- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

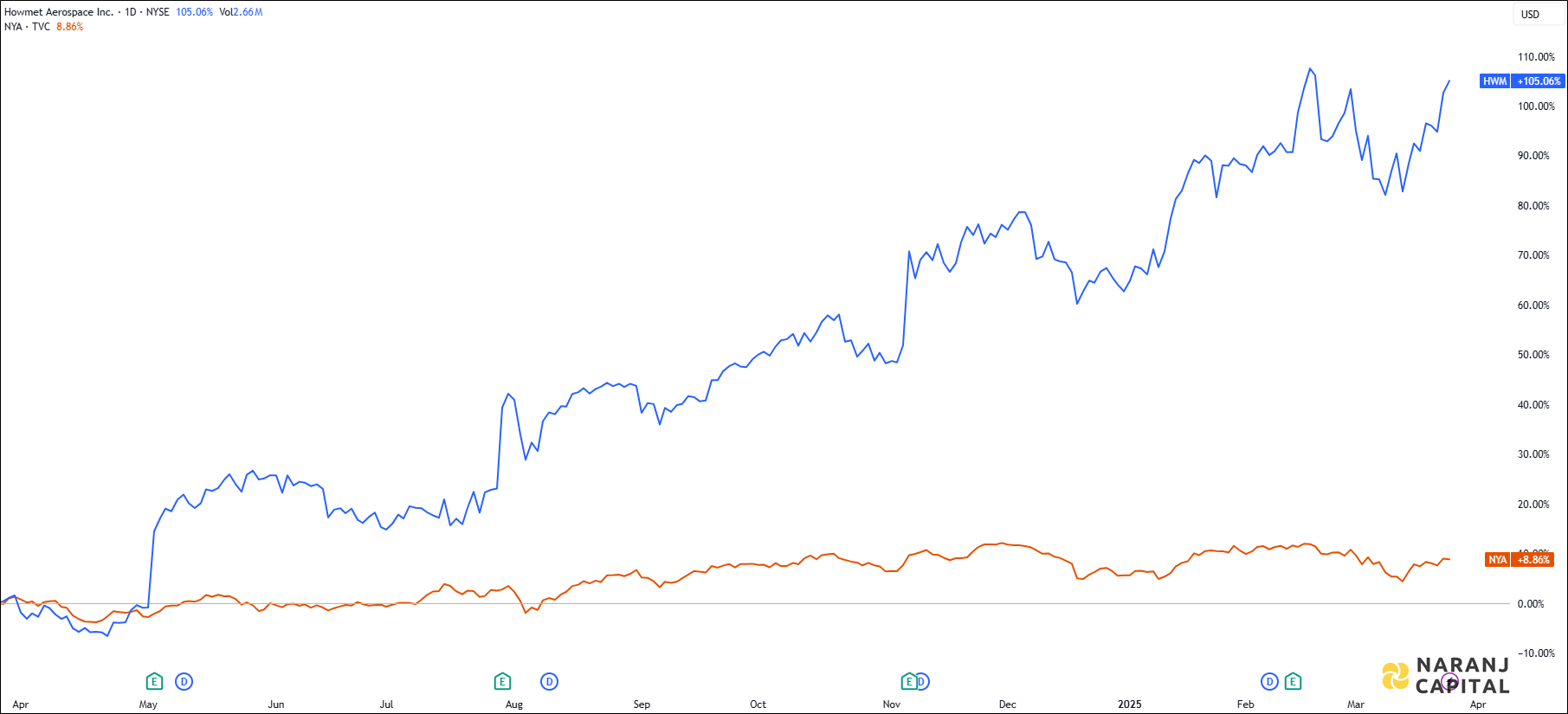

Howmet Aerospace Inc. provides advanced engineered solutions for the aerospace and transportation industries worldwide. The company operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels. These segments offer a range of products, including airfoils, fastening systems, titanium ingots, and forged aluminum wheels, catering to aerospace, defense, and commercial transportation markets. Founded in 1888 and formerly known as Arconic Inc., Howmet Aerospace Inc. is headquartered in Pittsburgh, Pennsylvania.

