- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Wells Fargo & Company is a leading financial services firm headquartered in San Francisco, California, founded in 1852. The company operates globally through four main segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. It provides a wide range of products and services, including checking and savings accounts, credit and debit cards, and various types of loans for individuals and small businesses. Wells Fargo also supports private and public companies with tailored banking and credit solutions across industries. Its Corporate and Investment Banking segment offers services such as capital markets, investment banking, and commercial real estate lending to institutional clients. Additionally, the company delivers personalized wealth management, brokerage, and private banking services to affluent and high-net-worth individuals through both in-person advisors and digital platforms.

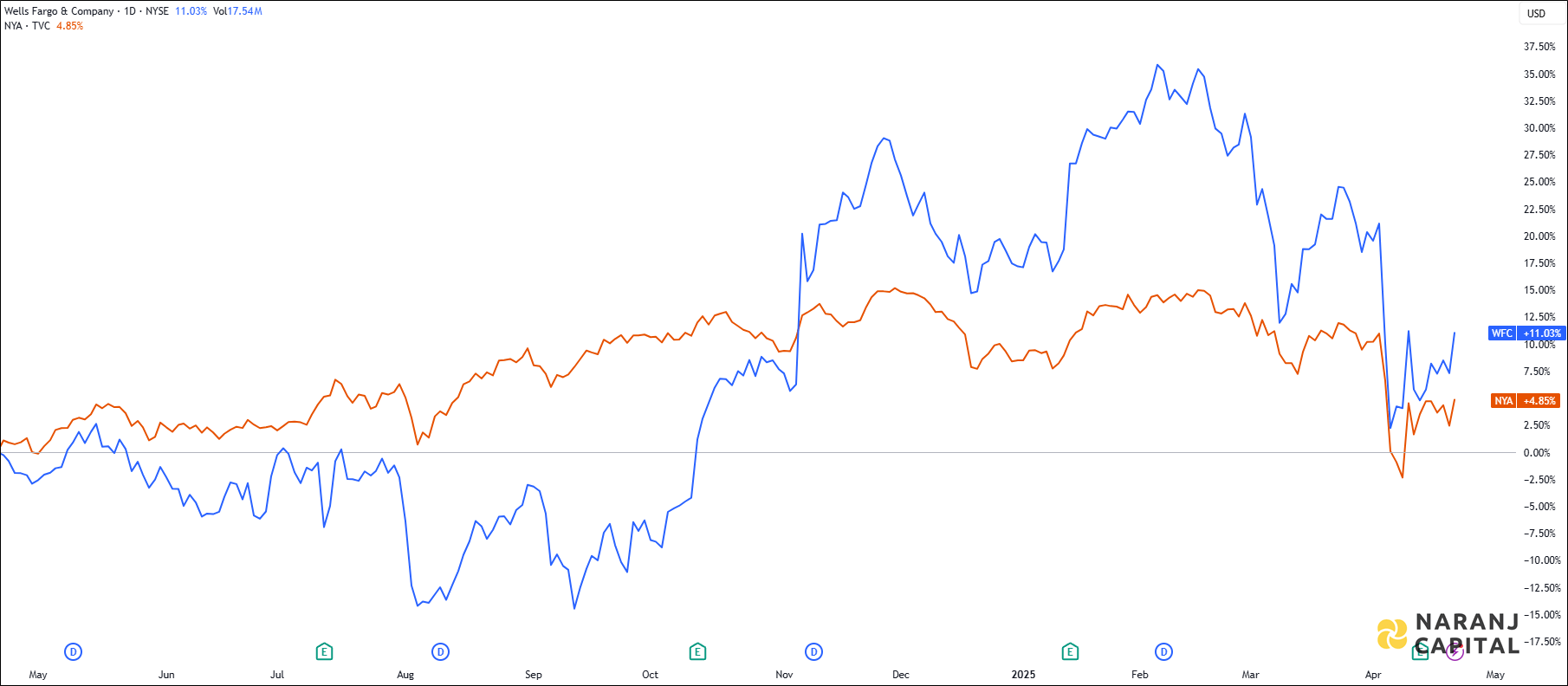

WFC — NYSE —

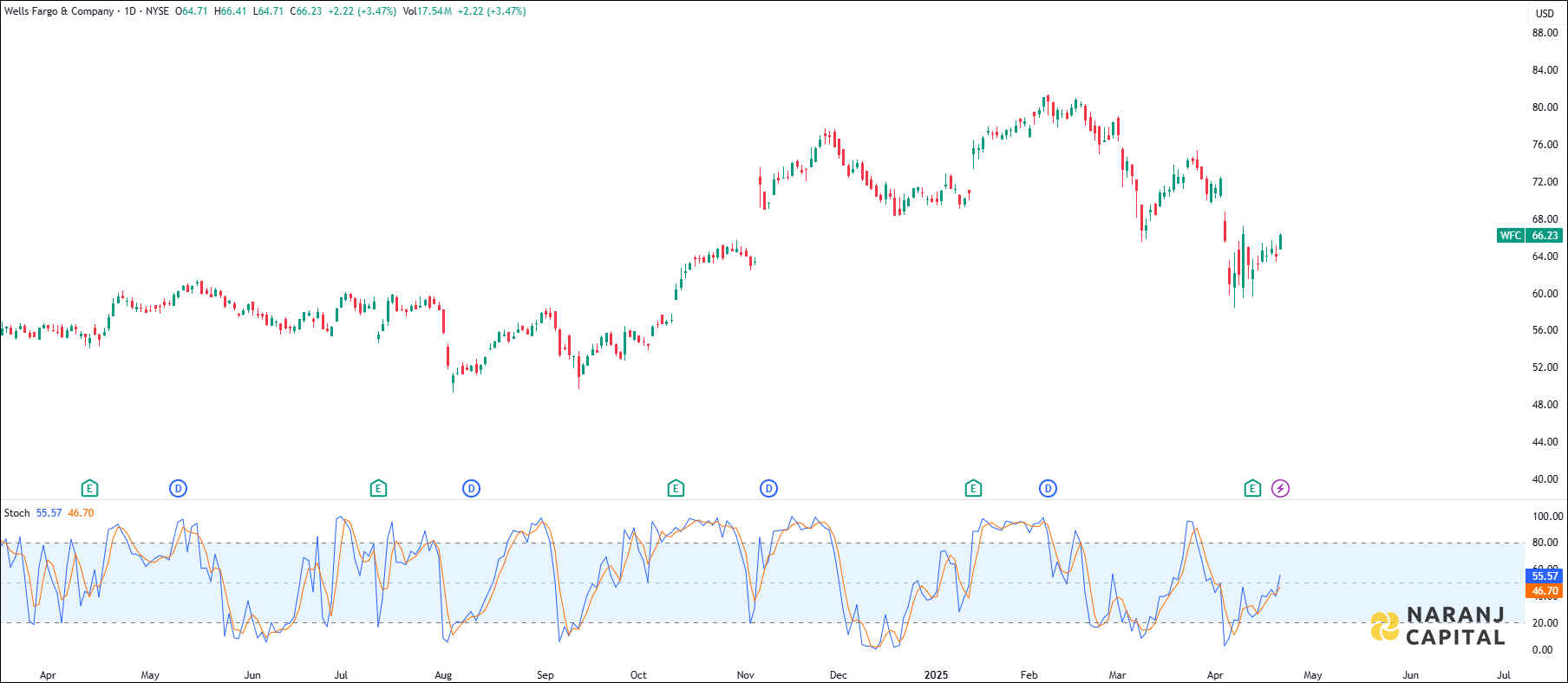

The K (Blue) line has crossed the D (Orange) line from the below, generates bullish signal.

