- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

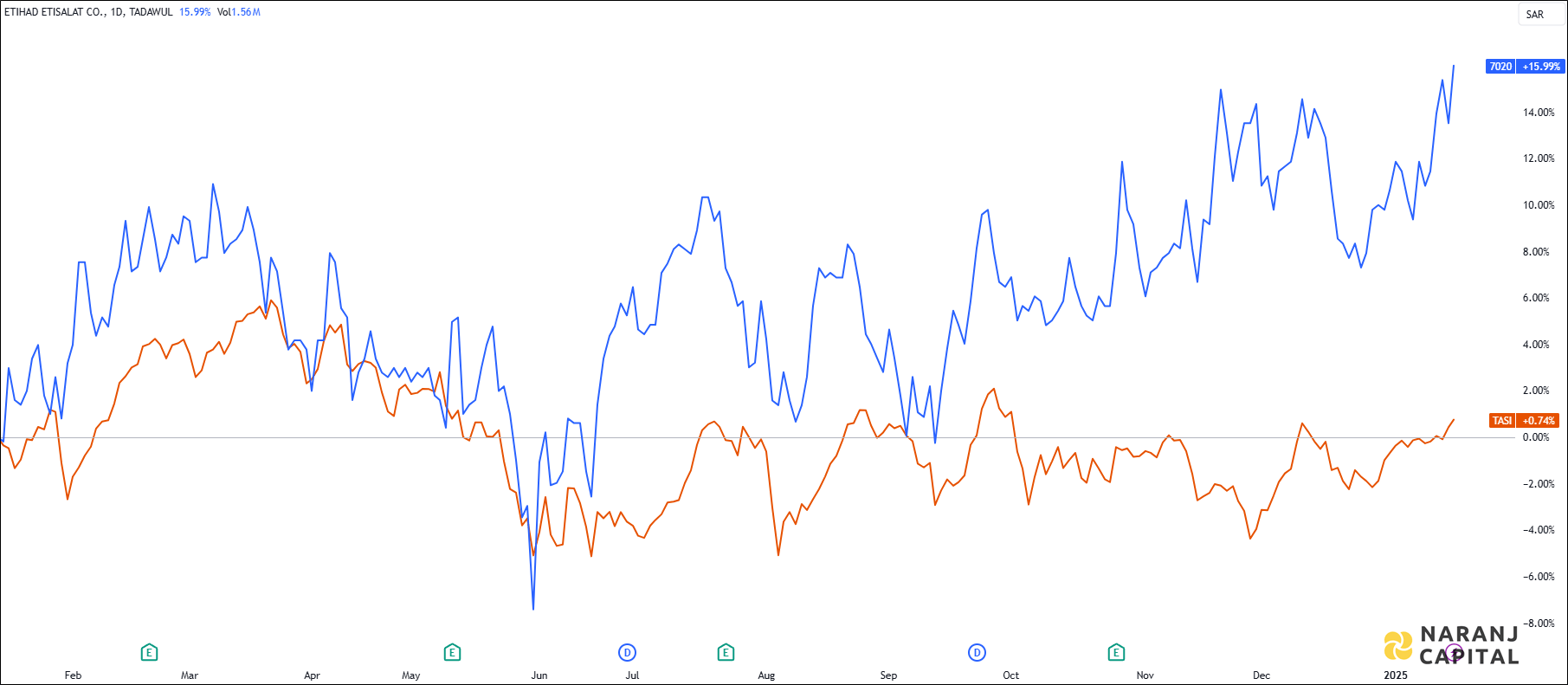

The chart highlights Etihad Etisalat's strong performance, with a 15% annual return that outshines the Tadawul all-share index.