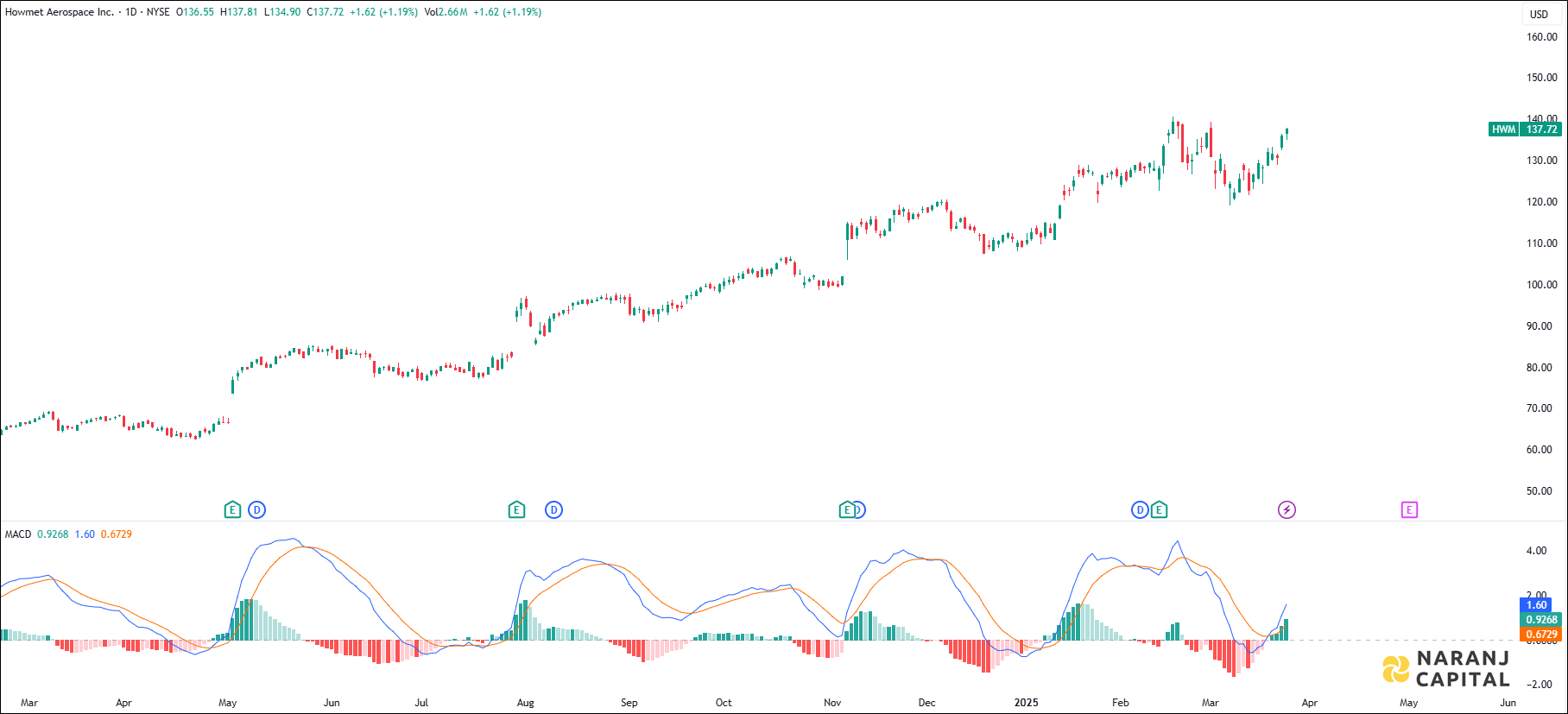

HWM — NYSE —

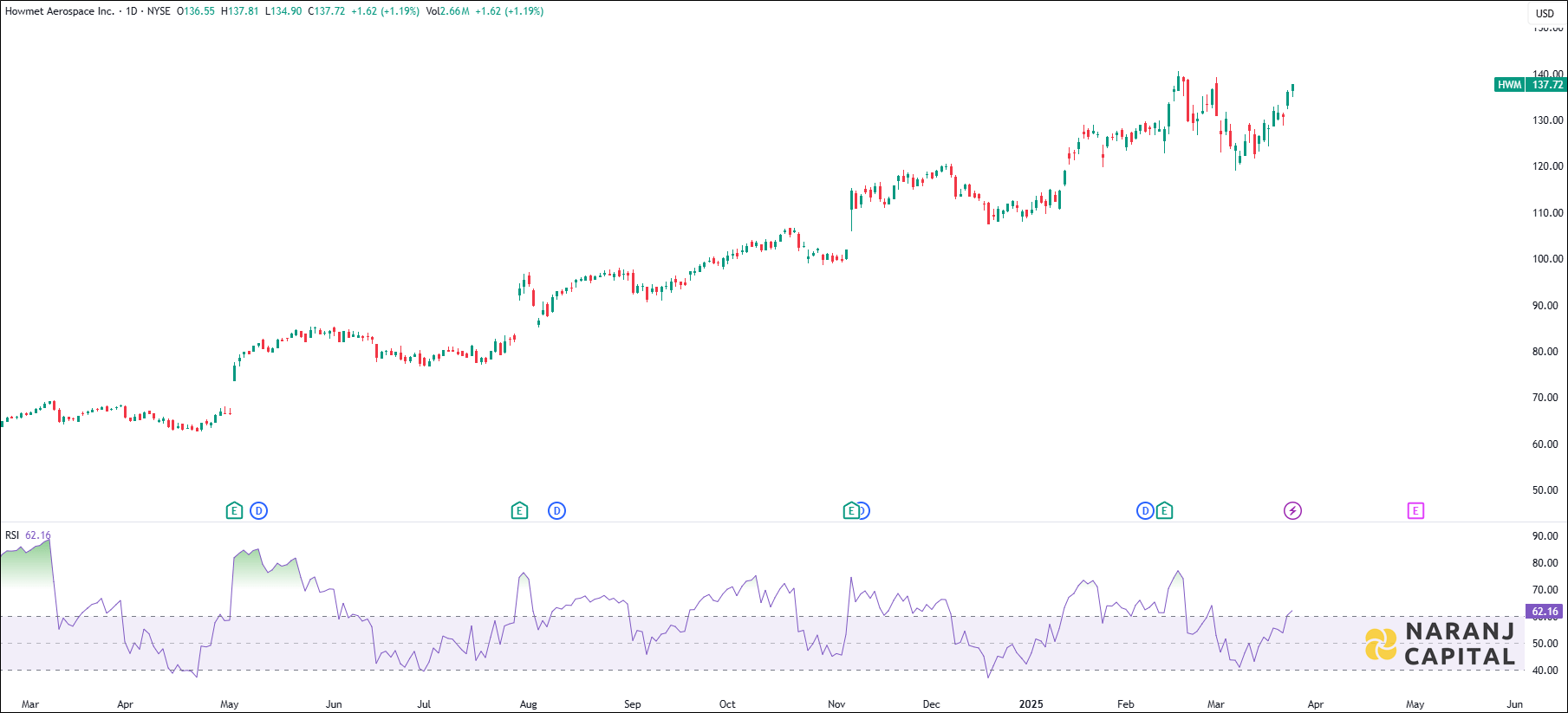

Current RSI of this stock is 62.16, which indicates the strength of buyers.

