- research@naranjcapital.com

- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

National Medical Care Company is responsible for the establishment, ownership, equipping, management, maintenance, and operation of healthcare facilities within the Kingdom of Saudi Arabia. The organization manages several institutions, including Riyadh Care Hospital, Family Health Care Center, National Hospital, and Care Company for Pharmaceutical and Medical Distribution. Additionally, it offers home healthcare services. Founded in 2003, the company is headquartered in Riyadh, Saudi Arabia.

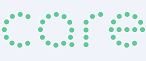

CARE — TASI —

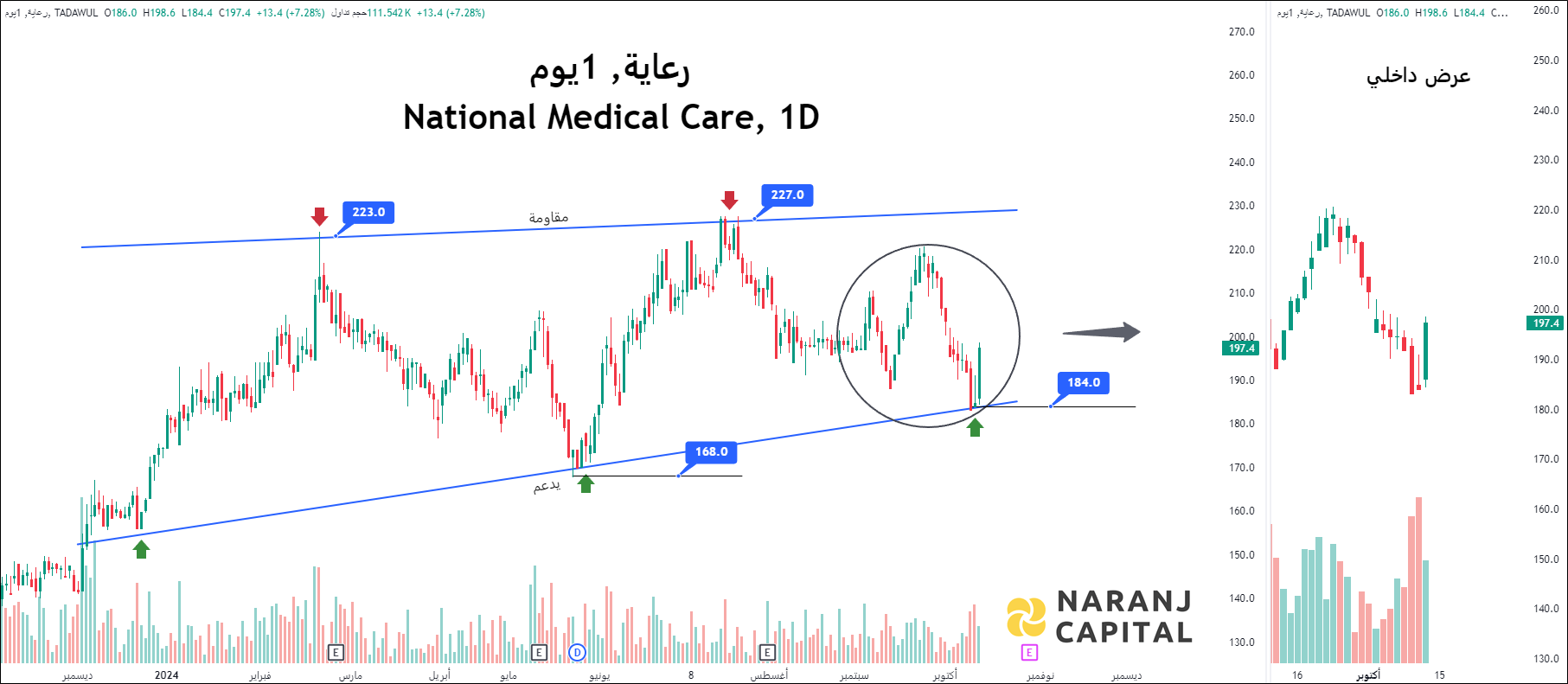

The current RSI for this stock is 47.70, having recently bounced back from a level near 30, which could be seen as a positive signal.

