns, operates, or leases a broad portfolio of entertainment venues and continues to shape the global live entertainment landscape.

LYV — NYSE —

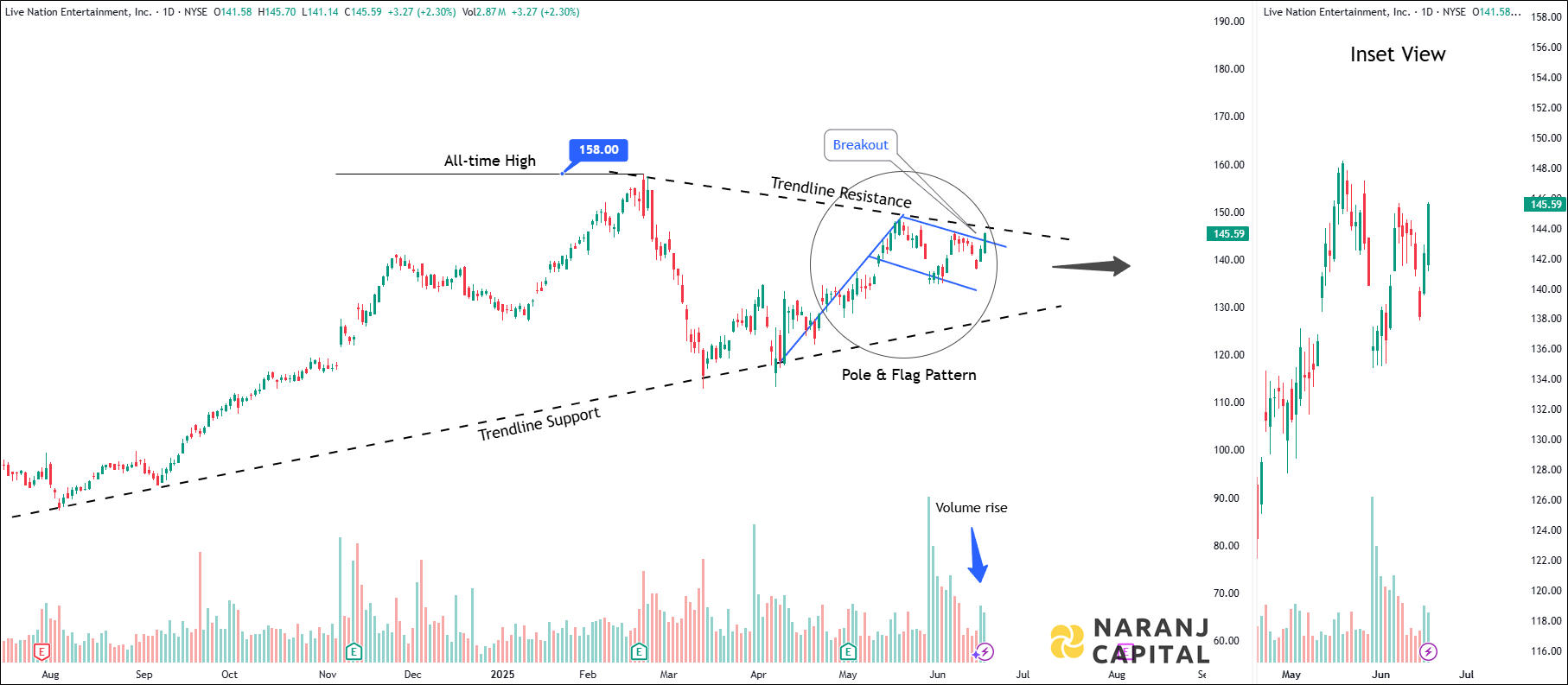

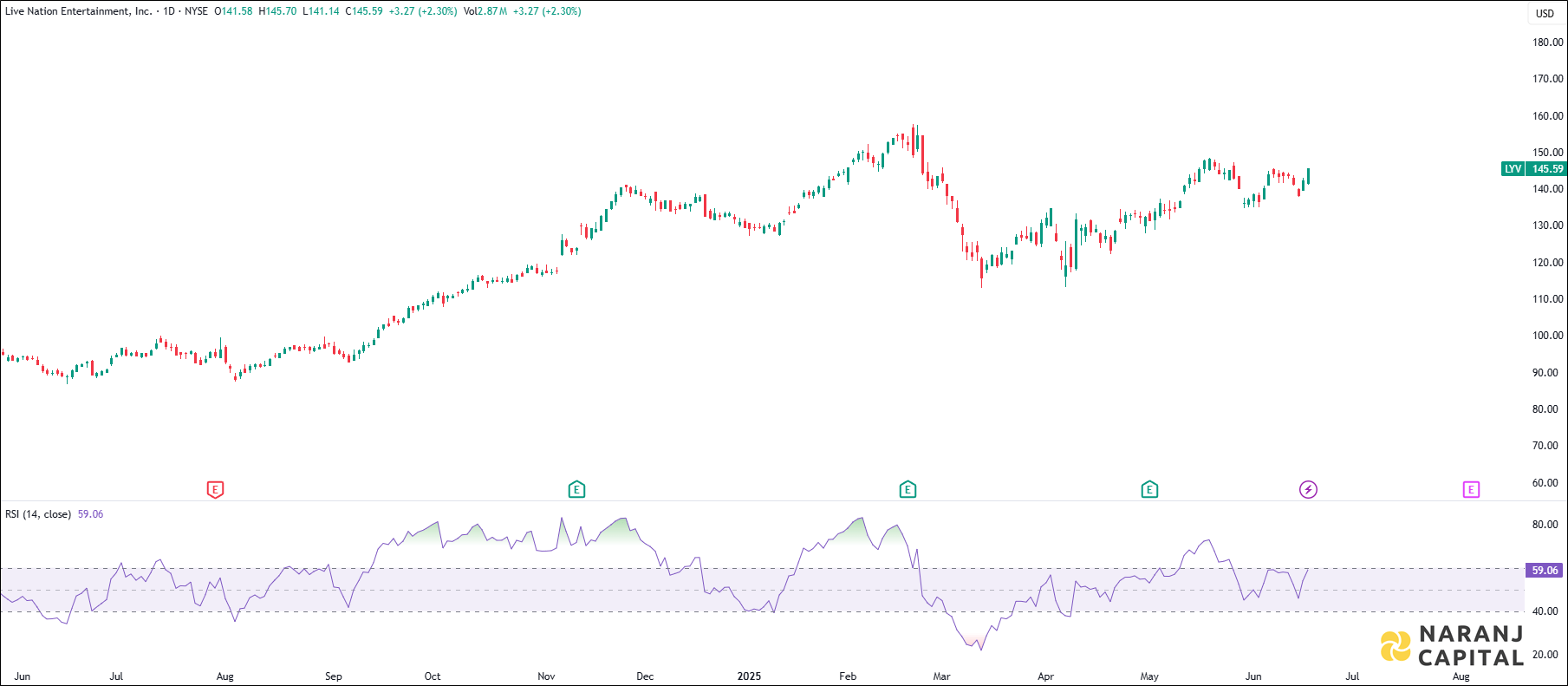

Current RSI of this stock is 59.06, which indicates the strength of buyers.

