- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

Take-Two Interactive Software, Inc. creates, publishes, and markets interactive entertainment for consumers globally. The company is known for its action/adventure titles like Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption, along with other franchises. It also publishes a variety of entertainment properties across multiple platforms and genres, including shooter, action, role-playing, strategy, sports, and family/casual games under names like BioShock, Mafia, Sid Meier’s Civilization, XCOM, Borderlands, and Tiny Tina’s Wonderland. Additionally, it offers sports simulation games such as the NBA 2K series, WWE 2K wrestling series, mobile games like WWE SuperCard, and PGA TOUR 2K. The company also features Kerbal Space Program and OlliOlli World, along with free-to-play mobile games like CSR Racing, Dragon City, Empires & Puzzles, FarmVille, Golf Rival, Harry Potter: Puzzles & Spells, and many others. Its products cater to console systems, PCs, and mobile devices, including smartphones and tablets, and are available through physical retail, digital downloads, online platforms, and cloud streaming. Founded in 1993, Take-Two Interactive Software, Inc. is headquartered in New York.

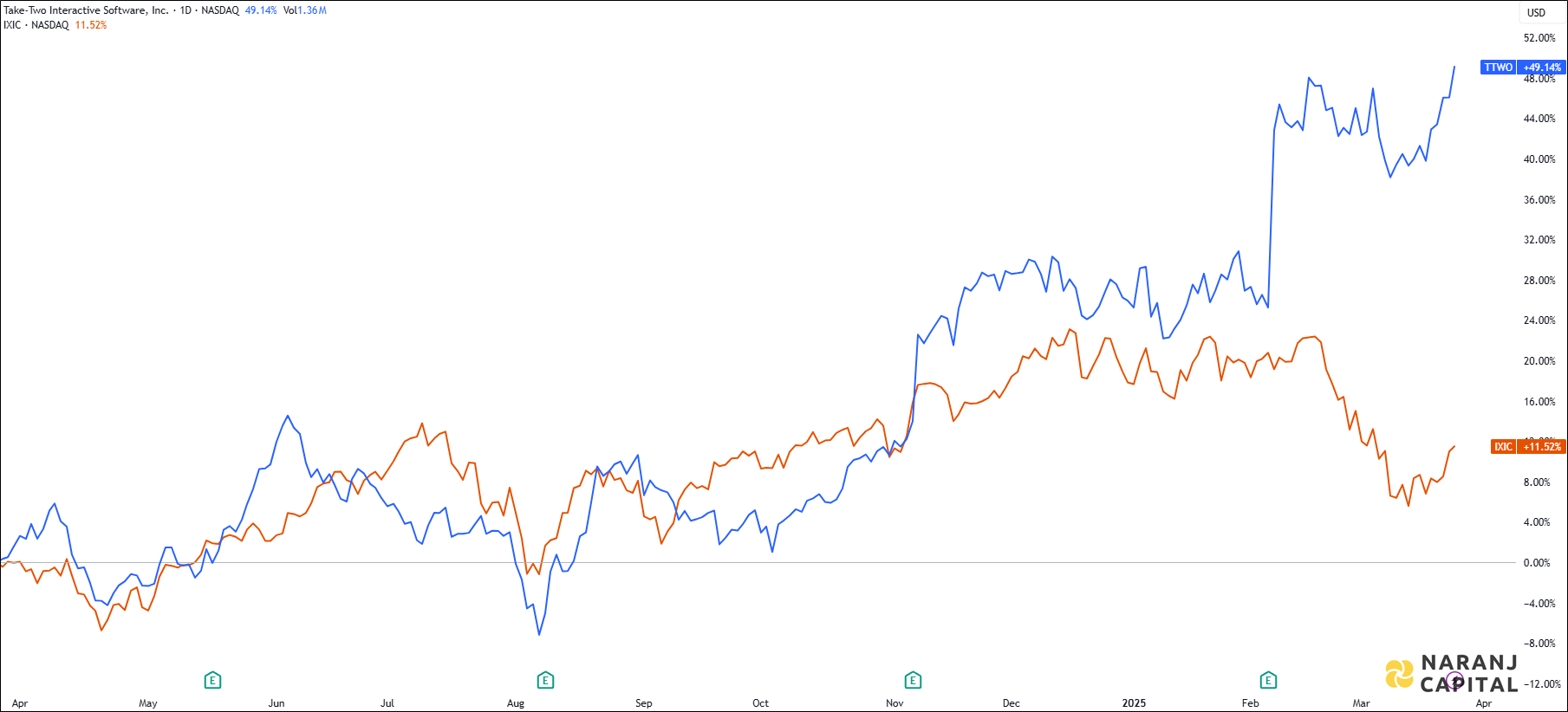

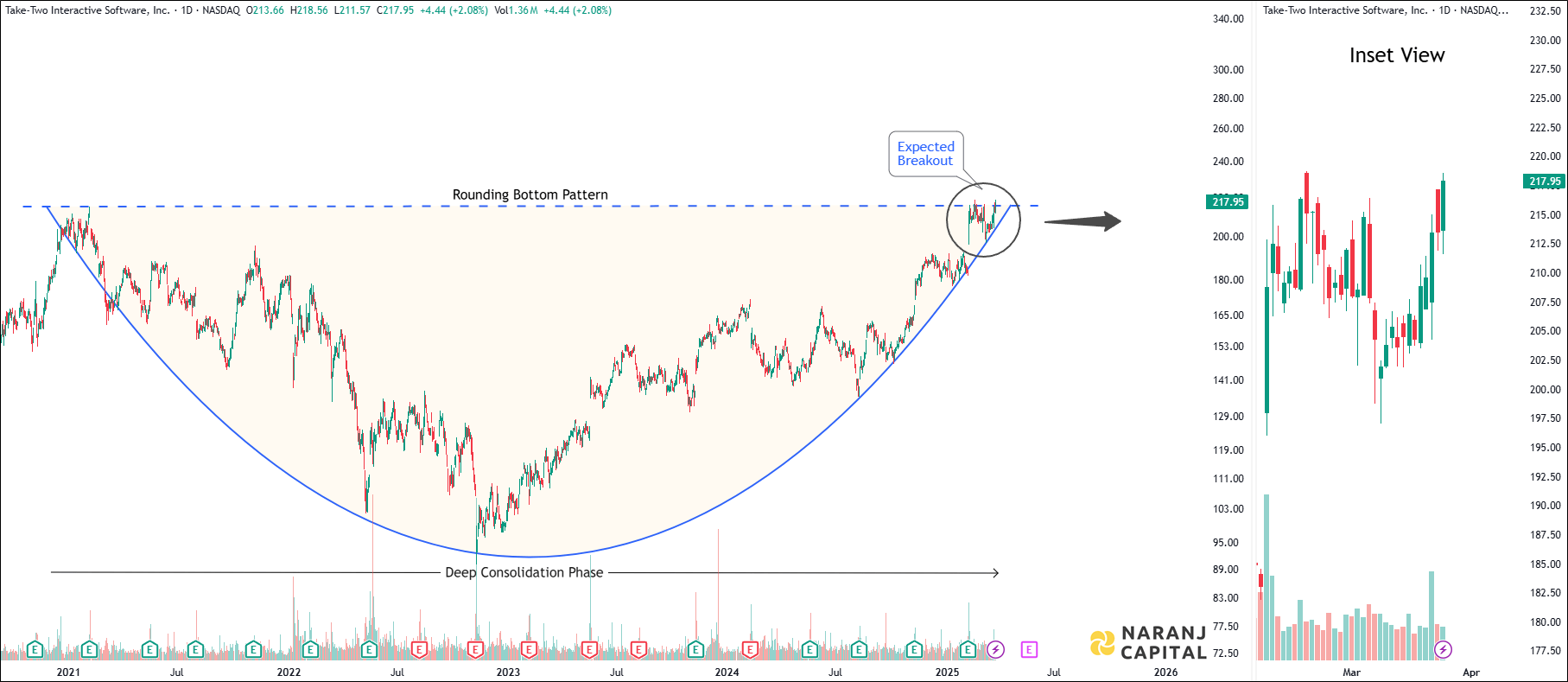

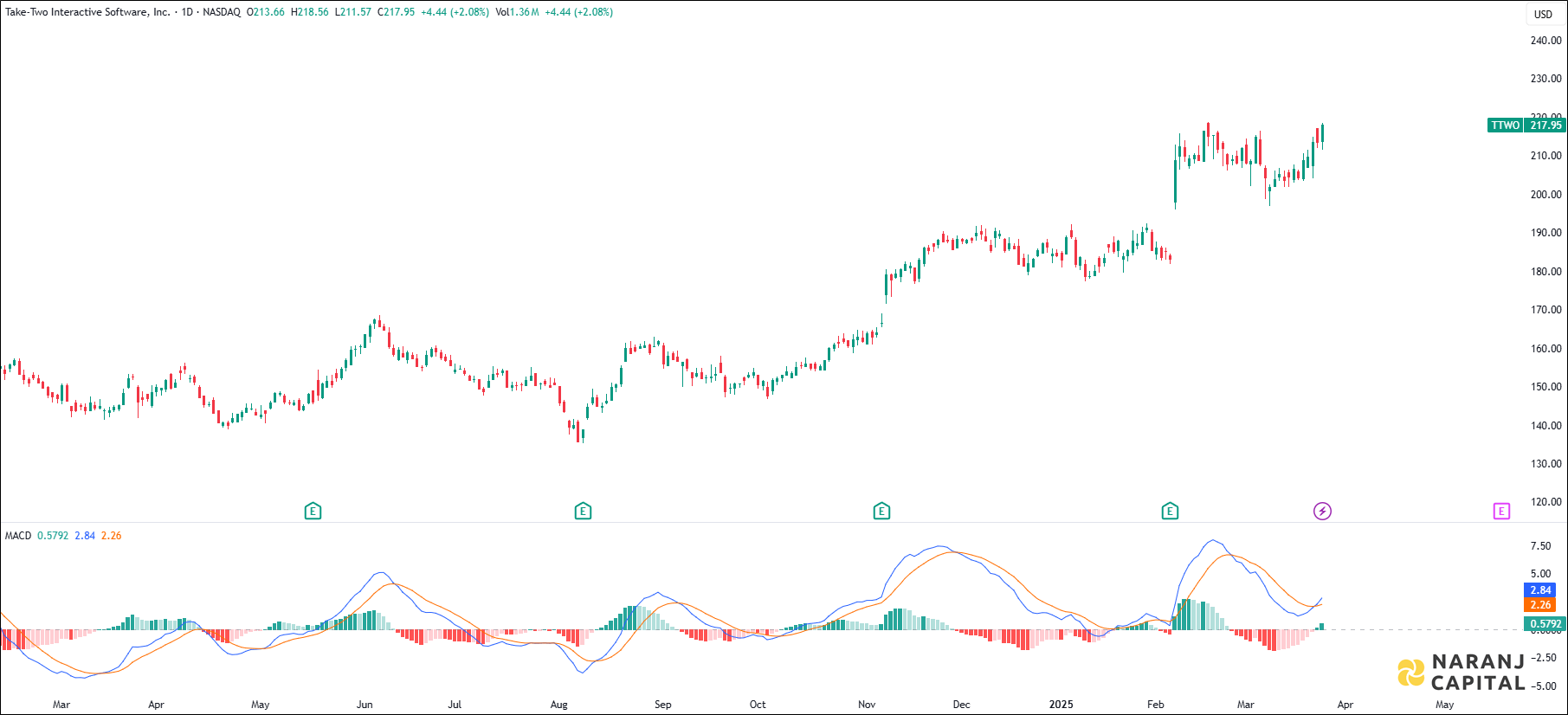

TTWO — NASDAQ —

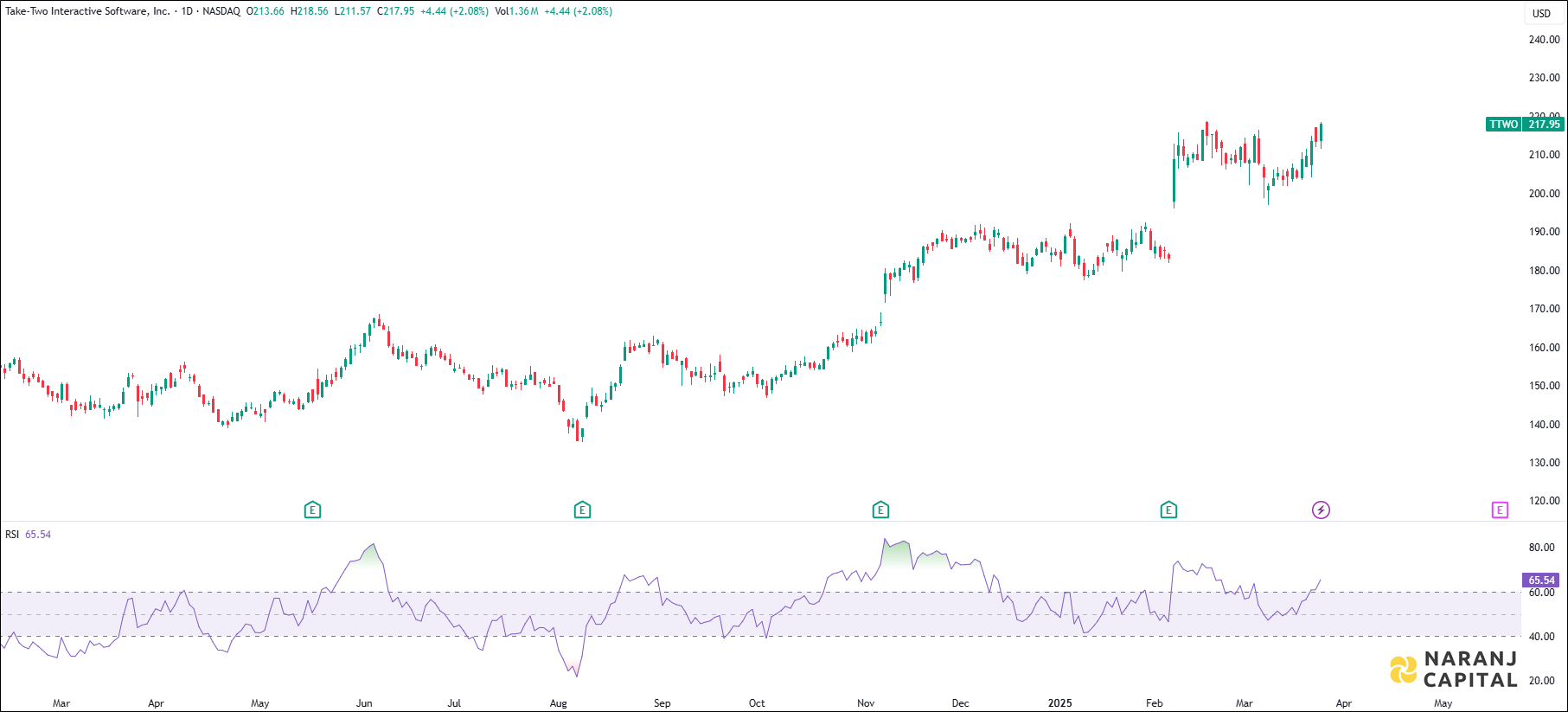

Current RSI of this stock is 65.54, which indicates the strength of buyers.

