- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

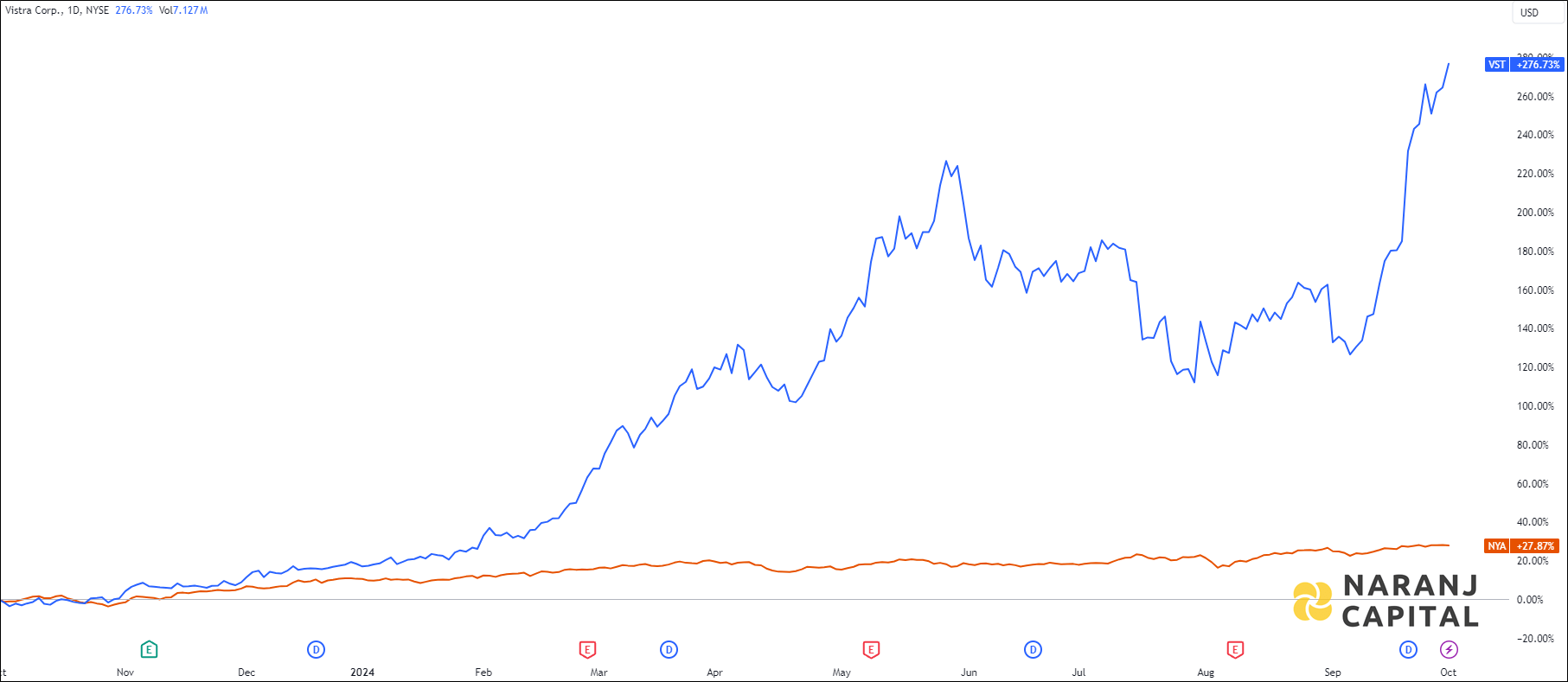

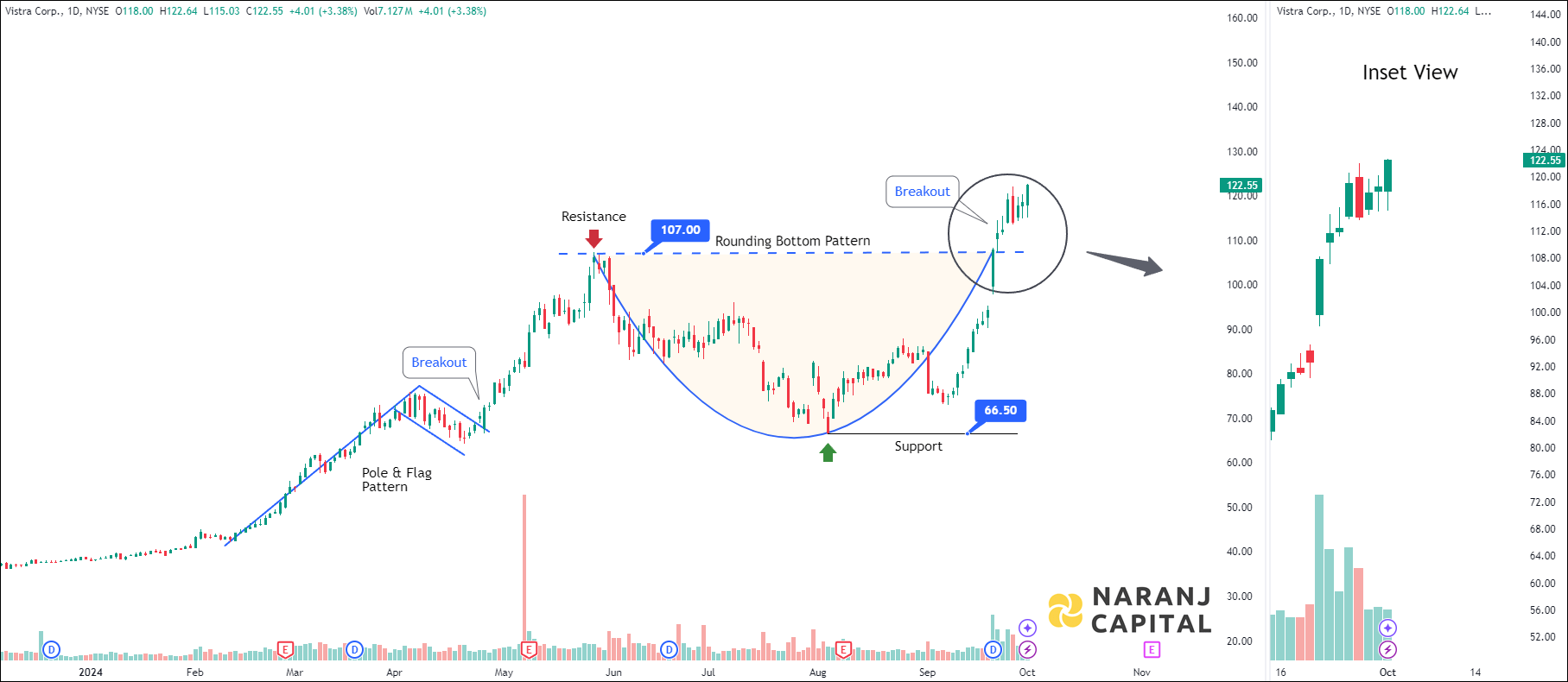

Vistra Corp., along with its subsidiaries, functions as a comprehensive retail electricity and power generation entity. The company is divided into six segments: Retail, Texas, East, West, Sunset, and Asset Closure. It provides electricity and natural gas services to residential, commercial, and industrial clients across various states in the U.S. and the District of Columbia. Additionally, Vistra is engaged in electricity generation, wholesale energy transactions, commodity risk management, fuel production, and fuel logistics. With a generation capacity of around 41,000 megawatts, it caters to approximately 5 million customers through a diverse portfolio that includes natural gas, nuclear, coal, solar, and battery energy storage facilities. Originally named Vistra Energy Corp., the company rebranded to Vistra Corp. in July 2020. Established in 1882, its headquarters is located in Irving, Texas.