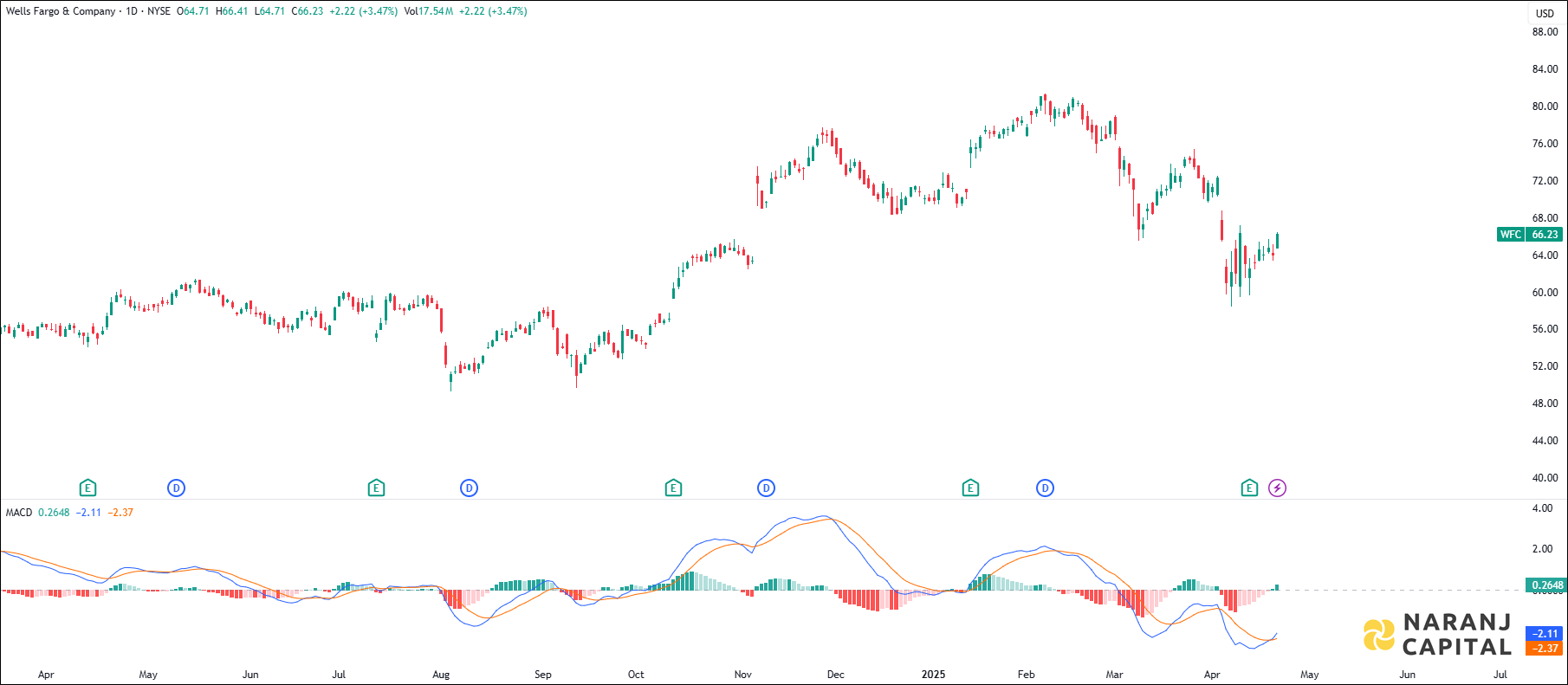

MACD line has just crossed the signal line from the below, generates bullish signal.

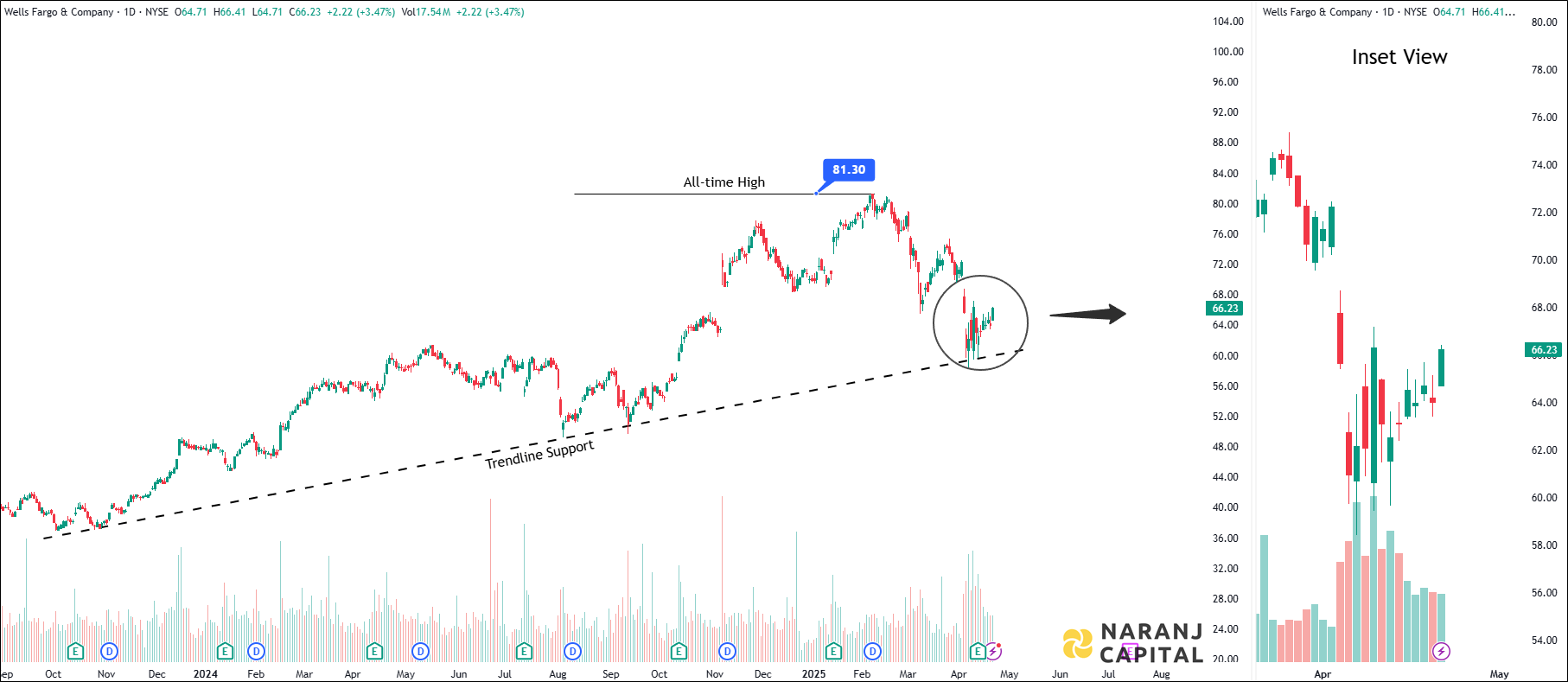

Based on our stock trading advice in Saudi Arabia, Wells Fargo stock price target will be USD 69.5 - USD 70.5 in the next 14-16 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website