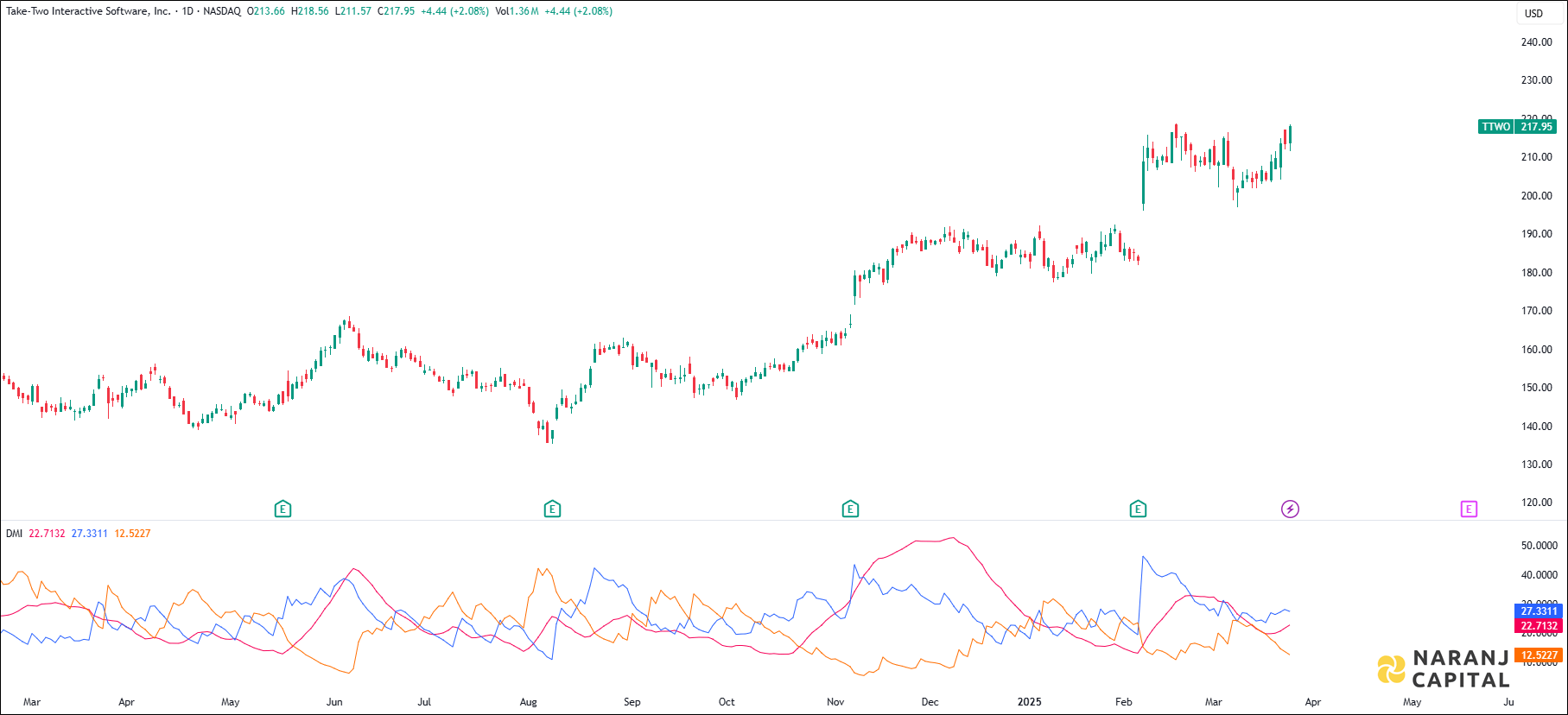

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

MACD line has crossed the signal line from the below, generates bullish signal.

Based on our stock trading advice in Saudi Arabia, Take-Two Interactive Software stock price target will be USD 225 - USD 228 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website