VST — NYSE —

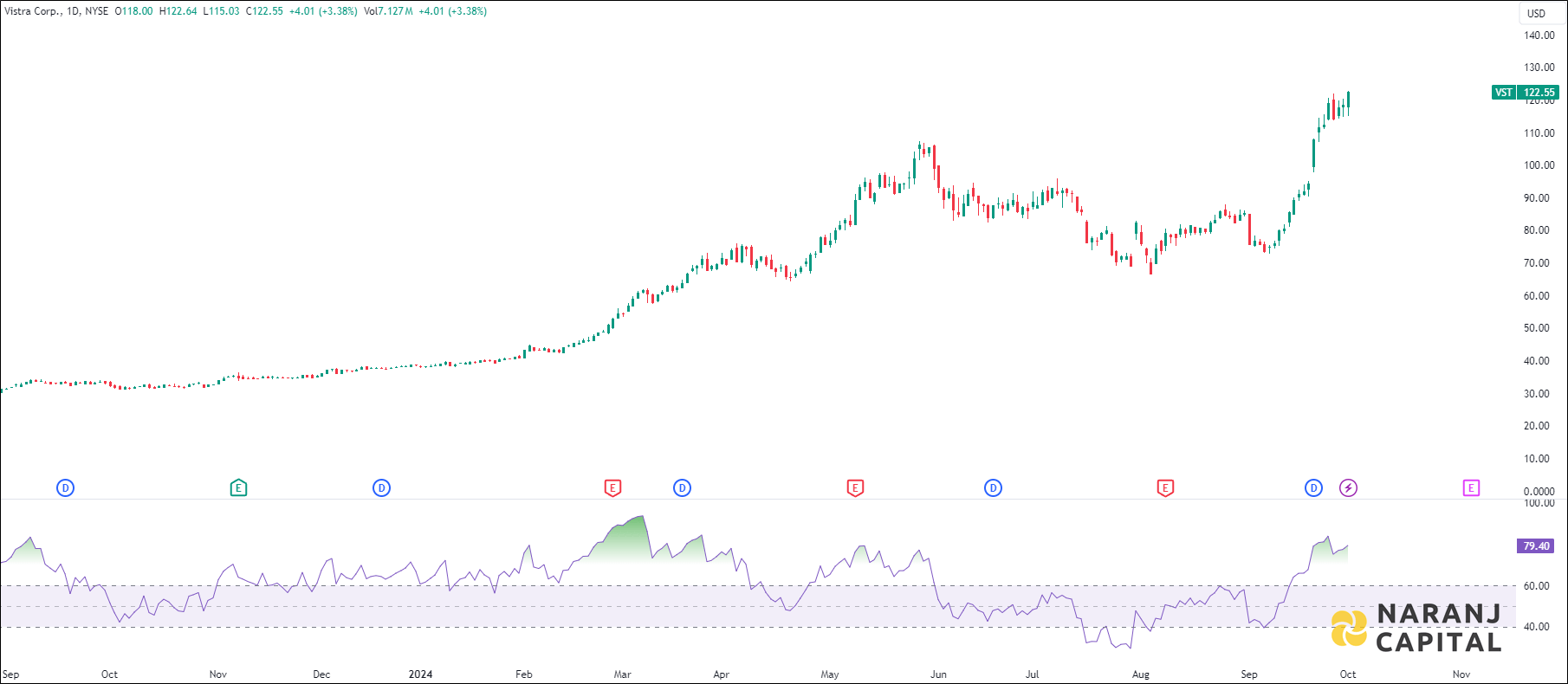

Current RSI of this stock is 79.40, which indicates the strength of buyers.

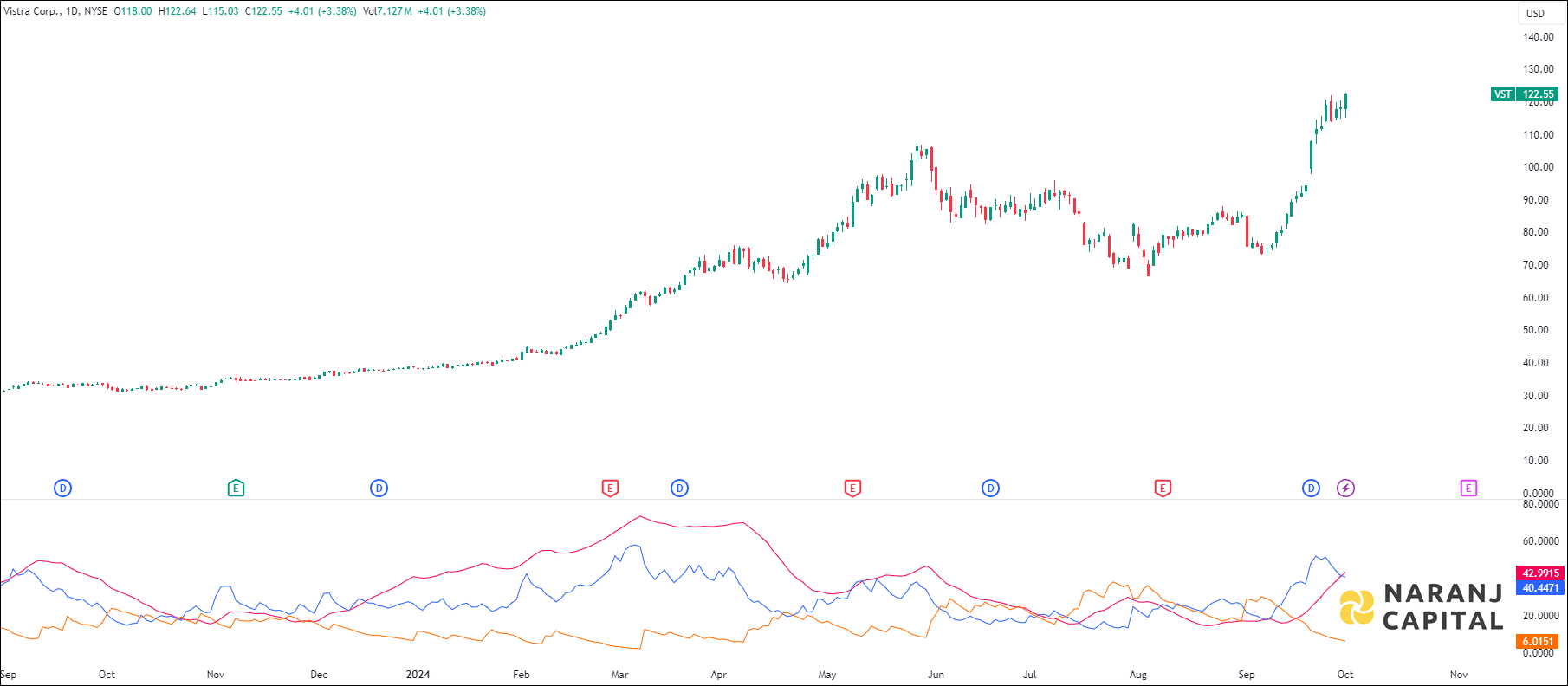

Increasing ADX value above 20, indicated the strength of the trend, thereby uptrending ADX confirms the bullish or bearish supportive decisions. Along with the rising ADX, and the +DI is above (or crossing) -DI, indicates the long trades should be favoured.

The short length exponential moving average (10 EMA) has crossed the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our US stock market trading signals, Vistra Corporation stock price target will be USD 127 - USD 130 in the next 14-15 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website