- 🇸🇦 Saudi Stock Market

- 🇺🇸 USA Stock Market

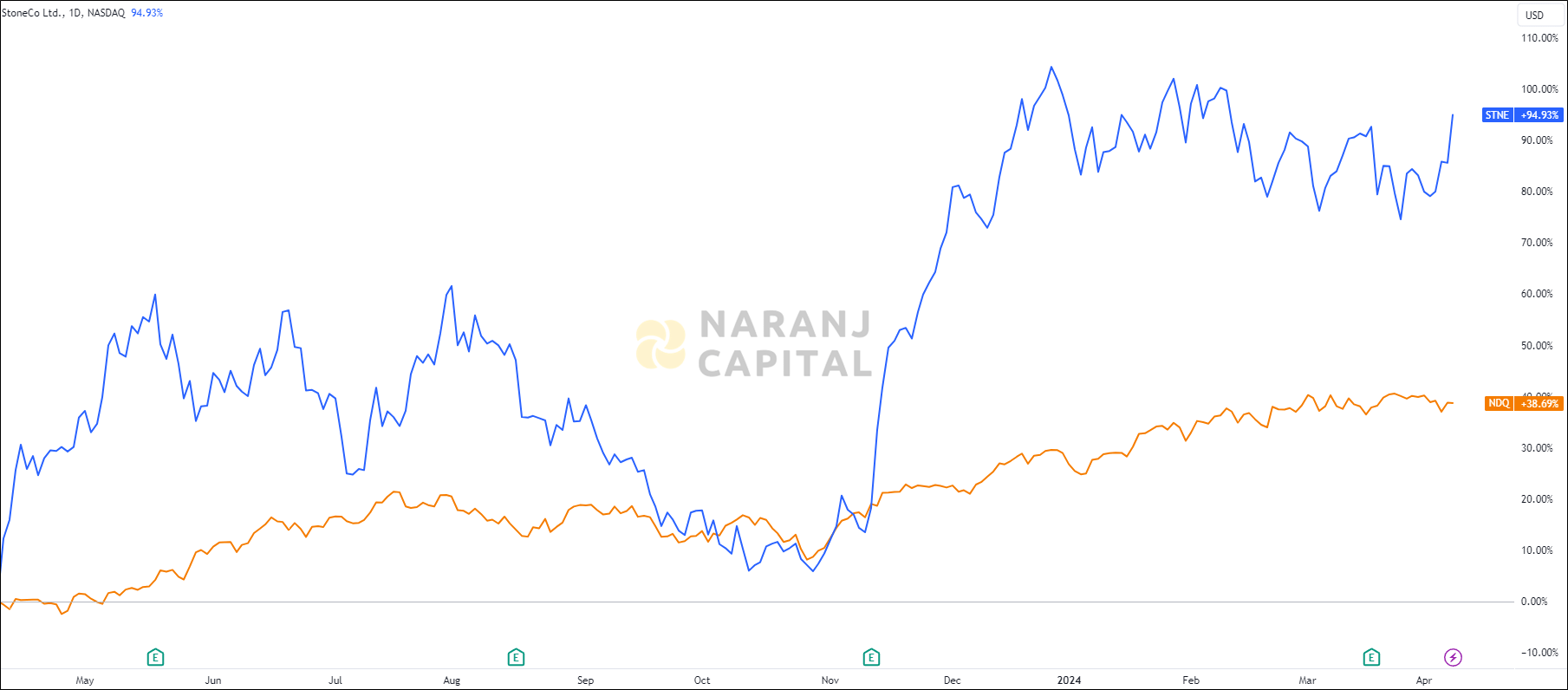

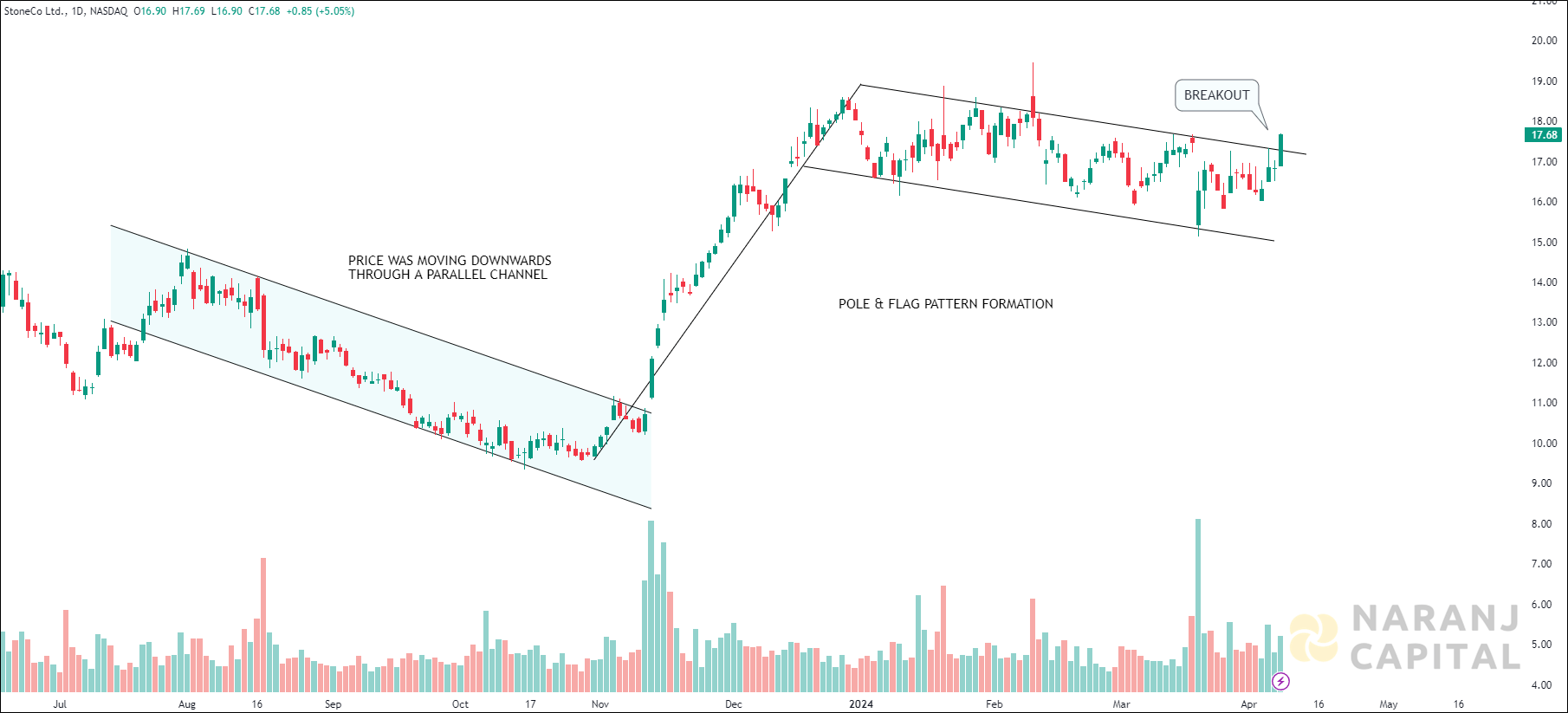

StoneCo Ltd. is a leading provider of cutting-edge financial technology and software solutions in Brazil. With a strong focus on empowering merchants and integrated partners, StoneCo enables seamless electronic commerce across multiple channels including in-store, online, and mobile platforms. Their innovative solutions are efficiently delivered through the proprietary Stone Hubs, strategically located to ensure excellent local sales and support services. We cater to diverse clients, ranging from small-and-medium-sized businesses to marketplaces, e-commerce platforms, and integrated software vendors. StoneCo limited is headquartered in George Town, the Cayman Islands, presents an exceptional investment opportunity in the rapidly growing US Stock Market.