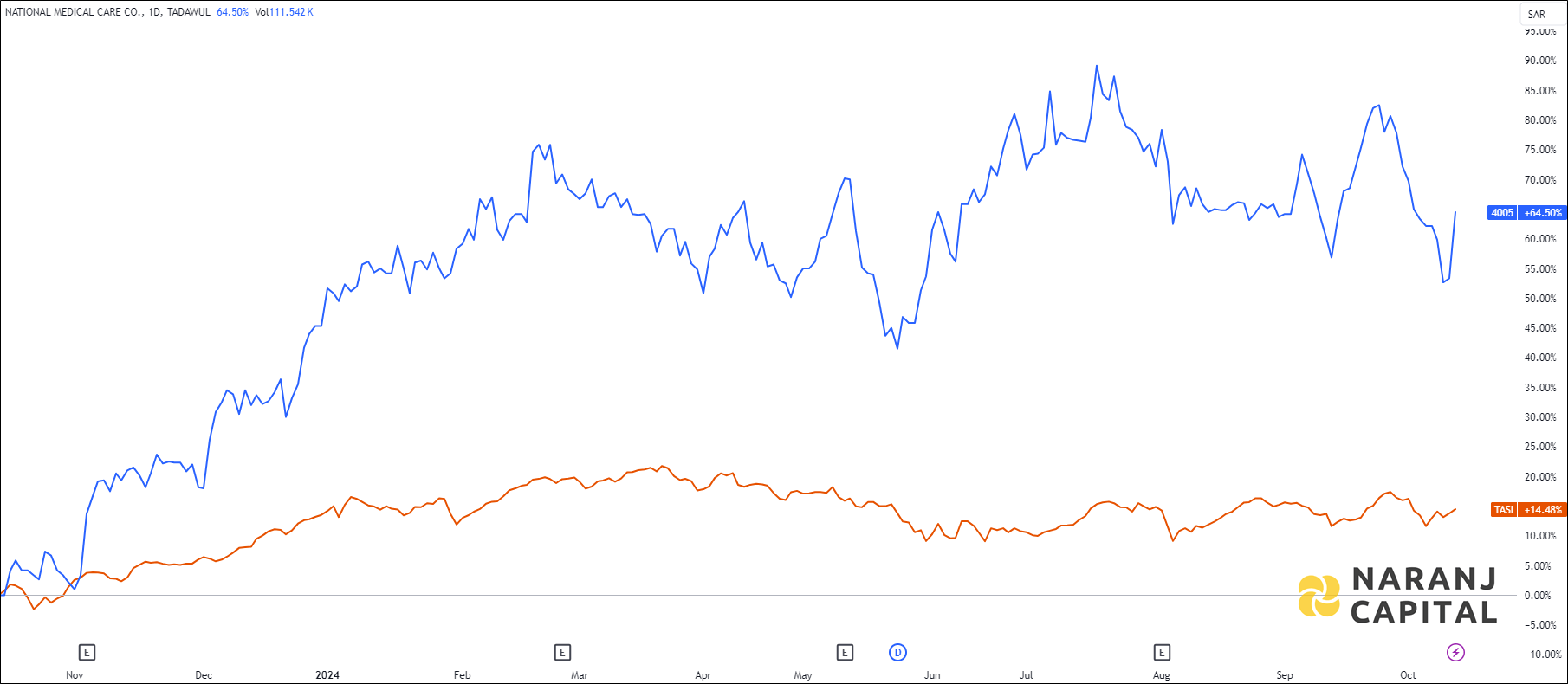

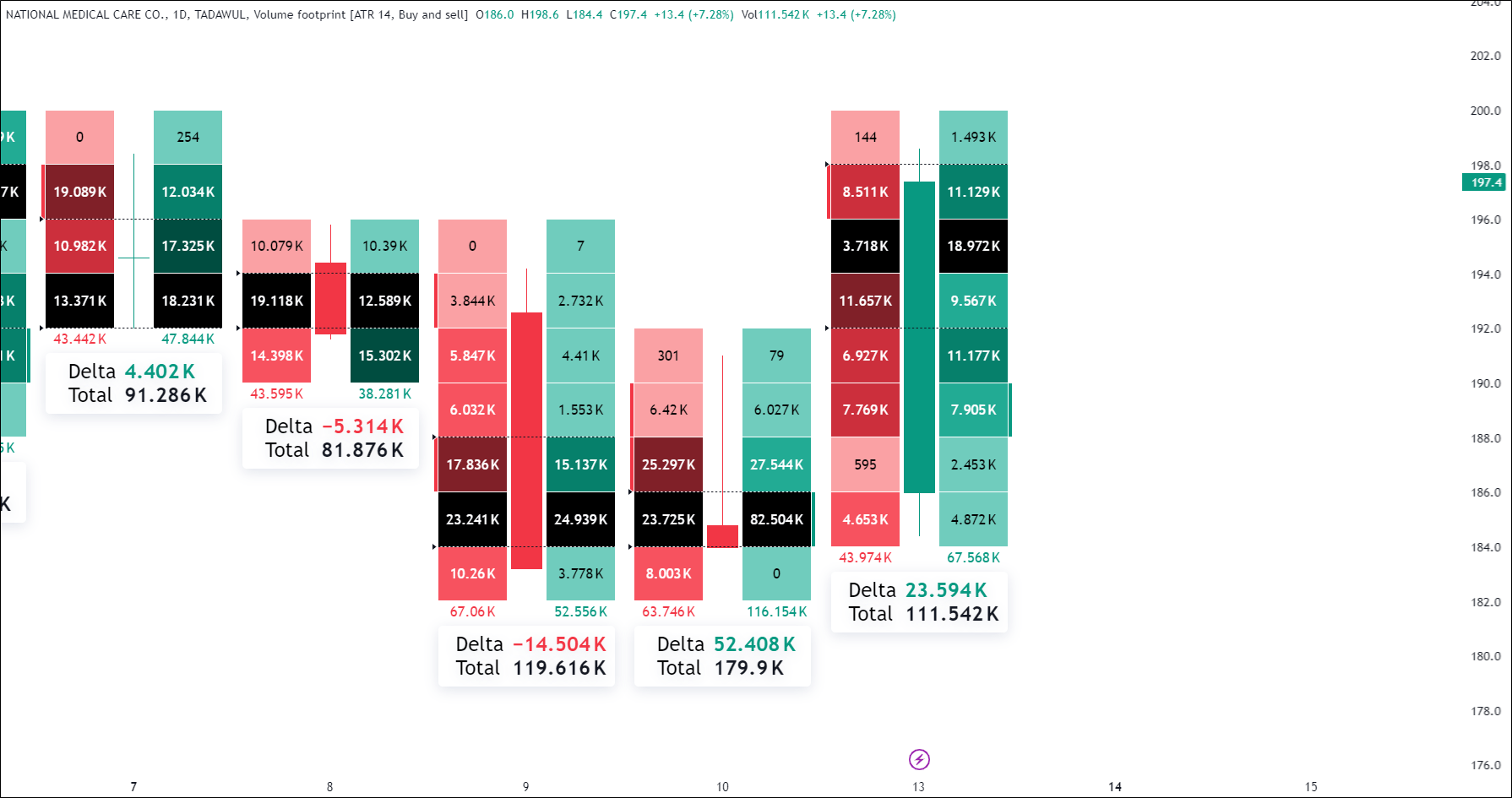

For the last two trading session, the delta value has surged hugely, signals there is a strong accumulation at the support level occurred rather than distribution.

Based on our positional stock recommendations for Saudi Tadawul, National Medical Care stock price target will be SAR 205 - SAR 208 in the next 12-14 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website