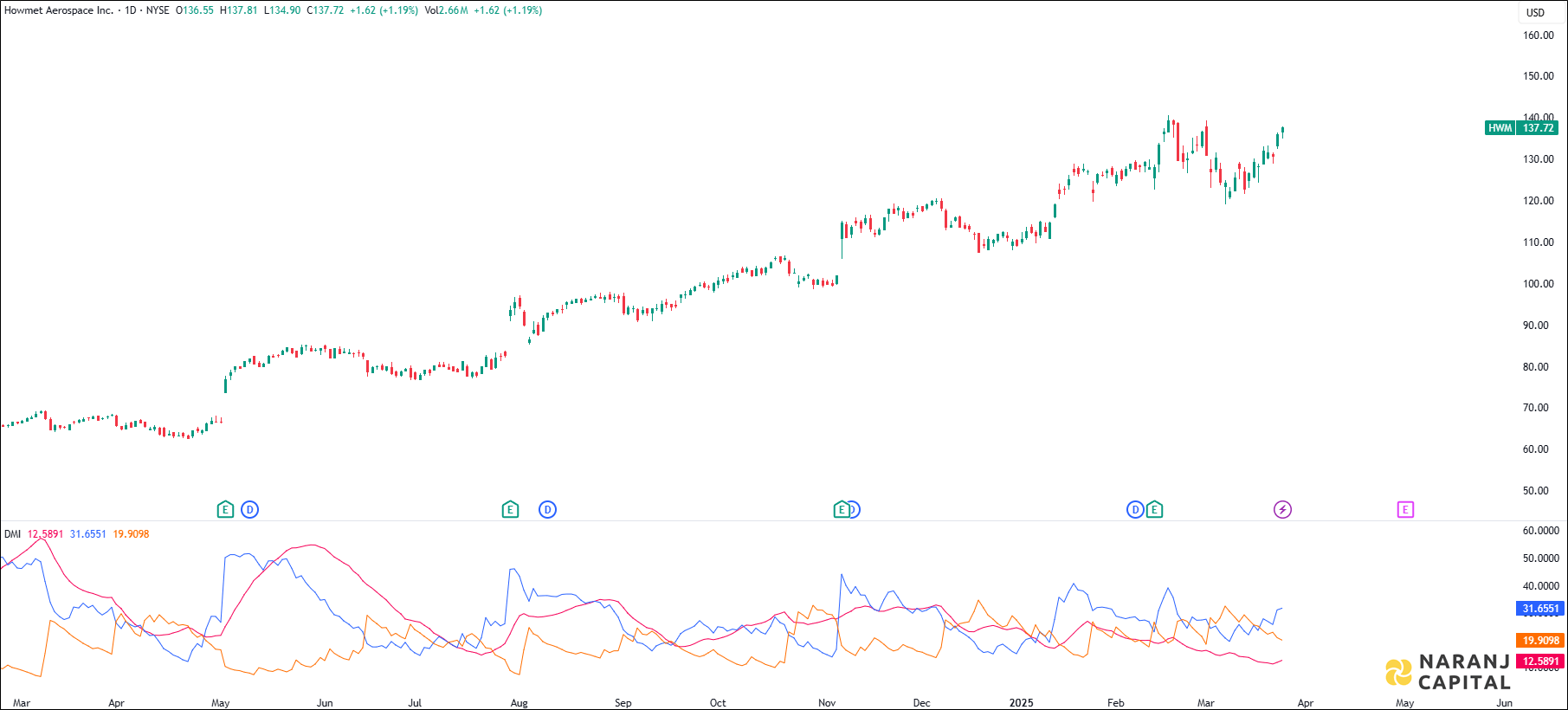

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

MACD line has crossed the signal line from the below, generates bullish signal.

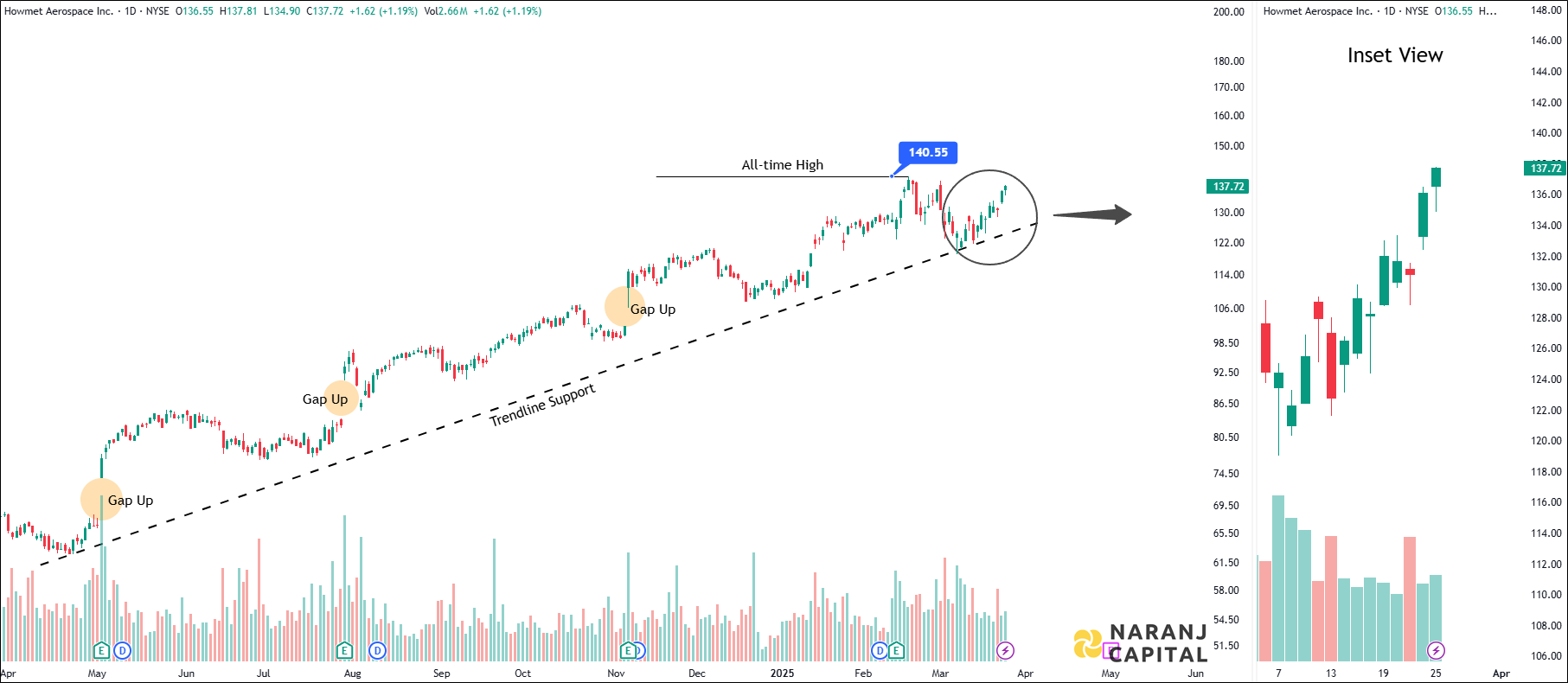

Based on our stock trading advice in Saudi Arabia, Howmet Aerospace stock price target will be USD 145 - USD 149 in the next 15-16 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website