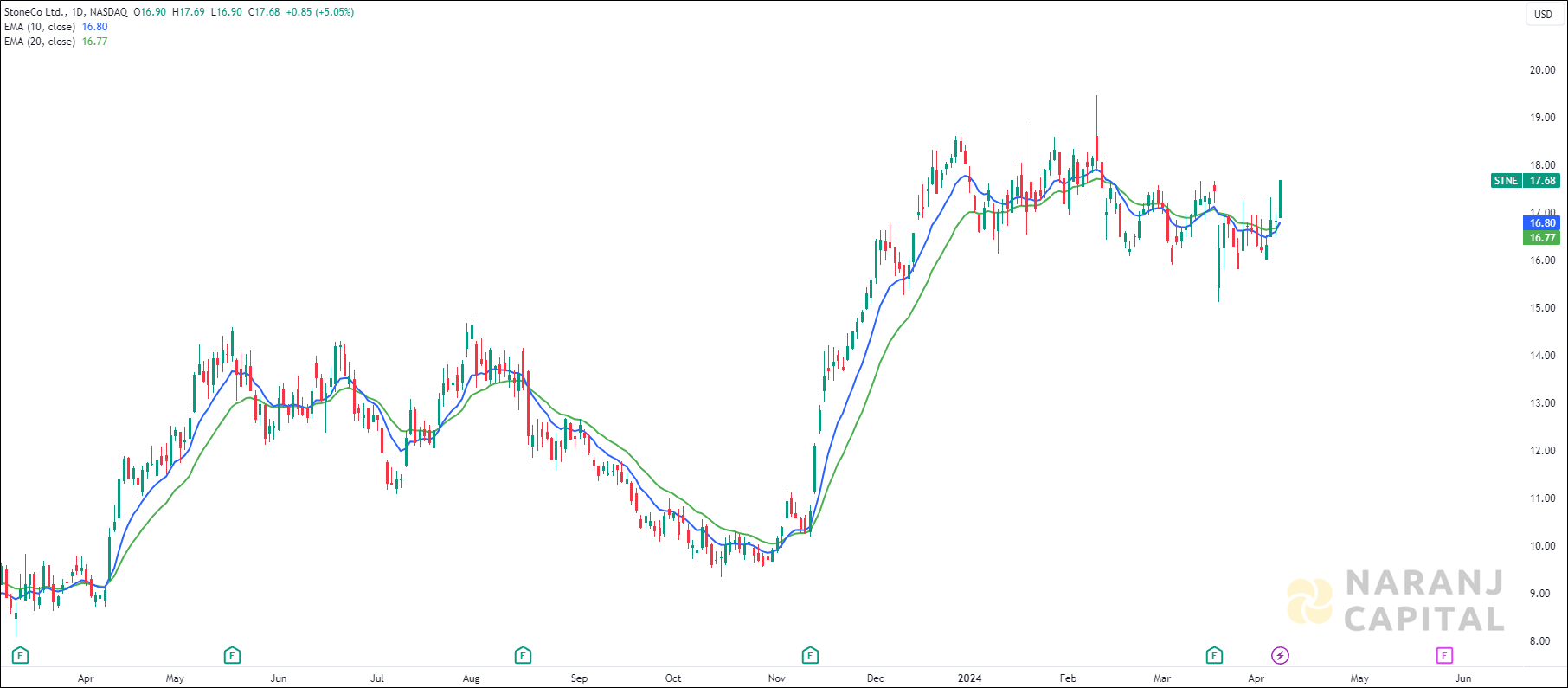

STNE — NASDAQ —

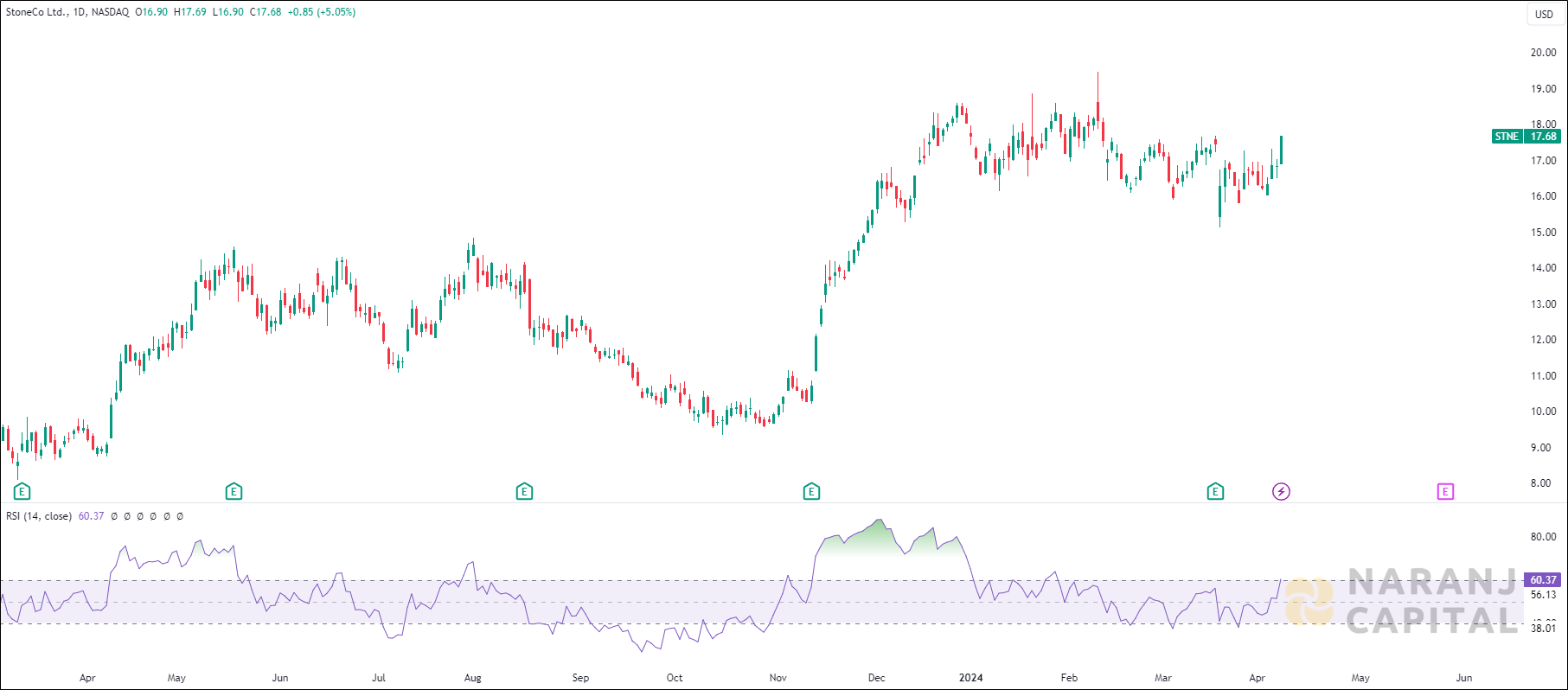

Current RSI of this stock is 60.37, which indicates the strength of buyers.