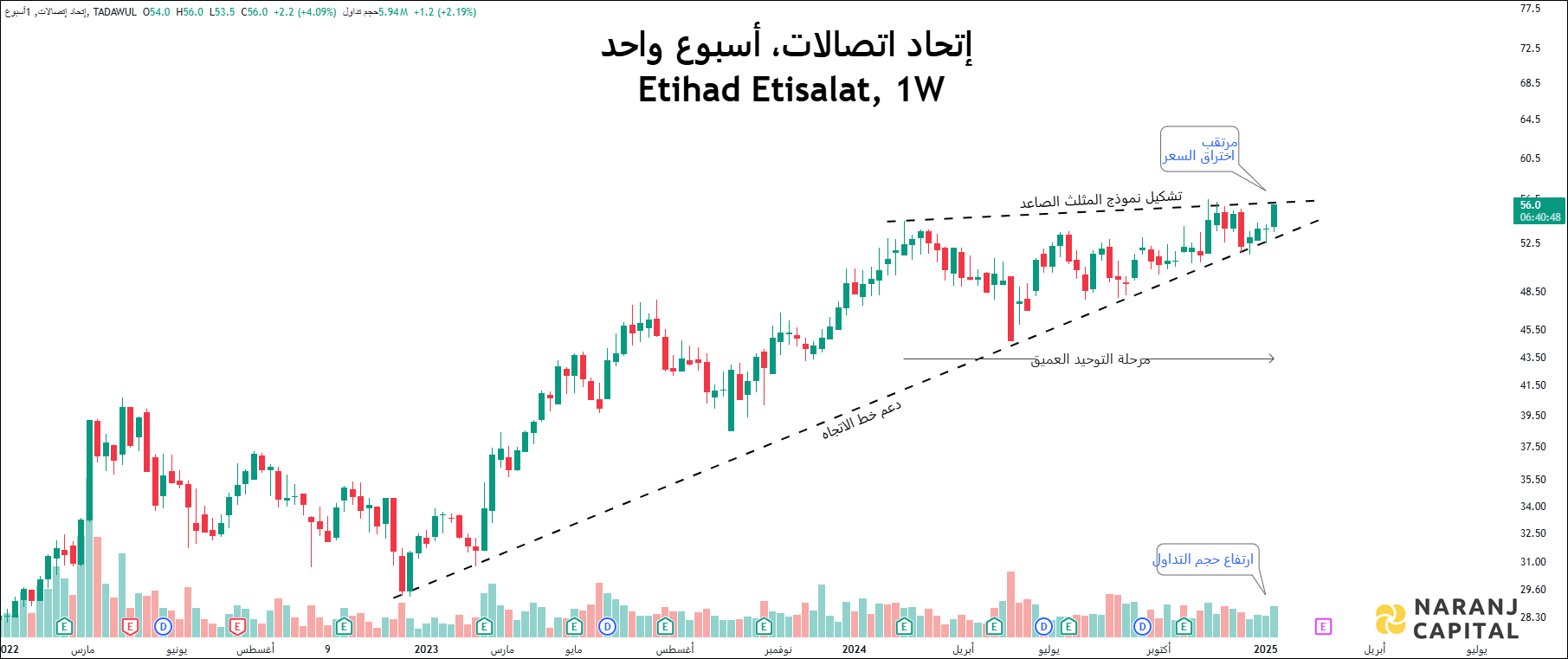

Saudi Arabia's telecommunications sector is poised for significant growth in the coming years, driven by the government's Vision 2030 initiative. This ambitious plan includes substantial investments in telecommunications infrastructure, particularly in building a national fiber optic network and expanding 5G services.

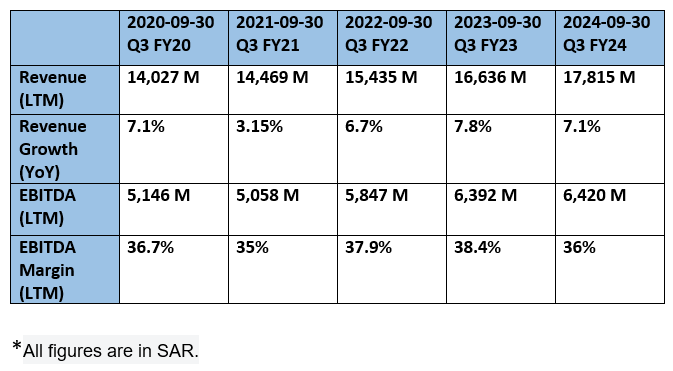

As a leading telecommunications provider, Etihad Etisalat (Mobily) is strategically positioned to capitalize on this momentum., supported by its strong financial performance and positive technical aspects.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website