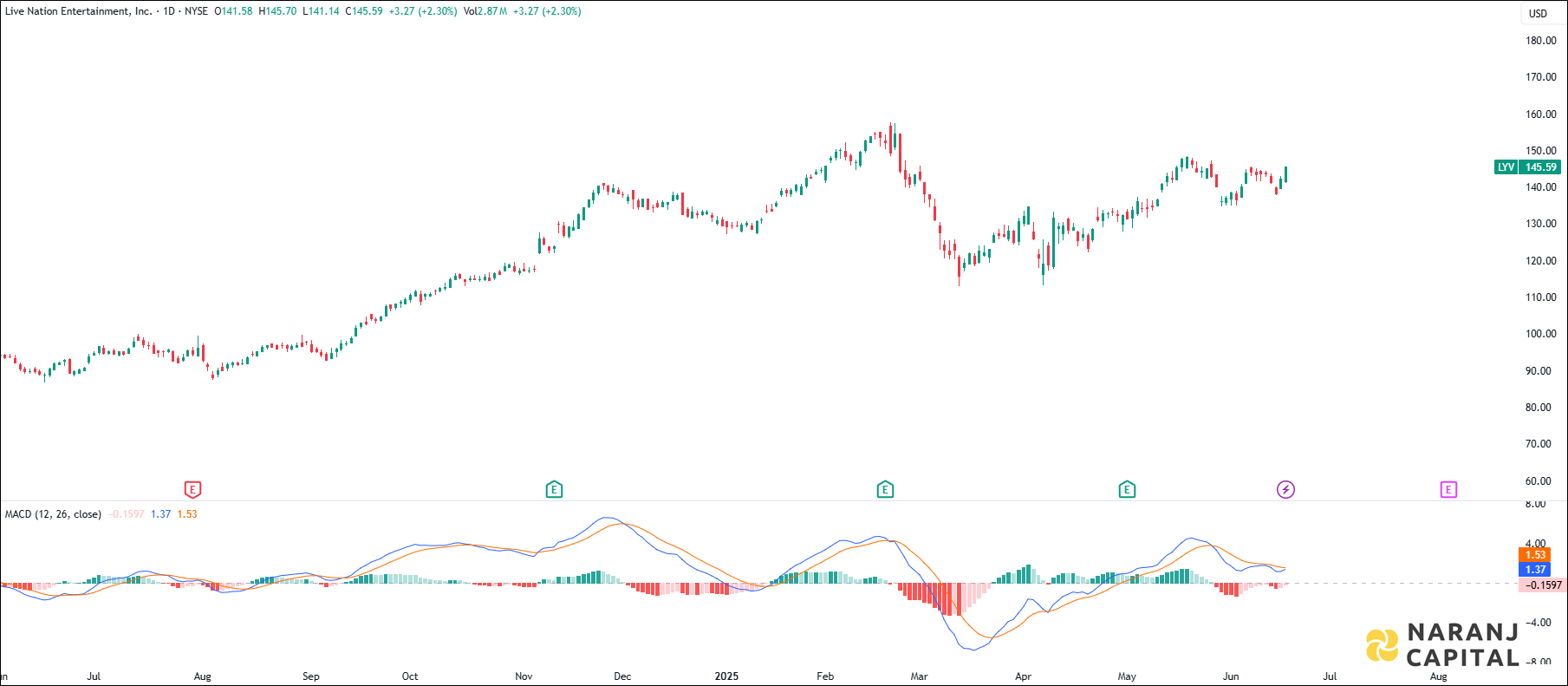

MACD line is about to cross the signal line from the below, generates bullish signal.

Based on our positional trading advisory in USA stocks, Live Nation Entertainment stock price target will be USD 152 - USD 154 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website