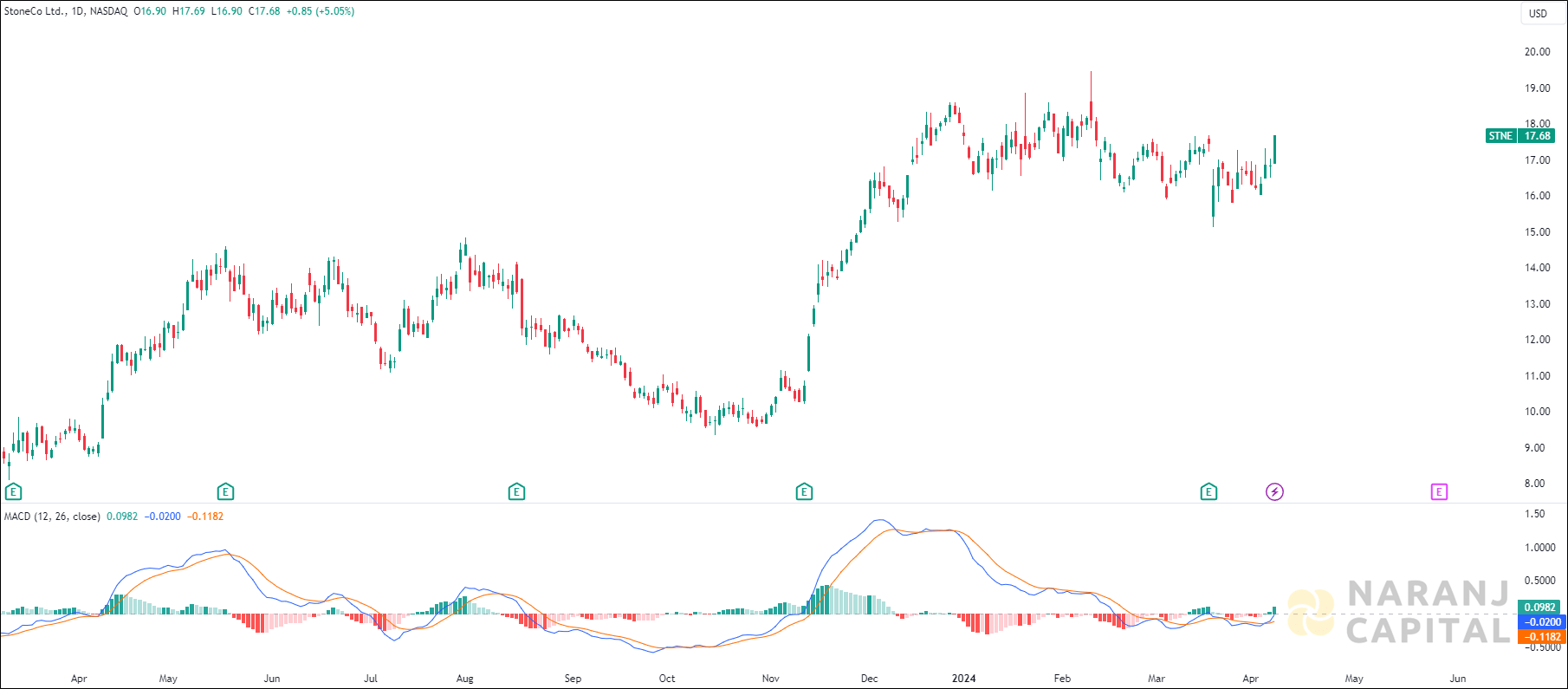

MACD line has just crossed the signal line from the below and a positive histogram chart is forming. This can be considered as a bullish signal.

The short length exponential moving average (10 EMA) has just crossed the long length exponential moving average (20 EMA) from the below, generates bullish signal. Last day’s candle has closed above all these moving averages. This suggests buyers are taking interest in this stock.

Based on our short term trading ideas in USA stocks, StoneCo stock price target will be USD 18.6 - USD 19 in the next 9-10 trading sessions.

Arijit Banerjee CMT CFTe is a seasoned expert in the financial industry, boasting decades of experience in trading, investment, and wealth management. As the founder and chief strategist of Naranj Capital, he’s built a reputation for providing insightful research analysis to guide investment decisions.

Arijit’s credentials are impressive, holding both the Chartered Market Technician (CMT) and Certified Financial Technician (CFTe) designations. These certifications demonstrate his expertise in technical analysis and financial markets.

Through Naranj Capital, Arijit shares his market insights and research analysis, offering actionable advice for investors. His work is featured on platforms like TradingView, where he publishes detailed analysis and recommendations.

If you’re interested in learning more about Arijit’s work or Naranj Capital’s services, you can reach out to them directly through their website